- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

What Do SiTime’s Recent 29% Surge and New AI Partnerships Mean for Its Share Price?

Reviewed by Bailey Pemberton

If you’ve been eyeing SiTime’s stock, you’re not alone, especially after the company’s shares have steadily climbed to $302. There’s a lot happening here. Over just the past month, SiTime’s price surged 28.6%, and if you zoom out to the past year, that number balloons to 66.5%. For the truly patient, SiTime boasts more than 283% growth over the last three years and a 233.7% gain across five years. These figures get investors talking, whether you’re considering jumping in or wondering if it’s time to cash out.

What’s fueling the buzz? Much of it comes down to broader market developments, including new entrants and innovations in timing technology, growing demand for precision electronics, and a generally optimistic outlook among analysts about the need for SiTime’s products in high-growth fields. These macro forces have likely helped shift risk perceptions, contributing to the stock’s upward momentum and keeping traders on their toes.

But let’s move past the headline numbers and daily moves for a moment. When you dig into SiTime’s fundamentals, things get interesting, especially on the valuation front. By traditional metrics, SiTime currently scores a 0 out of 6 on the undervaluation checklist. It’s a sobering figure that might surprise anyone expecting a bargain given the company’s spectacular run. So, how do standard valuation methods stack up, and is there something they might be missing? Let’s dive into the most common ways value is determined, and stick around, because there’s an even smarter way to gauge worth that we’ll get to at the end.

SiTime scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SiTime Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach aims to determine what a business is fundamentally worth based on the cash it is expected to generate in the future.

For SiTime, the most recent full year Free Cash Flow was $9.46 million. Analysts estimate this number will rise dramatically, with projections reaching $262.4 million by 2028. These forecasts are based on anticipated growth in key sectors. After 2028, future cash flows are extrapolated to build a ten-year outlook. All figures are reflected in US dollars. The DCF calculation uses a "2 Stage Free Cash Flow to Equity" model. This method is well-suited to companies expected to grow quickly before settling into a more stable phase.

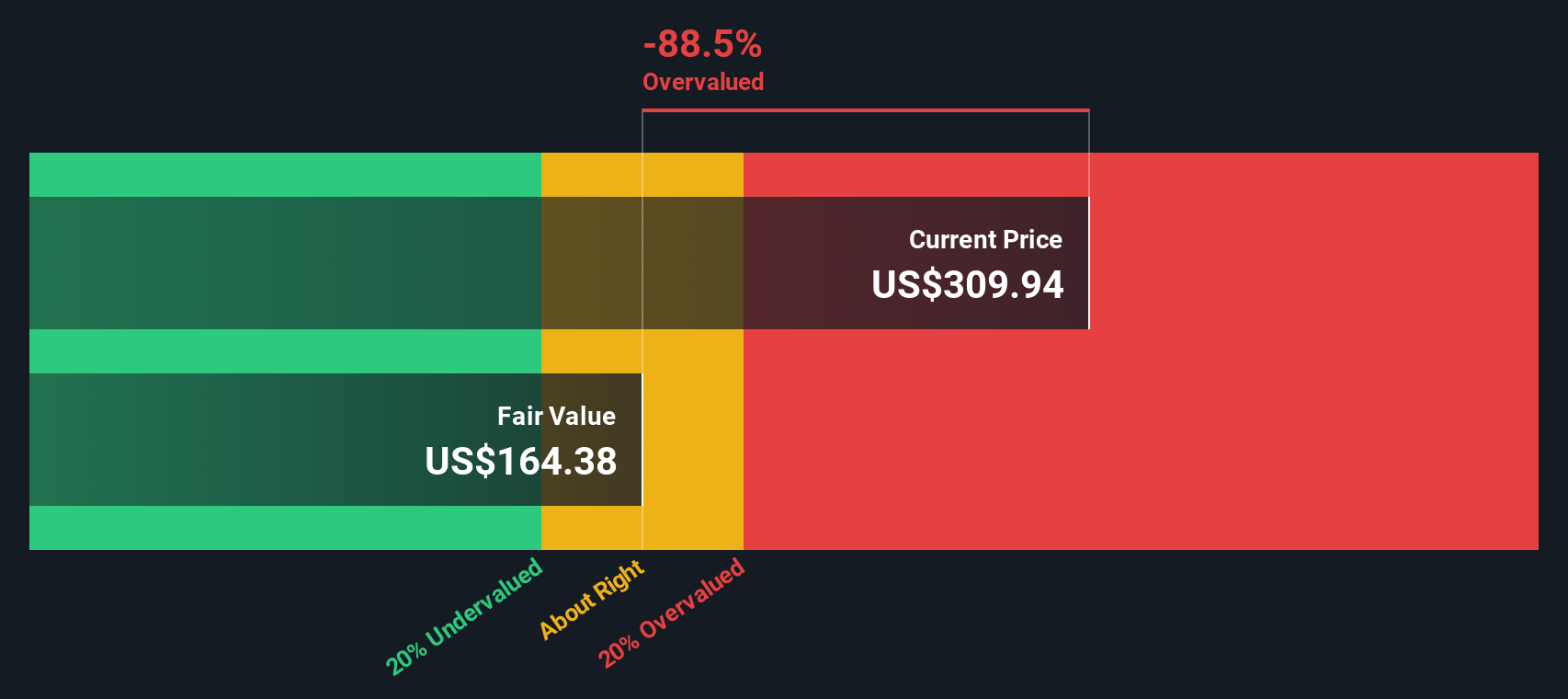

According to the DCF model, the estimated intrinsic value of SiTime is $164.49 per share. This is substantially below the current share price of $302, implying the stock is approximately 83.6% overvalued based on conservative cash flow projections and discount assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SiTime may be overvalued by 83.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SiTime Price vs Sales (P/S) Ratio

The Price-to-Sales (P/S) ratio is a go-to valuation tool for companies like SiTime that are still scaling profitability or have volatile earnings. This metric allows investors to gauge how much they are paying for each dollar of the company's revenue, making it especially relevant for high-growth technology firms where future profit potential is a major story.

Growth prospects and perceived risk both influence what counts as a "fair" P/S multiple. A company expected to deliver rapid growth or to lead in a hot sector might attract a higher P/S ratio. On the other hand, higher risk or slower growth tends to push this multiple down. That means context matters, and you cannot just look at a raw number in isolation.

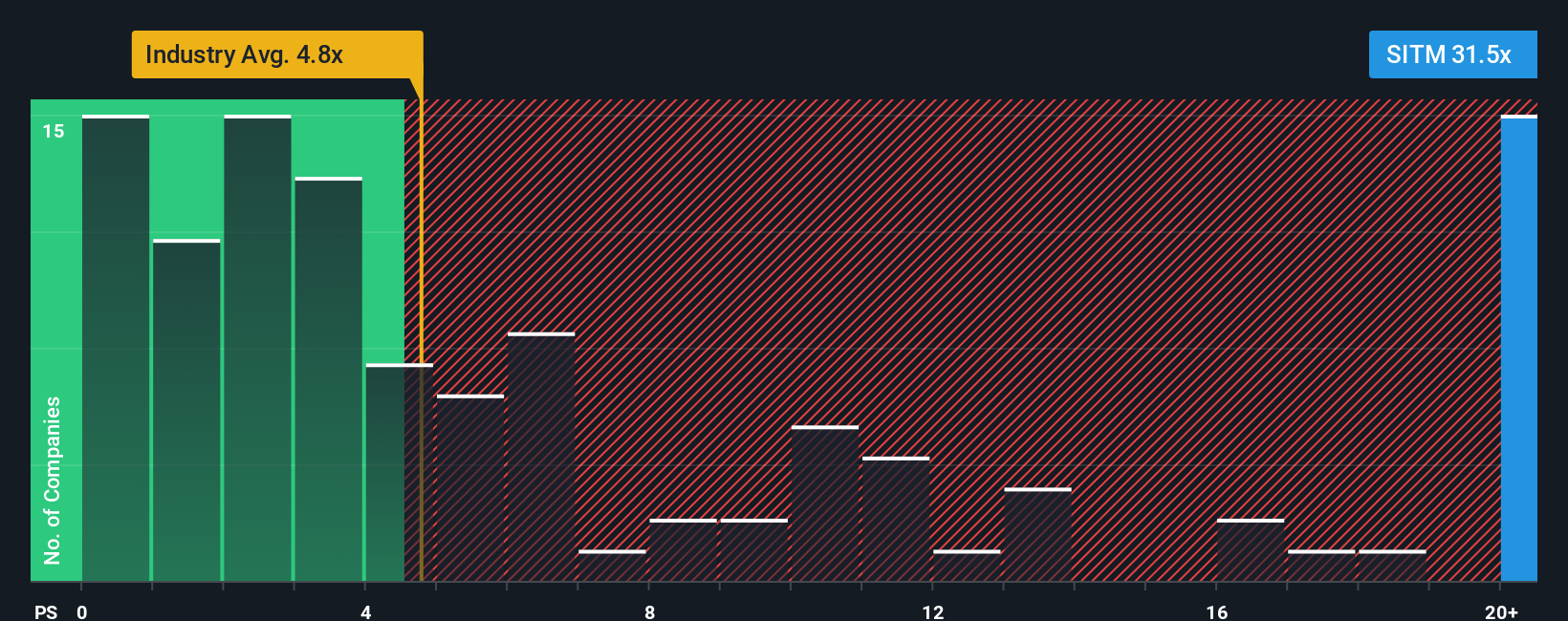

Currently, SiTime trades at a P/S ratio of 30.7x. For comparison, the average P/S in the semiconductor industry is 4.8x, with key peers averaging 7.6x. While these benchmarks offer a sense of the broader playing field, Simply Wall St’s "Fair Ratio" goes further. The Fair Ratio, calculated at 10.5x for SiTime, adjusts for critical variables including expected revenue growth, profit margins, risk profile, market capitalization, and sector dynamics. Because this proprietary metric takes into account more than just industry norms or recent peer performances, it provides investors with a smarter baseline for what is reasonable to pay for SiTime’s sales.

SiTime’s actual P/S of 30.7x is nearly three times its Fair Ratio of 10.5x, signaling the stock is currently priced well above what its fundamentals would suggest, even after accounting for future growth and other relevant factors.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SiTime Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story of what you believe about a company’s future, connecting industry trends, company strategy, and your outlook for things like revenue, earnings, and margins into a clear forecast and a personal estimate of fair value.

Unlike rigid checklists or one-size-fits-all models, a Narrative lets you weave together the numbers and the reasoning behind them, empowering you to test different scenarios and see instantly how your assumptions compare to others’ views. Narratives link the company’s story directly to financial forecasts and then to a target fair value, making the investing process more dynamic, transparent, and personal.

This approach is not just for experts. Simply Wall St makes Narratives accessible to everyone through the Community page, where millions of investors share and update their perspectives in real time.

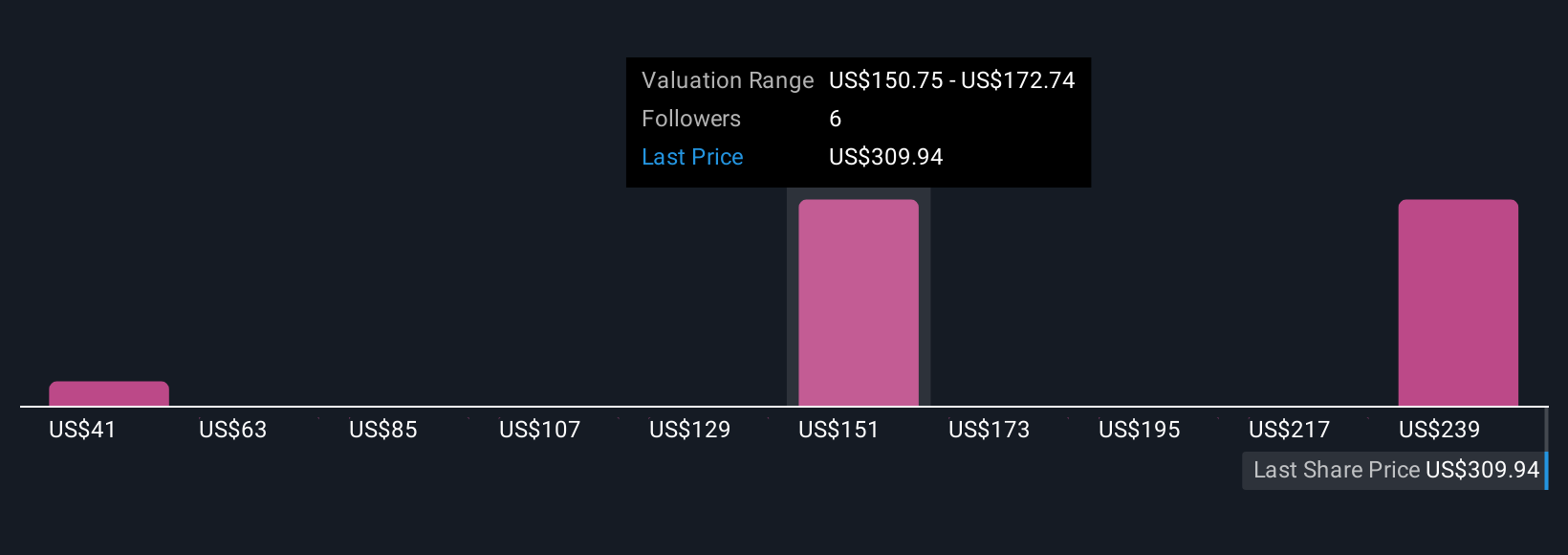

As new information like news or earnings emerges, Narratives update automatically, showing how shifting facts (and sentiment) impact your fair value estimate versus the current price. For example, one SiTime Narrative projects a fair value of $275, driven by bullish expectations on growth in AI data centers and IoT, while another takes a conservative view, targeting only $220 based on concerns over market risks and future profitability.

No matter your investing style, Narratives provide a flexible, informed way to decide if it’s time to buy, hold, or sell, and to see exactly why.

Do you think there's more to the story for SiTime? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives