- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Skyworks Solutions (SWKS): Exploring Valuation After Solid Quarterly Outperformance and Renewed Investor Focus

Reviewed by Kshitija Bhandaru

Skyworks Solutions (SWKS) recently delivered a strong quarterly update. The company reported year-on-year revenue growth and exceeded expectations on several operating metrics. This performance has put the spotlight back on the company for investors.

See our latest analysis for Skyworks Solutions.

Fresh off its upbeat quarterly report, Skyworks Solutions has still seen its share price slip to $77.1, with a one-year total shareholder return of -17.3% and a challenging five-year run. While short-term momentum has yet to ignite, the solid earnings beat could be the catalyst investors have been waiting for.

If this turnaround story has you thinking bigger, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With a resilient quarterly showing but a share price still down significantly from prior highs, is Skyworks Solutions an overlooked value play, or is the current valuation already factoring in any future rebound the market expects?

Most Popular Narrative: 6% Overvalued

With Skyworks Solutions trading at $77.10 and the most-followed narrative projecting a fair value of $72.47, market optimism may already be reflected in the share price. This sets up an intriguing debate around future expectations and whether company fundamentals can deliver enough upside to justify these levels.

Rapid growth in edge IoT, automotive, and industrial applications, in part due to the proliferation of WiFi 7 and high-connectivity requirements, is enabling Skyworks to diversify beyond mobile and build a more resilient, higher-margin Broad Markets business. This supports topline growth and margin improvement.

What’s fueling the fair value in this narrative? It hinges on major transformation bets, expansion into new high-growth segments, margin lifts, and big tech design wins. Curious about the unique forecasts and assumptions that hold up this price target? Unpack the full story for the financial drivers behind this valuation.

Result: Fair Value of $72.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risk remains high because Skyworks is still heavily reliant on a single major customer and is exposed to ongoing pricing pressure in the mobile market.

Find out about the key risks to this Skyworks Solutions narrative.

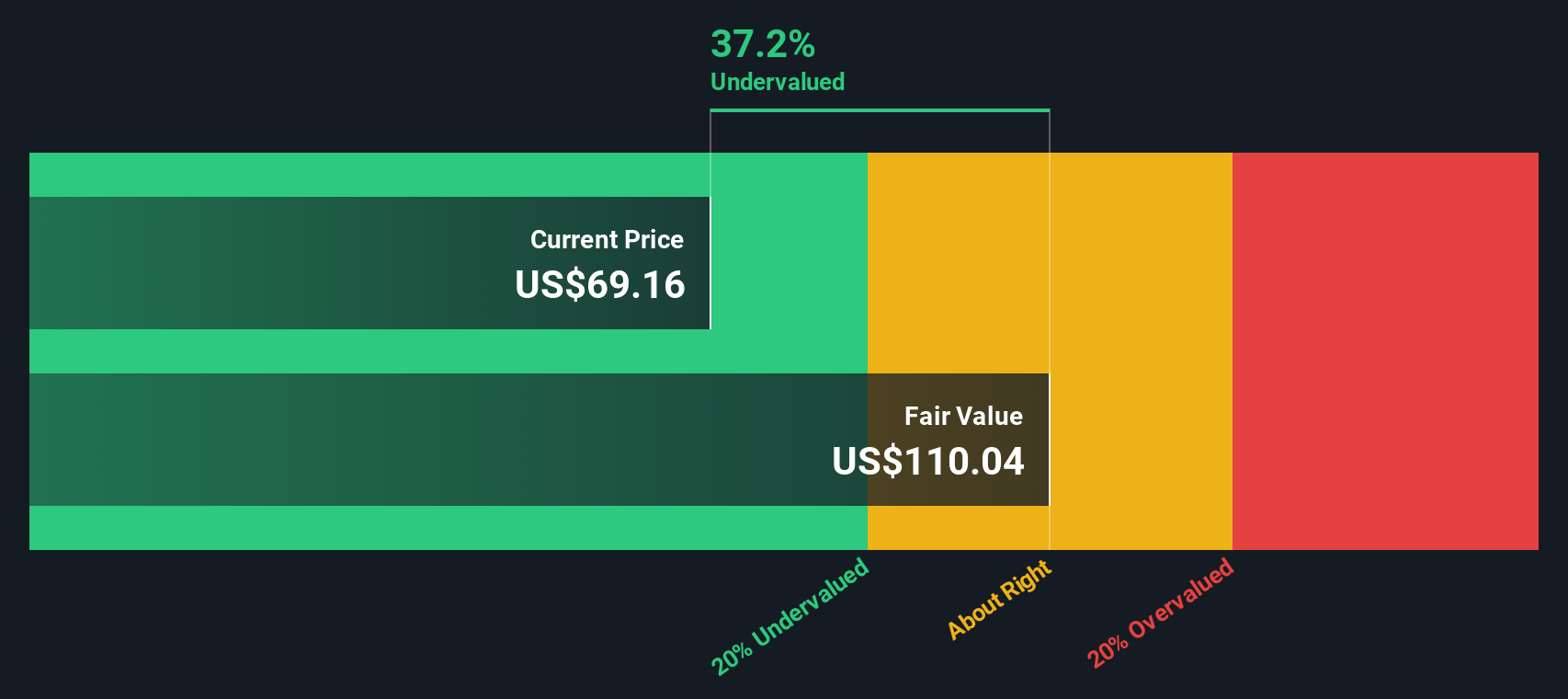

Another View: SWS DCF Model Points to Undervaluation

While the analyst consensus sees Skyworks Solutions as slightly overvalued based on earnings forecasts, the SWS DCF model paints a different picture. This cash flow-based approach suggests the shares are actually trading well below fair value right now. Could the crowd be overlooking long-term potential hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Skyworks Solutions Narrative

Keep in mind, if you want to dig into the numbers yourself or provide a different perspective, you can build your own take with just a few clicks: Do it your way

A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let a single opportunity slip by. Open the door to high-potential investments with tailored screener picks on Simply Wall Street. Here are three standout ways to take action now:

- Unlock the power of artificial intelligence in your portfolio by checking out these 24 AI penny stocks, which are reshaping industries with rapid innovation and standout growth potential.

- Capture stable, inflation-beating income with these 19 dividend stocks with yields > 3%, which offers yields above 3% and a proven record of rewarding shareholders.

- Step into the future with these 26 quantum computing stocks, focused on trailblazing companies driven by game-changing quantum technologies and next-level computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Designs, develops, manufactures, and markets semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives