- United States

- /

- Semiconductors

- /

- NasdaqGS:QRVO

Qorvo (QRVO): Revisiting Valuation Following Mizuho Downgrade on Smartphone Chip Demand Concerns

Reviewed by Simply Wall St

Qorvo (QRVO) shares have been facing extra scrutiny after Mizuho Securities downgraded the company. The move comes as analysts anticipate softer demand in smartphone chips, particularly with concerns about shrinking iPhone shipments and ongoing challenges in China.

See our latest analysis for Qorvo.

After Mizuho’s downgrade and renewed worries around smartphone demand, Qorvo’s share price has been volatile. Still, it managed a 34% year-to-date gain. Despite this recent strength, its 1-year total shareholder return remains negative, which highlights that momentum has improved lately, but longer-term holders are still underwater.

If this shift in chip demand has you reassessing your portfolio, now’s the perfect moment to explore See the full list for free.

Yet with shares still trading below analysts’ price targets and recent momentum outpacing longer-term returns, investors are left to wonder if Qorvo is undervalued right now, or if the market is already anticipating its next leg of growth.

Most Popular Narrative: 3.9% Undervalued

Qorvo's most recent consensus narrative places its fair value slightly above the last close price, hinting that the market isn't fully pricing in its next phase of growth. This setup invites a closer look at the assumptions driving the current outlook and sets the stage for a deeper dive into the catalysts underpinning analyst confidence.

Qorvo is set to benefit from accelerating adoption and content expansion tied to the rollout of 5G and future 6G networks, as evidenced by strong design wins in flagship smartphones, Wi-Fi 7/8 deployments, and persistent efforts to increase RF content per device. These factors directly support multi-year revenue growth and margin expansion.

Want to know what’s behind this high-stakes valuation? The narrative hinges on breakthrough technology cycles and a profit forecast that could surprise even optimists. Discover which financial levers are powering the consensus price target. See the revenue and earnings moves that analysts are betting on.

Result: Fair Value of $97.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Qorvo still faces significant risks, including heavy reliance on a single customer and potential setbacks in its diversification strategy. These factors could disrupt growth expectations.

Find out about the key risks to this Qorvo narrative.

Another View: Multiples Tell a Different Story

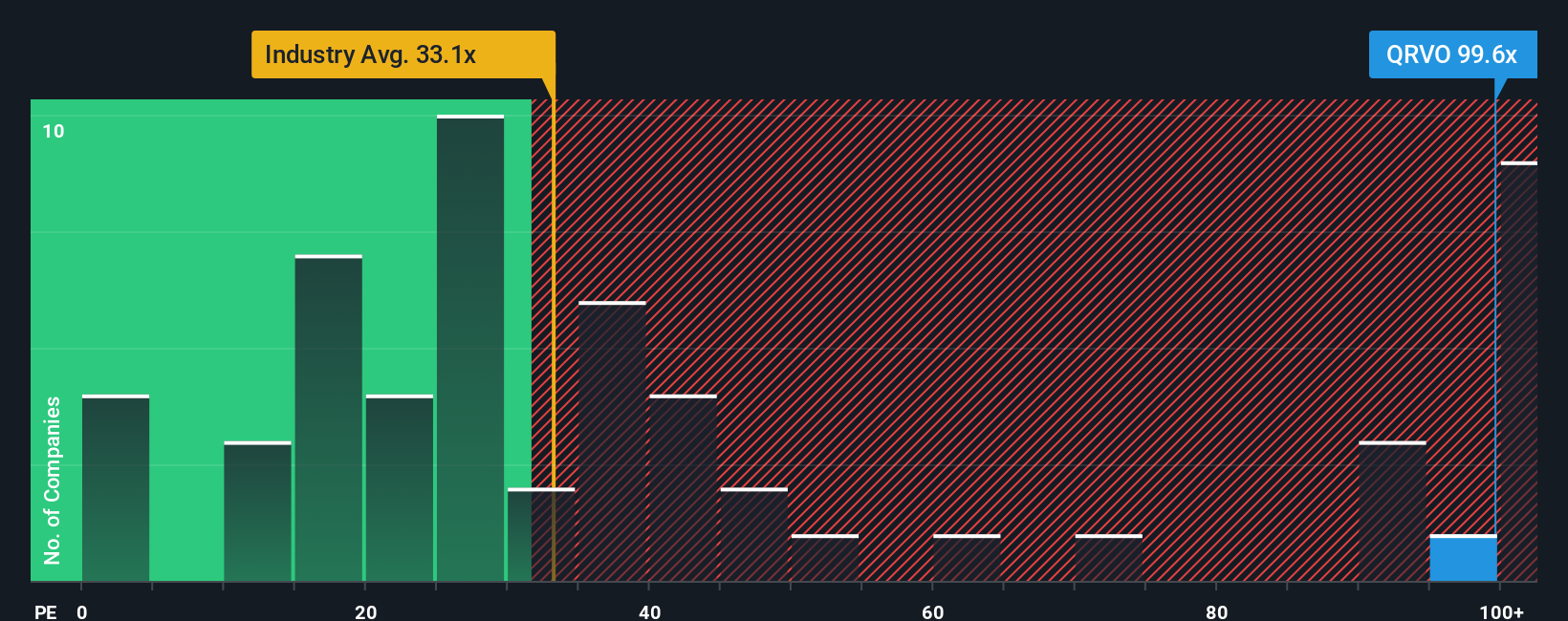

While the consensus narrative points to undervaluation, a closer look at the price-to-earnings ratio raises questions. Qorvo trades at 107.2 times earnings, far above the US Semiconductor industry average of 37.4 and its fair ratio of 36.5. This steep premium suggests investors are betting heavily on future growth. Could expectations be set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qorvo Narrative

If you’d rather dig into the numbers your way or think the real story looks different, it takes less than three minutes to craft your own narrative, and you can Do it your way.

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The world of stocks is full of potential. Use the right tools and you can spot what others miss. Start your search with these handpicked screens:

- Uncover hidden gems that could deliver robust returns by checking out these 881 undervalued stocks based on cash flows for companies trading below their intrinsic value.

- Catch the ongoing innovation boom by seeing these 24 AI penny stocks powering growth at the intersection of software, automation, and big data.

- Lock in reliable income streams and see which companies are offering generous yield opportunities with these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qorvo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QRVO

Qorvo

Engages in development and commercialization of technologies and products for wireless, wired, and power markets in the United States, China, rest of Asia, Taiwan, and Europe.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives