- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

How Investors Are Reacting To Rigetti Computing (RGTI) After JPMorgan’s Quantum Computing Endorsement

Reviewed by Sasha Jovanovic

- JPMorgan Chase recently announced a US$10 billion investment plan focusing on industries critical to U.S. national economic security, with quantum computing highlighted as a key sector for potential capital deployment.

- This endorsement has fueled debate among analysts about whether pure-play quantum firms like Rigetti Computing are benefiting from fundamental progress or speculative sentiment.

- We'll take a closer look at how JPMorgan's backing as a catalyst raises questions about Rigetti's business fundamentals and future prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Rigetti Computing's Investment Narrative?

To be a Rigetti Computing shareholder, you have to believe that commercial quantum computing will transition from hype to profitable reality, with Rigetti cementing its role as a key player. The JPMorgan news injected new optimism, triggering a surge in pure-play quantum stocks like Rigetti, but the market reaction appears to have been sentiment-driven rather than a reflection of immediate business transformation. The most important short-term catalysts remain the delivery of new client systems, key academic and defense contracts, and further product rollouts. However, the risks, including steep and widening losses, modest current revenue, dilution from recent capital raisings, and strong competition from large tech firms, have not materially changed with JPMorgan’s announcement. Despite the headline, Rigetti still faces the same fundamental hurdles, making the JPMorgan signal interesting but not a game-changer for Rigetti’s immediate risk-reward equation.

But despite the headlines, shareholder dilution remains a key issue investors should be aware of.

Exploring Other Perspectives

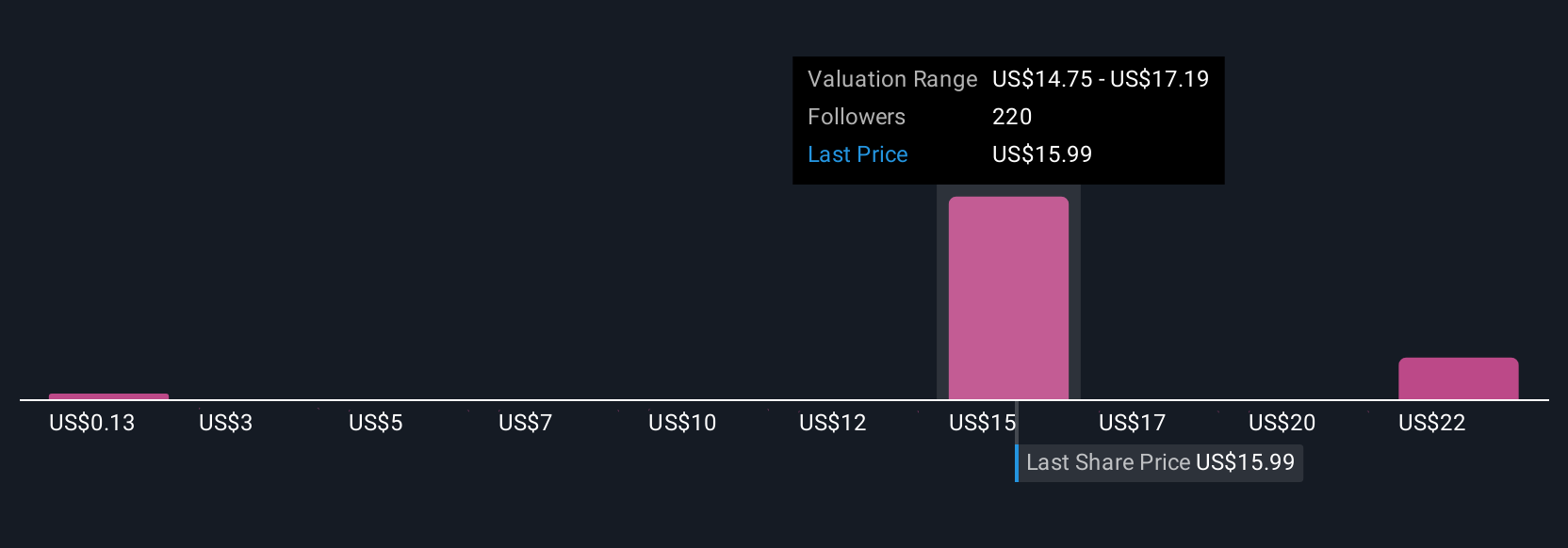

Explore 45 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives