- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (NasdaqCM:RGTI) Secures US$5M Air Force Research Grant

Reviewed by Simply Wall St

Rigetti Computing (NasdaqCM:RGTI) has seen a substantial price movement of 25% over the past month, coinciding with several key developments that may have added weight to the broader market's ascent of 10% over the past year. The company's significant milestones include closing a private placement transaction and receiving a $5.48 million grant from the Air Force Office of Scientific Research to advance its chip fabrication technology, ABAA. Additionally, Rigetti's selection for DARPA's Quantum Benchmarking Initiative highlights its ongoing commitment to quantum computing innovations, suggesting that these advancements play a role in its recent price performance, complementing the overall positive market trajectory.

Over the longer period of the last year, Rigetti Computing's shares have experienced a very large total return of 659.29%, an indication of significant investor interest and positive sentiment. When considering the company's share performance relative to a one-year timeframe, Rigetti outperformed the general US market, which gained 10%, and the US Semiconductor industry, which advanced 12.6% during the same period.

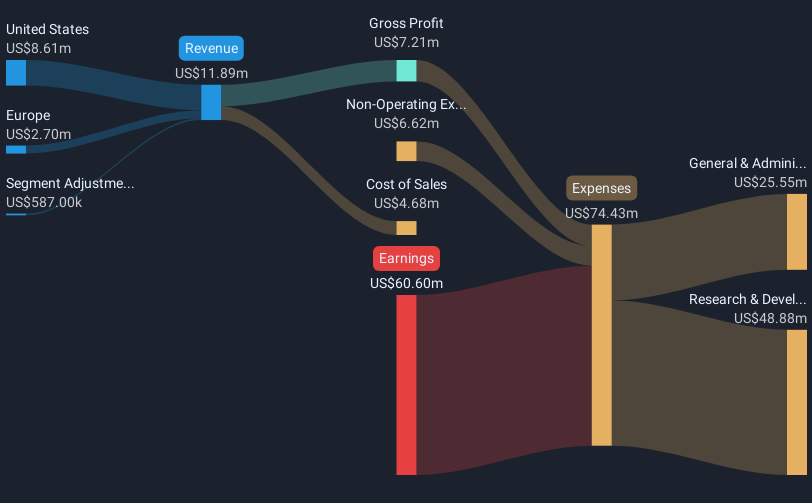

The developments highlighted in the introduction, such as securing a US$5.48 million grant and participating in landmark quantum computing projects, underscore potential growth avenues for revenue. However, the company's earnings remain challenged, with considerable losses reported in their latest financial period. Despite revenue forecasts indicating significant growth, profitability remains out of reach for the foreseeable future.

In terms of market valuation, Rigetti's current share price reflects a discount of approximately 41.1% to consensus analyst price targets, suggesting analysts anticipate potential upside. The recent price movement could be a reaction to these strategic developments, yet the path to achieving financial stability appear crucial, given the current negative margins and planned outsized revenue growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rigetti Computing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives