- United States

- /

- Semiconductors

- /

- NasdaqGS:SIMO

Silicon Motion (SIMO): Weighing Conflicting Valuation Views After a Strong Run and Recent Pullback

Reviewed by Simply Wall St

Silicon Motion Technology (SIMO) has quietly delivered a strong run this year, yet the past month’s pullback stands out. That mix of longer term gains and recent weakness is where things get interesting.

See our latest analysis for Silicon Motion Technology.

The pullback over the past month sits against a much stronger backdrop, with a robust year to date share price return and solid multi year total shareholder returns suggesting momentum is cooling slightly rather than breaking.

If Silicon Motion’s move has caught your eye, it might be worth exploring other chip names and adjacent innovators through high growth tech and AI stocks for more potential ideas.

With Silicon Motion still trading at a notable discount to analyst targets after a strong run, the key question now is whether the market is underestimating future earnings power or already pricing in the next leg of growth.

Most Popular Narrative Narrative: 22.3% Undervalued

With the most followed narrative putting fair value at $114 versus a last close of $88.63, the story leans toward meaningful upside driven by growth.

The rapid expansion of high performance storage demand from AI, data centers, cloud computing, and edge computing is fueling adoption of advanced NAND controller solutions, particularly Silicon Motion's PCIe Gen 5 and enterprise focused MonTitan controllers supporting robust future revenue and margin growth as these markets scale. Silicon Motion's unique position as the only controller partner with all major NAND flash makers and its design win momentum in next generation QLC NAND solutions enable it to capture increased market share across consumer, automotive, and enterprise segments, underpinning long term recurring revenue growth and improved earnings stability.

Curious how this controller stack translates into a higher price tag? The narrative leans on aggressive growth, fatter margins, and a punchy future earnings multiple. Want the exact playbook behind that $114 fair value call?

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained price competition and rising R&D spend could crimp the margin expansion story and quickly challenge today’s upbeat growth assumptions.

Find out about the key risks to this Silicon Motion Technology narrative.

Another Lens on Value

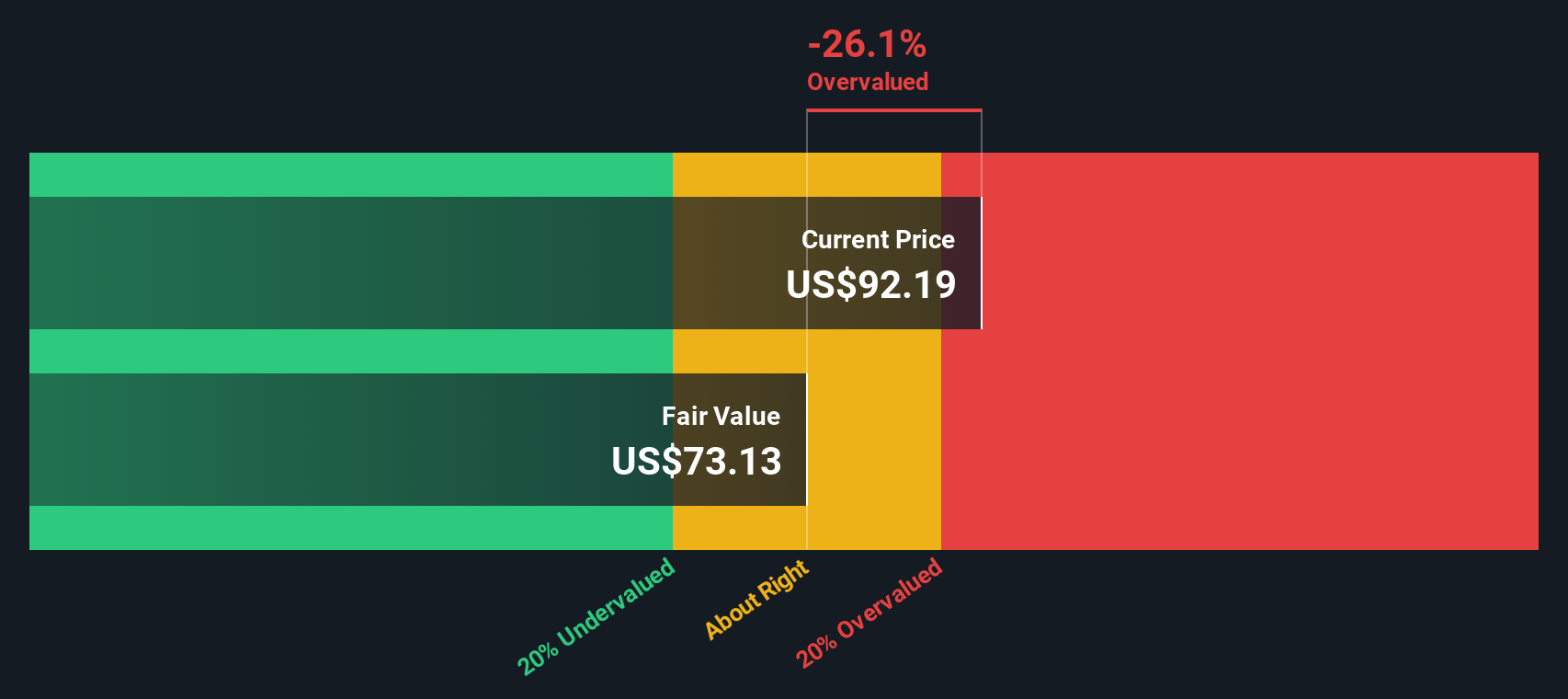

Our DCF model paints a very different picture, putting Silicon Motion’s fair value at just $36.99 per share versus the current $88.63. This implies the stock screens as overvalued rather than cheap. Is the market correctly betting on a supercharged future, or simply getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Silicon Motion Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Silicon Motion Technology Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, starting with Do it your way.

A great starting point for your Silicon Motion Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock. Use the Simply Wall Street Screener to uncover targeted opportunities other investors may overlook and sharpen your next move.

- Capture potential multi baggers early by reviewing these 3570 penny stocks with strong financials that pair low share prices with surprisingly solid fundamentals.

- Position yourself ahead of the next tech wave by scanning these 24 AI penny stocks shaping developments in automation, data processing, and intelligent software.

- Research potential income-focused opportunities by reviewing these 14 dividend stocks with yields > 3% that combine attractive yields with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIMO

Silicon Motion Technology

Designs, develops, and markets NAND flash controllers for solid-state storage devices and related devices in Taiwan, the United States, Korea, China, Malaysia, Singapore, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026