- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (RGTI): Valuation Under Fresh Analyst Scrutiny After New Quantum Sector Coverage

Reviewed by Simply Wall St

Rigetti Computing (RGTI) is suddenly front and center again after a wave of new analyst coverage put its quantum ambitions and stock valuation under the microscope, mixing long term optimism with sharper questions about near term risks.

See our latest analysis for Rigetti Computing.

Those fresh notes land after a choppy stretch for Rigetti, with a 1 year total shareholder return of about 201 percent but a weaker recent run including a 90 day share price return of negative 21 percent. This suggests momentum is cooling as valuation and execution risk move back into focus.

If Rigetti has you thinking more broadly about where the next big tech winner might come from, this is a good moment to explore high growth tech and AI stocks as potential alternatives.

Analysts now see Rigetti trading at a steep discount to their price targets. However, against a backdrop of shrinking revenues, rising losses and mounting insider selling, is this a high risk entry point or is the market already discounting future growth?

Price to Book of 19.9x: Is it justified?

Rigetti's latest close at $22.47 implies a lofty valuation multiple, with the stock trading well above semiconductor peers on a price to book basis.

The price to book ratio compares a company's market value to the accounting value of its net assets, a useful lens for capital intensive, asset heavy tech like quantum hardware. At 19.9 times book value, investors are effectively paying a substantial premium over the company's balance sheet for its future potential rather than current fundamentals.

That premium stands out even more starkly when set against benchmarks. Rigetti's 19.9 times price to book compares with an average of 6.6 times for its direct peer set and just 3.6 times for the broader US semiconductor industry, which underscores how aggressively the market is pricing in future growth versus the sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 19.9x (OVERVALUED)

However, shrinking sales, steep losses, and heavy insider selling could quickly unwind sentiment if execution stumbles or funding conditions tighten.

Find out about the key risks to this Rigetti Computing narrative.

Another View: Cash Flows Paint a Harsher Picture

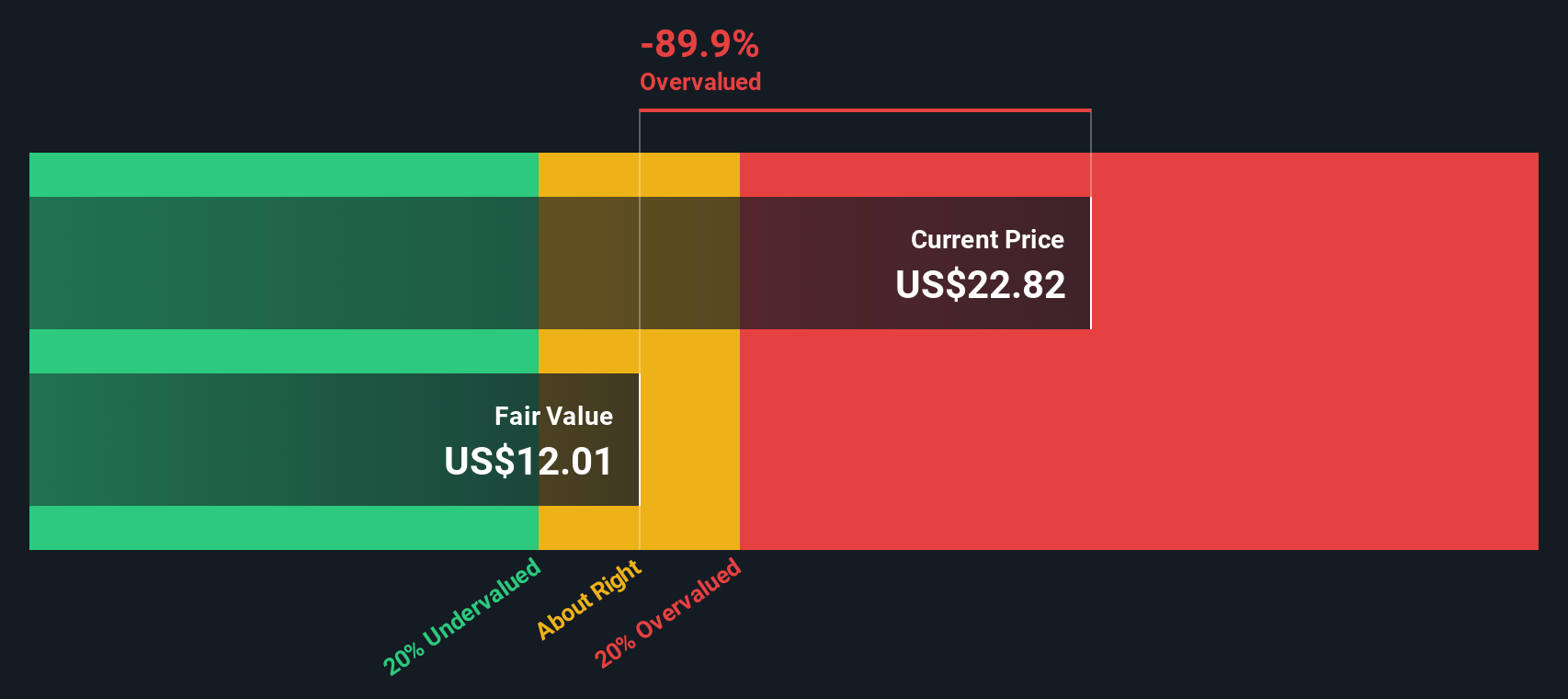

While price to book implies a rich valuation, our DCF model is even more cautious, pointing to a fair value of about $12.02 versus the current $22.47. That gap suggests markets may be banking on flawless execution and leaving little room for setbacks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rigetti Computing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rigetti Computing Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, find a few fresh ideas from the Simply Wall St screener so you are not relying on a single high risk story.

- Look for potential mispricings by scanning these 913 undervalued stocks based on cash flows that combine strong cash flows with attractive entry points.

- Explore structural tech shifts by focusing on these 24 AI penny stocks positioned to benefit from the adoption of intelligent software and automation.

- Consider opportunities for asymmetric upside by reviewing these 3636 penny stocks with strong financials where robust financials may indicate room for substantial re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion