- United States

- /

- Semiconductors

- /

- NasdaqGS:RMBS

Earnings Tell The Story For Rambus Inc. (NASDAQ:RMBS) As Its Stock Soars 28%

Despite an already strong run, Rambus Inc. (NASDAQ:RMBS) shares have been powering on, with a gain of 28% in the last thirty days. The last month tops off a massive increase of 139% in the last year.

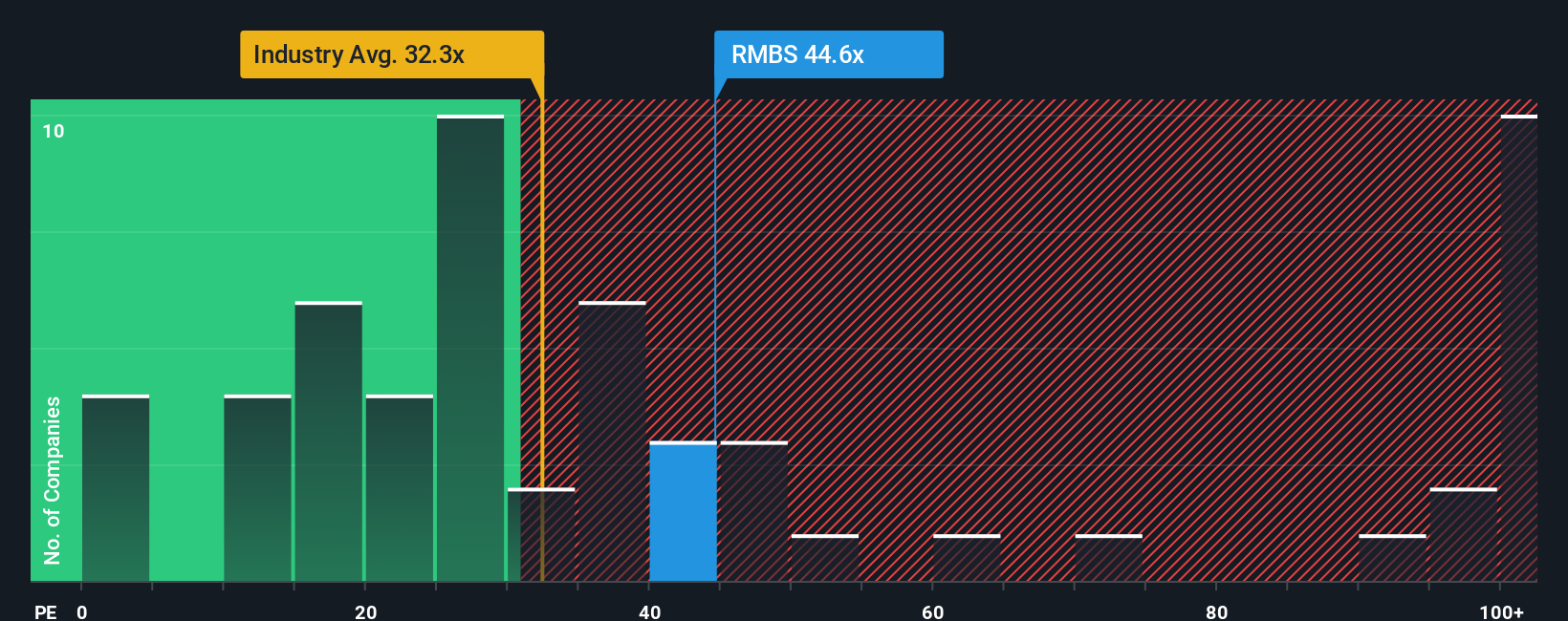

Following the firm bounce in price, Rambus may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 44.6x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Rambus could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Rambus

How Is Rambus' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Rambus' to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow earnings meaningfully over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 17% per year over the next three years. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

With this information, we can see why Rambus is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Rambus' P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Rambus maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Rambus is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Rambus, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RMBS

Rambus

Manufactures and sells semiconductor products in the United States, South Korea, Singapore, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026