- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (RGTI) Is Up 13.5% After Securing Multi-Million Dollar Quantum System Orders

Reviewed by Sasha Jovanovic

- Rigetti Computing recently announced it secured approximately US$5.7 million in purchase orders for two 9-qubit Novera quantum computing systems, with deliveries expected in the first half of 2026 to clients in Asia and California.

- This milestone highlights growing real-world demand for Rigetti’s proprietary quantum hardware, supporting its move from laboratory innovation to commercial adoption in the quantum computing market.

- With a very large 1-day share price gain, we'll explore how landing commercial Novera system orders bolsters Rigetti's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Rigetti Computing's Investment Narrative?

To own Rigetti Computing stock, you have to believe in the long-term promise of commercial quantum computing, and accept that the road to profitability is still unproven. Securing US$5.7 million in purchase orders for its 9-qubit Novera systems looks like a real step forward, showing that Rigetti can translate its technology into customer demand outside of research labs. With the order split between clients in Asia and California, and the customizable potential of the Novera hardware, Rigetti is gaining diverse traction. But while these orders bring validation, the business is still generating limited revenue and running significant ongoing losses. The fresh news may give bulls some confidence and shift attention to execution and growth, but it does not eliminate major risks like heavy cash burn, volatility, and uncertainty about when or if the company will break even. Contrast this with significant insider selling and continued unprofitability, critical risks investors should be aware of.

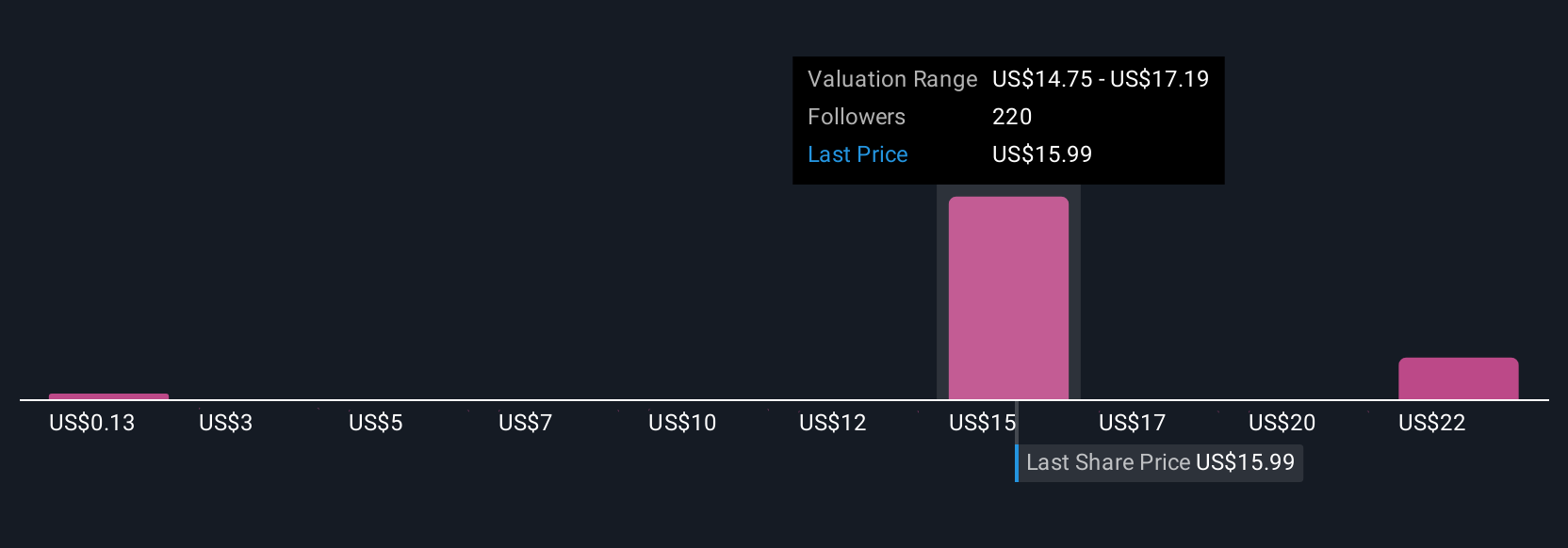

In light of our recent valuation report, it seems possible that Rigetti Computing is trading beyond its estimated value.Exploring Other Perspectives

Explore 43 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion