- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Assessing Semtech’s (SMTC) Valuation Ahead of Earnings as AI and Industrial Growth Raise Expectations

Reviewed by Simply Wall St

Earnings season is coming up fast for Semtech (SMTC), and with the company set to announce its quarterly numbers on August 25, investors are watching closely. There is a lot of talk about potential year-over-year growth, especially as analysts anticipate higher sales from the Industrial and Infrastructure segments. Interest in Semtech has also benefited from broader optimism around AI and 5G. Some see this as a timely test of whether the company’s strategy can deliver lasting gains in a fast-evolving market.

But the run-up has not been smooth. Semtech shares slipped about 3% during a recent sector pullback, even as longer-term enthusiasm for AI exposure and ongoing technology spending continues to dominate headlines. Over the past year, Semtech is up nearly 38%, with most momentum building strongly in the past three months. While year-to-date returns remain negative, the three-month rally stands out against a backdrop of macroeconomic uncertainty and market swings.

With all that in mind, it is worth asking whether Semtech is trading at a bargain ahead of its results or if the recent surge has already factored in expectations for future growth.

Most Popular Narrative: 11.3% Undervalued

According to the community narrative, Semtech shares are considered undervalued, with analysts anticipating significant improvement in future earnings as core technology bets begin to pay off.

Semtech's focus on portfolio optimization and simplification is expected to drive stronger revenue growth through a more concentrated strategy on core competencies. This approach can improve net margins. Strategic investments in R&D are aimed at accelerating innovation to support broader customer programs, which could potentially lead to sustainable long-term revenue growth.

Curious what’s fueling this bold price target? The real story is hidden in the future financial assumptions: surging profits, expanding margins, and a powerful turnaround narrative. Ready to dig into the surprising growth drivers and find out what’s behind the bullish valuation? The numbers might change everything you thought you knew about this stock.

Result: Fair Value of $57.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delays in CopperEdge demand or setbacks in new tech rollouts could challenge the optimism and alter the current outlook for Semtech.

Find out about the key risks to this Semtech narrative.Another View: Multiples Tell a Different Story

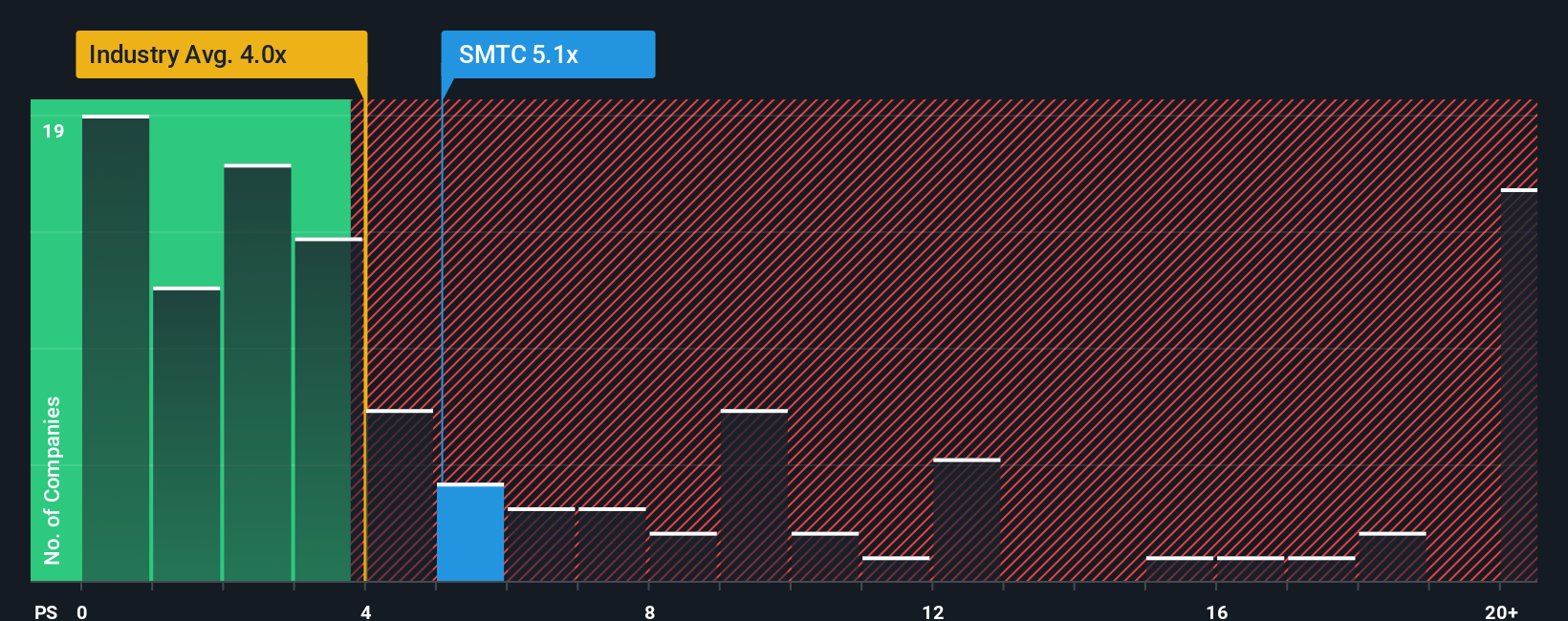

Looking at Semtech through the lens of recent market ratios, things appear less rosy. This method suggests the shares may actually be trading on the expensive side compared to other US chip stocks. Is the market getting too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Semtech Narrative

If you are the type who likes to dig into the details and question the consensus, you can review the numbers and shape your own perspective in just a few minutes, or simply do it your way.

A great starting point for your Semtech research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for What's Next? Find Winning Stocks Before Everyone Else

Smart investors never stop searching for their next opportunity. If you want an edge, the Simply Wall Street Screener is your secret weapon, packed with unique ideas you might miss elsewhere. Tap into these handpicked themes below and give your portfolio a new spark while others are still playing catch-up.

- Boost your portfolio with income by targeting dividend stocks with yields > 3%; this includes companies paying strong yields above 3% and featuring a track record of reliability.

- Get ahead of the tech curve by exploring AI penny stocks, which focuses on forward-thinking businesses integrating artificial intelligence with potential for significant growth.

- Secure long-term potential by researching healthcare AI stocks, which highlights leading firms at the intersection of healthcare and artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives