- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Qualcomm (QCOM): Assessing Valuation as Layoffs and Legal Disputes Drive Strategic Shift Beyond Smartphones

Reviewed by Kshitija Bhandaru

QUALCOMM (QCOM) is back in the headlines, this time announcing layoffs connected to its ongoing tussle with Apple and the fallout from recent regulatory settlements. While these job cuts signal some real pressure on the business, such as multibillion-dollar legal battles and hostile takeover attempts, the company is framing these moves as steps to streamline its cost base and stay agile. There is also an unmistakable signal to investors that QUALCOMM is ready to adapt, even if it means making tough calls.

But that isn't the full story. Alongside trimming costs, QUALCOMM is doubling down on its diversification push beyond smartphones, moving deeper into automotive, IoT, and even AI-powered processors for next-generation PCs. Over the past year, the stock has delivered just under a 1% total return, with price momentum picking up in recent months, but far from the strong gains of years past. Legal settlements and news from rivals have kept things interesting, but right now the real question is whether these transformation efforts are resonating with the market.

With QUALCOMM’s share price and revenue outlook at an inflection point, is the stock's current valuation a genuine opportunity for investors to get in ahead of renewed growth, or is the market already pricing in all the upside?

Most Popular Narrative: 44.4% Undervalued

According to the most widely followed narrative, Qualcomm is trading well below its perceived fair value. The narrative points to a significant upside potential for investors who believe in the company’s transformation and financial discipline.

Qualcomm (QCOM) delivered a strong start to FY2025, posting record revenues of $11.7 billion (up 18% year over year) and EPS growth of 24% year over year to $3.41. The company’s handset, automotive (up 61% year over year), and IoT (up 36% year over year) segments drove top-line expansion, while $2.7 billion was returned to shareholders through buybacks and dividends.

Imagine a company not only posting historic earnings but also returning billions to shareholders, and now being called deeply undervalued. What drives a fair value nearly twice as high as today’s price? It comes down to the bold multi-segment growth strategy and ambitious margin benchmarks. Interested in how robust expansion across AI, automotive, and connected devices supports the narrative? Take a closer look and explore the assumptions behind this eye-catching price target.

Result: Fair Value of $300 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent legal disputes and intensifying competitive pressure from global semiconductor rivals could quickly challenge even the most optimistic growth outlook for Qualcomm.

Find out about the key risks to this QUALCOMM narrative.Another View: The DCF Model Perspective

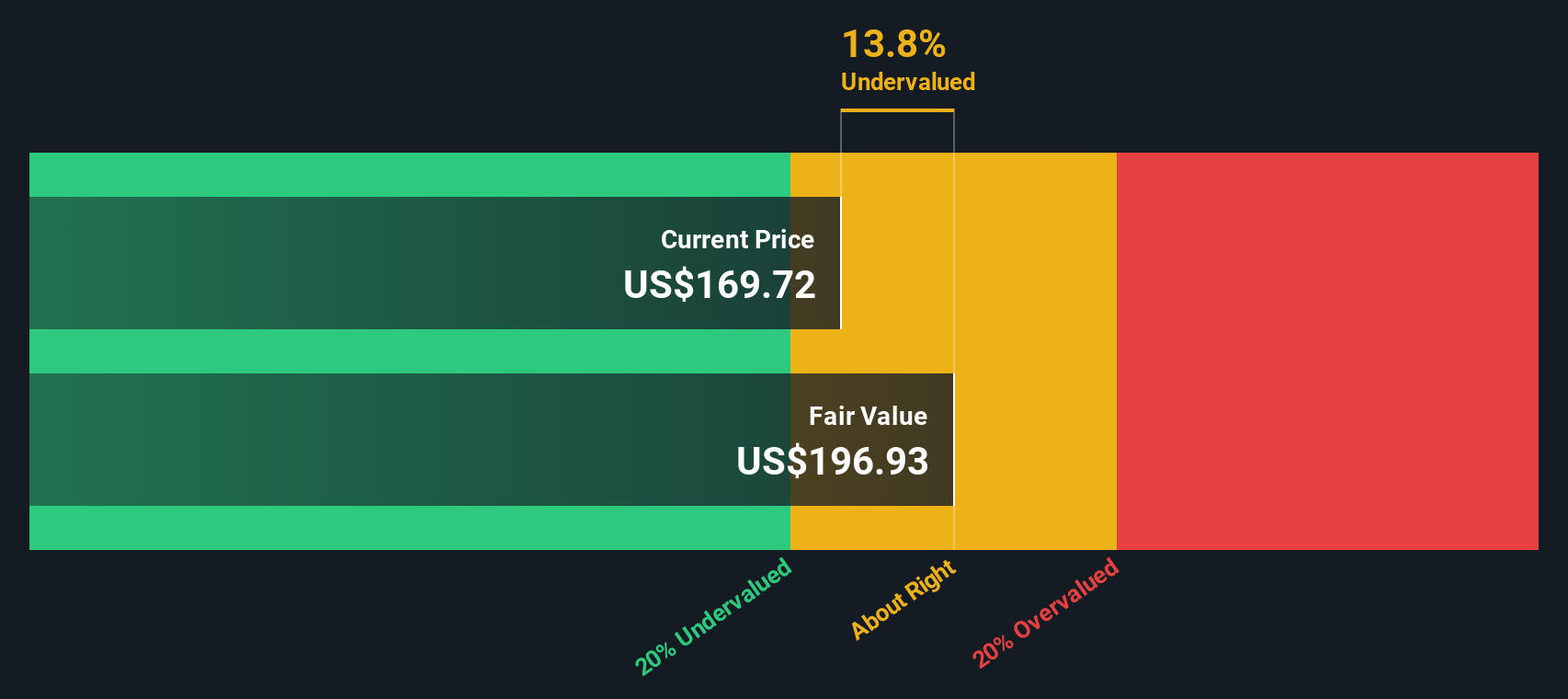

While some see QUALCOMM as a bargain based on its share price versus fair value, our DCF model tells a similar story by estimating the company is still trading below its intrinsic worth. This alignment raises the question of whether there is genuine value or if the real upside has already been priced in.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out QUALCOMM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own QUALCOMM Narrative

If you think the numbers tell a different story, or want to shape your own perspective, you have the tools to build your own in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding QUALCOMM.

Looking for More Investment Ideas?

Stay ahead of market trends and supercharge your portfolio by checking out other high-potential stocks hand-picked for different strategies on Simply Wall Street. Don’t let the next opportunity pass you by. Your smartest investment move could be just one click away.

- Uncover overlooked opportunities among budget-friendly companies when you seize the chance with penny stocks with strong financials.

- Tap into booming advancements in artificial intelligence, harnessing growth potential with our AI penny stocks.

- Boost your search for value by zeroing in on stocks that may be trading below their true worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives