- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

SMART Global Holdings, Inc.'s (NASDAQ:SGH) 36% Dip In Price Shows Sentiment Is Matching Revenues

SMART Global Holdings, Inc. (NASDAQ:SGH) shares have had a horrible month, losing 36% after a relatively good period beforehand. The last month has meant the stock is now only up 7.3% during the last year.

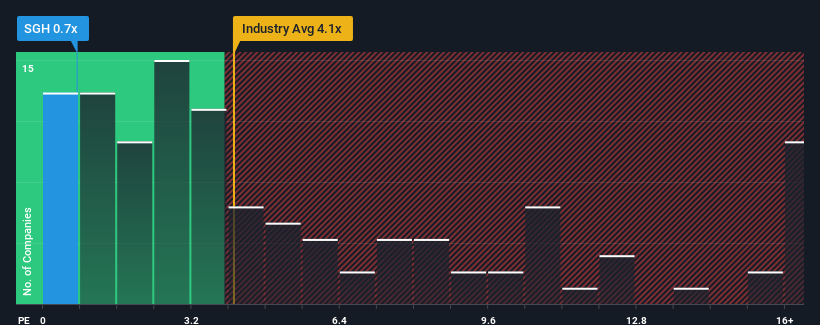

Even after such a large drop in price, SMART Global Holdings may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 4.1x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for SMART Global Holdings

How Has SMART Global Holdings Performed Recently?

While the industry has experienced revenue growth lately, SMART Global Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SMART Global Holdings.Is There Any Revenue Growth Forecasted For SMART Global Holdings?

In order to justify its P/S ratio, SMART Global Holdings would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 8.7% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 46%, which is noticeably more attractive.

In light of this, it's understandable that SMART Global Holdings' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does SMART Global Holdings' P/S Mean For Investors?

Having almost fallen off a cliff, SMART Global Holdings' share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of SMART Global Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware SMART Global Holdings is showing 3 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of SMART Global Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PENG

Penguin Solutions

Engages in the designing and development of enterprise solutions worldwide.

Very undervalued with reasonable growth potential.