- United States

- /

- Semiconductors

- /

- NasdaqGS:RMBS

Examining Rambus (RMBS) Valuation Following Its Recent 28% Three-Month Share Price Surge

Reviewed by Simply Wall St

Rambus (RMBS) has recently caught the attention of investors looking for potential opportunities in the semiconductor industry. The stock’s performance over the past three months, with a 28% gain, has sparked interest in its underlying momentum.

See our latest analysis for Rambus.

After surging 28% over the last three months, Rambus is still building momentum, delivering a remarkable 78% share price return year-to-date. Over the past year, investors have enjoyed an even higher total shareholder return of 86%, reflecting long-term confidence in the company despite a few short-term swings.

If chip sector momentum has your attention, you might also want to uncover other high-potential names in our curated list of top tech and AI stocks in See the full list for free.

With shares boasting double-digit returns and outpacing analyst targets, the big question remains: is Rambus still trading at an attractive valuation, or has the market already factored in all of its expected growth?

Most Popular Narrative: 17.8% Undervalued

With Rambus's narrative fair value set at $115.88 compared to a last close of $95.25, there is a notable valuation gap that has drawn attention. The stage is set for strong upside potential, driven by megatrends reshaping the semiconductor space.

Ongoing rapid growth in AI and data center workloads is accelerating the industry's need for high-speed memory interfaces and connectivity, driving demand for Rambus's DDR5, HBM4, and PCIe 7.0 solutions. This positions the company for sustained top-line revenue growth as new design wins and customer qualifications convert into production orders.

Want to know what powers this bullish narrative? The calculation is built on bold profit margin forecasts, rising revenues, and a premium tech sector earnings multiple. Curious how these surprising financial bets combine to justify Rambus’s elevated fair value? Find out what really underpins the optimism.

Result: Fair Value of $115.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Rambus’s dependence on a few high-margin memory products, along with rising competition, could challenge the optimism driving recent gains.

Find out about the key risks to this Rambus narrative.

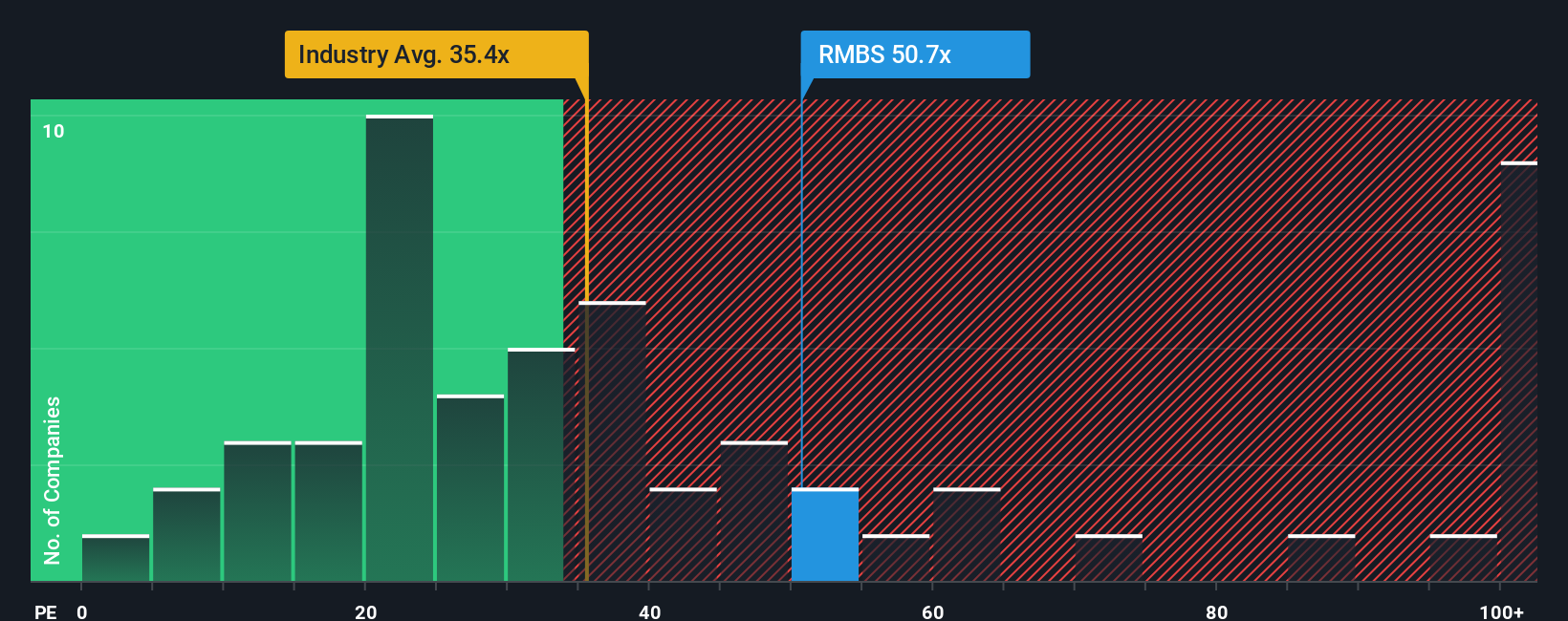

Another View: Multiples Tell a Different Story

Looking at valuation from a different angle, Rambus currently trades at a price-to-earnings ratio of 44.8x. This is notably higher than both its industry average of 34x and the calculated fair ratio of 31.1x. This premium signals the market may be pricing in a lot of future growth, but it could also mean less margin for error if results stumble. Does Rambus really deserve this lofty valuation, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rambus Narrative

If you want to question the assumptions or dive deeper into the numbers, crafting your own view on Rambus takes less than three minutes with Do it your way.

A great starting point for your Rambus research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

You deserve every shot at outsmarting the market. Don’t leave opportunities on the table. Get ahead of the crowd by searching for hidden gems and trends with Simply Wall Street’s powerful Screener.

- Unlock potential with steady cash flows by targeting value plays featured among these 879 undervalued stocks based on cash flows.

- Capture consistent income with high-yield picks available from these 16 dividend stocks with yields > 3%.

- Ride the surge in artificial intelligence innovation by tracking standout opportunities in these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RMBS

Rambus

Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives