- United States

- /

- Semiconductors

- /

- NasdaqGS:SIMO

Silicon Motion Technology (NASDAQ:SIMO) has the Potential to Lead the Semiconductor Recovery

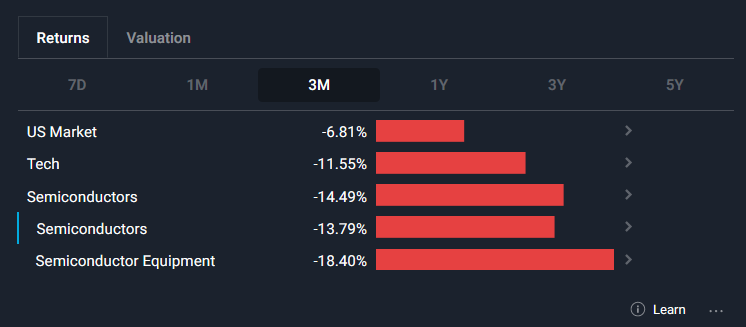

While the semiconductor sector drove the market rally in 2021, after the Q1 of 2022, it is one of the sectors leading the decline.

Yet, with no apparent bottom in sight, niche operators like Silicon Motion Technology Corporation(NASDAQ: SIMO) are starting to look attractive as they approach single-digit price-to-earnings (P/E) ratios.

View our latest analysis for Silicon Motion Technology

Company Profile

Founded in 1995, Silicon Motion Technology Corporation designs, develops, and markets NAND flash controllers for solid-state storage devices (SSDs). This, once expensive technology, is vastly superior to mechanical data drives, and nowadays, we find it anywhere from smartphones to data centers.

The company markets and sells products directly or through independent electronic distributors to flash makers, module makers, hyperscalers, and OEMs. Its headquarters are in Kowloon, Hong Kong.

Fundamental Perspective

With a P/E ratio of 11.5x, one would expect Silicon Motion Technology to underperform the market. Yet, the earnings-per-share (EPS) is anticipated to climb by 29%, according to 8 analysts that follow the company. Thus, it is surprising that its price-to-earnings-growth ratio (PEG) is at an attractive 0.5x.

You can see the sector performance from the following data,

You can find other data, including top gainers and losers, on the dedicated Semiconductors page on our platform.

What makes it more impressive is that the rest of the market is set to expand by a significantly smaller amount – just 8.6%. Furthermore, its price-to-book ratio (PB) is at 3.5x, well below the industry average of 4x. Yet, the company outperforms the industry on return on equity by a solid margin (30.4% vs. 18.1%).

Finally, over the last 5 years, the company cleared up little debt that it had off its books, and it is now debt-free. With a clean balance sheet, both short-term and long-term assets outweigh the liabilities by a wide margin.

The Cherry on the Cake: Growing Dividend

Silicon Motion has been paying the dividend for almost a decade now, and during that time, it grew from the first annual payment of US$0.6 to the current payment of US$2.0. Adding it up, the compound annual growth rate (CAGR) turns out to be approximately 14% a year.

The dividend yield is notable at 3%, well over the industry average of 1.3%. Furthermore, the investors will appreciate the low payout ratio of 27%. This means that the dividend is shielded from potential turmoils – like in 2020 when the company didn't have to cut the dividend when many other companies did.

Conclusion

Looking into our database, the U.S. Semiconductors market currently trades with a median P/E ratio of 25.5. Meanwhile, Silicon Motion is less than half of that, with no apparent explanations except for the soft Q1 guidance.

This guidance was at +12.7% Y/Y, which is not as impressive as the growth in 2021, yet with an FY2022 outlook of +25.3%, we can expect the interest to pick up through the year. Thus, keen observers might want to pay attention to news and options trade flow as we approach the next earnings report date, which is expected to happen in one month, on May 4.

Even the most attractive opportunities are not without some risks. We've identified 2 warning signs with Silicon Motion Technology, and understanding them should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:SIMO

Silicon Motion Technology

Designs, develops, and markets NAND flash controllers for solid-state storage devices and related devices in Taiwan, the United States, Korea, China, Malaysia, Singapore, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026