- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Semtech (SMTC) Valuation Check After Recent Share Price Pullback

Reviewed by Simply Wall St

Semtech (SMTC) shares have quietly pulled back about 6% in the past day and 16% over the past week, even though the stock is still up this month and in the past 3 months.

See our latest analysis for Semtech.

Viewed over a longer stretch, Semtech’s recent pullback sits against a still positive backdrop, with an 8.1% year to date share price return and a hefty 148.45% three year total shareholder return suggesting momentum is cooling rather than broken.

If you are weighing what comes next for chip and connectivity plays, this could be a good moment to scan similar names using high growth tech and AI stocks.

With profits rebounding, revenue growing double digits, and the share price still trading below analyst targets, is Semtech a quietly undervalued recovery story, or has the market already priced in its next leg of growth?

Most Popular Narrative: 18.1% Undervalued

With Semtech closing at $67.13 versus a narrative fair value of $82, the story tilts toward upside potential, anchored in structurally rising connectivity demand.

Accelerating demand from hyperscale data centers and AI infrastructure is associated with robust, multi-year growth across Semtech's high-margin data center business, supported by design wins in advanced optical (FiberEdge), low-power (LPO), and active copper interconnects (CopperEdge/ACC); as data rates move from 400G to 800G and 1.6T, Semtech may be positioned to capture additional revenue and margin expansion from new content per deployment.

Want to see the math behind that upside case? The narrative leans on aggressive earnings expansion, rising margins, and a future profit multiple that assumes sustained infrastructure tailwinds. Curious how far those forecasts stretch, and what has to go right to justify that fair value? Dive in to uncover the assumptions driving this price target.

Result: Fair Value of $82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in integrating acquisitions, or margin pressure driven by a shift toward lower margin IoT segments, could quickly erode the upside baked into current expectations.

Find out about the key risks to this Semtech narrative.

Another View On Value

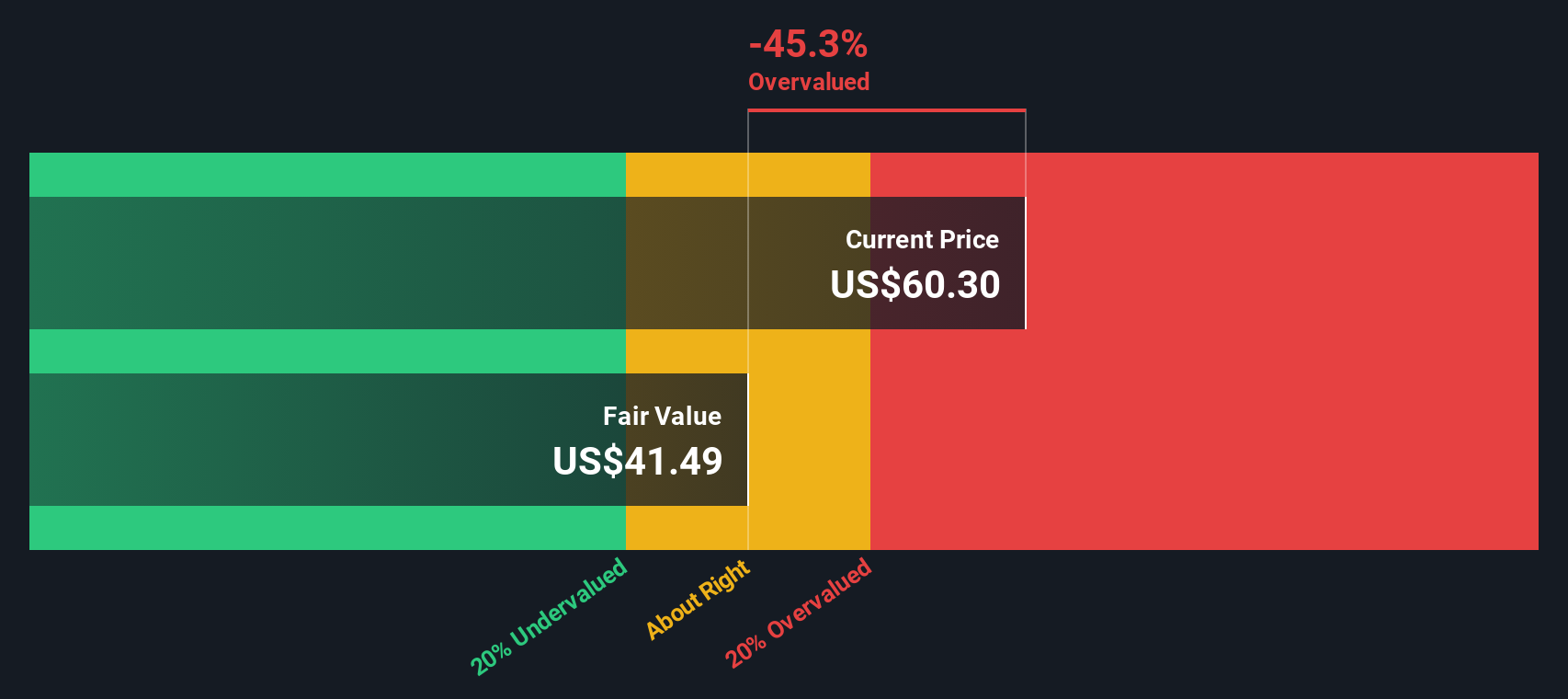

Our DCF model paints a cooler picture, putting Semtech’s fair value closer to $46.74. At that level, the current $67.13 share price would look overvalued rather than cheap. Is the market now paying up for AI and data center optimism, or just getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Semtech Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a personalized view in just a few minutes using Do it your way.

A great starting point for your Semtech research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investment Move?

Do not stop with a single idea when you can quickly uncover fresh opportunities tailored to your style using the Simply Wall Street Screener today.

- Capture potential mispricing by scanning these 915 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations before the crowd catches on.

- Ride powerful technology trends by targeting these 24 AI penny stocks positioned to benefit from breakthroughs in automation, machine learning, and intelligent software.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that aim to deliver cash returns alongside long term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion