- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (NasdaqGS:SEDG) Stock Dips 17% Over Last Quarter

Reviewed by Simply Wall St

SolarEdge Technologies (NasdaqGS:SEDG) recently announced a partnership with Enstall and other firms to streamline tax benefits for developers, yet its share price declined 17% last quarter. This drop aligns with earnings challenges and a downturn in the broader market, which declined 12% amid U.S.-China trade tariff uncertainty. Additionally, the hiring of a new CFO, Mr. Asaf Alperovitz, and weak financial performance only compounded investor concerns. While the tech sector saw gains, SolarEdge's results and strategic moves did little to counteract overall market pessimism and macroeconomic tensions.

Every company has risks, and we've spotted 2 risks for SolarEdge Technologies you should know about.

Over the past year, SolarEdge Technologies' total shareholder return plummeted 82.82%, reflecting greater challenges than both the broader US market, which fell by 3.8%, and the US Semiconductor industry, which saw a 6.7% decline. This underperformance highlights significant investor apprehension associated with the company's financial and strategic developments mentioned earlier.

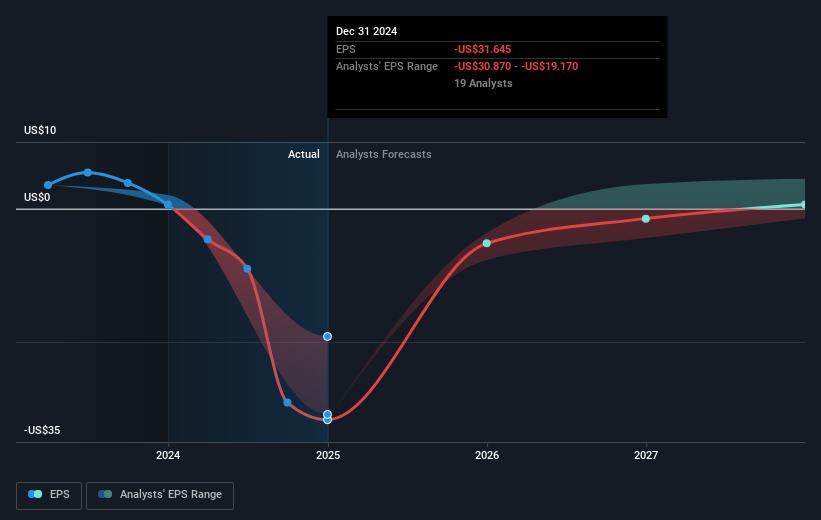

The earnings challenges, alongside macroeconomic pressures and leadership changes, have impacted SolarEdge's revenue and earnings forecasts. With annual sales projected at US$901.46 million, a decrease from the previous year's US$2.98 billion, the company's forecasts reflect ongoing difficulties. Analysts have set a price target of US$17.10, with the current share price well below this target. This discrepancy underscores concerns about SolarEdge's ability to navigate its market environment effectively and achieve profitability soon.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives