- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (NasdaqGS:QCOM) Extends Talks for Alphawave Acquisition Consideration Deadline

Reviewed by Simply Wall St

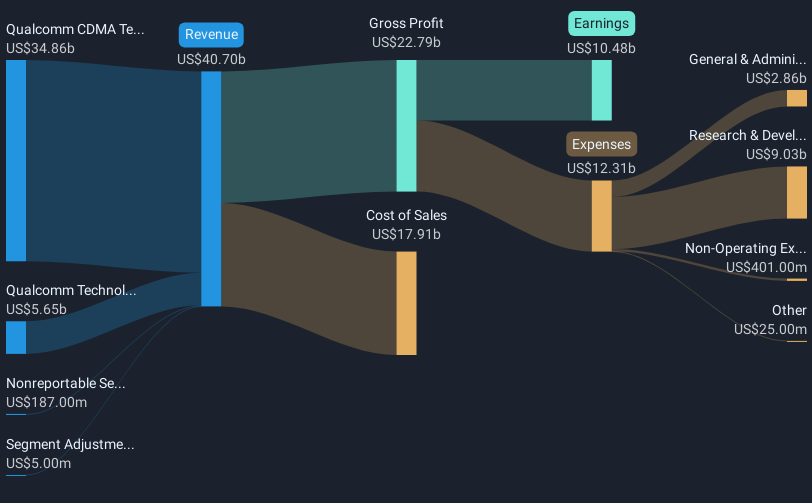

In recent developments, Qualcomm (NasdaqGS:QCOM) has been at the center of acquisition discussions with Alphawave IP Group, extending the timeframe for decision-making, and announcing robust quarterly earnings, while confirming future revenue guidance. Over the past month, the stock moved up by 4%, amid a positive market backdrop highlighted by the US-China tariff agreement, which buoyed tech stocks considerably. Qualcomm's earnings report revealed strong financial performance, with revenue and net income showing substantial year-over-year growth. These factors likely added positive momentum to the company's shares, aligning them with broader market gains in the tech sector.

Buy, Hold or Sell QUALCOMM? View our complete analysis and fair value estimate and you decide.

The recent news surrounding Qualcomm's acquisition discussions, robust earnings, and future revenue guidance could impact the company's broader narrative. With expansion into automotive and IoT sectors being key, these developments may enhance Qualcomm's ability to achieve its long-term revenue goal of US$22 billion by 2029. The Snapdragon and 5G advancements position the company to potentially capture additional market segments, though global trade uncertainties and competitive pressures remain pertinent challenges.

Over the past five years, Qualcomm's total shareholder return was 102.38%, indicating significant value creation amid industry volatility. While its one-year performance lagged behind the US Semiconductor industry's 12.1% return, the longer-term gains demonstrate resilience and agility in adapting to market changes. Compared to the broader US market's 8% return over the previous year, Qualcomm's performance was similarly behind, emphasizing the need for strategic maneuvers to align more closely with industry trends.

In terms of revenue and earnings forecasts, the positive momentum from Qualcomm's announcements could lead analysts to reevaluate its potential growth trajectory. Analysts have projected revenue growth of 2.4% annually over the next three years, with earnings expected to reach US$11.6 billion by 2028. The current share price of US$139.9 suggests a significant discount to the consensus price target of US$176.86, indicating potential room for upward movement if Qualcomm meets or surpasses these expectations. Shareholder confidence might also be positively influenced by these developments if execution aligns with strategic objectives.

Upon reviewing our latest valuation report, QUALCOMM's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives