- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Assessing Teradyne (TER) Valuation as Robotics and Automation Drive Its Structural Shift

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 3.3% Overvalued

The most widely followed narrative currently sees Teradyne trading slightly above its calculated fair value. The company's ambitious shift into robotics and AI-driven automation, combined with recent financial forecasts, are central to this valuation view.

Teradyne expects significant future growth potential from AI accelerators, robotics, and semiconductor automation. These opportunities are being driven by long-term industry themes such as AI, verticalization, and electrification. These areas are likely to boost future revenue.

Curious what underpins this aggressive growth story? The narrative is built on big assumptions about accelerations in key profit drivers and a path to expansion that is not for the faint of heart. Want to know which leap-of-faith projections are baked into this target? There is more than meets the eye in how the numbers are stacked up to reach that fair value.

Result: Fair Value of $116.06 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still catalysts that could derail this outlook, such as ongoing macro uncertainty and weak robotics demand, which are weighing on revenue momentum.

Find out about the key risks to this Teradyne narrative.Another View: SWS DCF Model Signals Caution

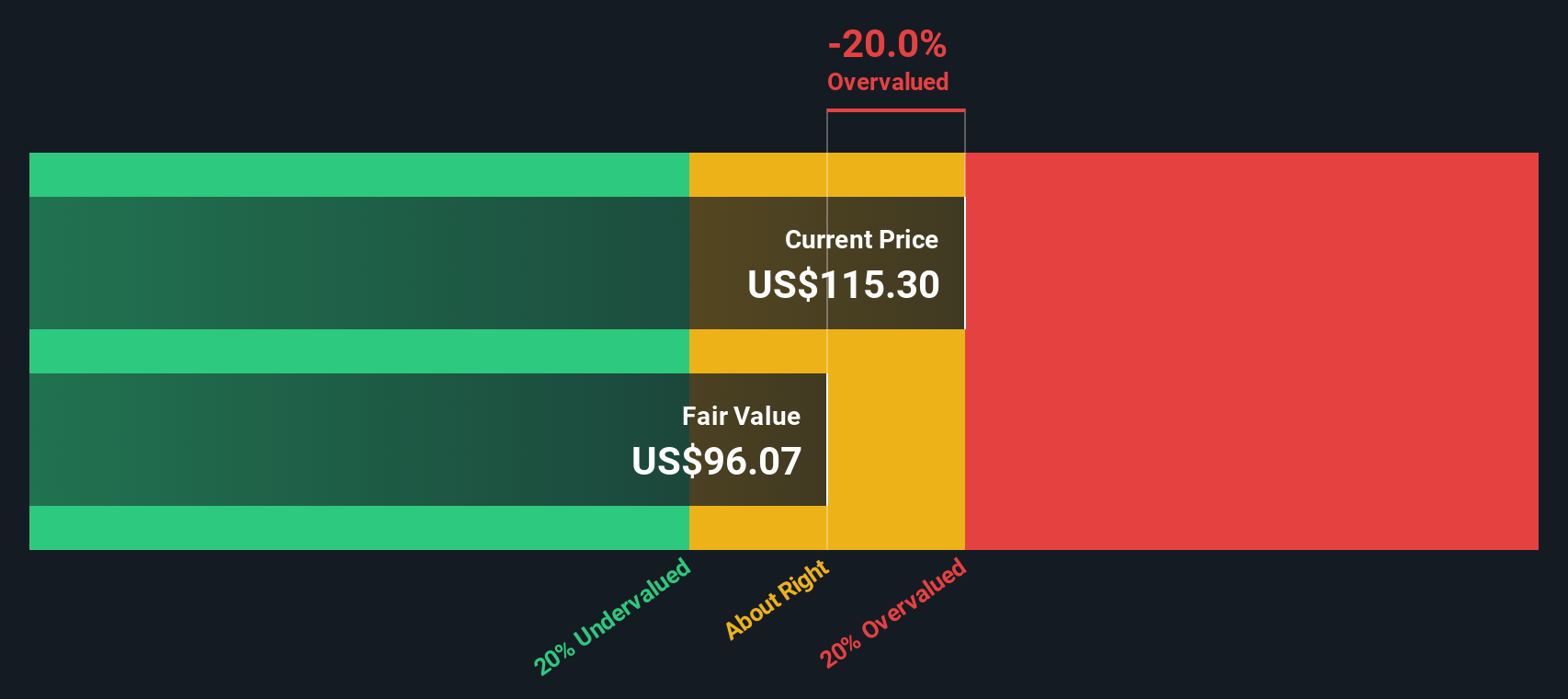

While analysts see Teradyne as only slightly overvalued, our DCF model paints a different picture and suggests the stock could be even more expensive than it appears. Which method tells the truer story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teradyne Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can quickly put together your own take and share your perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Teradyne.

Looking for More Investment Ideas?

Don’t let your next big opportunity slip away. Simply Wall Street’s screeners help you spot standout investments across emerging industries and untapped markets. Start your search now and get ahead of the crowd.

- Uncover hidden gems poised for growth by checking out undervalued stocks based on cash flows for stocks trading at attractive valuations compared to future cash flows.

- Ride the digital disruption by scanning AI penny stocks that are revolutionizing industries with breakthrough artificial intelligence applications.

- Boost your portfolio with steady income as you browse dividend stocks with yields > 3% featuring companies delivering reliable dividend yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026