- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (NasdaqGS:QCOM) Extends Alphawave Acquisition Discussions Deadline

Reviewed by Simply Wall St

QUALCOMM (NasdaqGS:QCOM) has been in discussions regarding a potential acquisition of Alphawave IP Group, with extended deadlines highlighting the ongoing interest. This news emerged amidst broader market growth of 2% over the past week and a 12% increase over the last year. Concurrently, QUALCOMM's share price rose 5% over the past month. Although the market saw notable upward movement, Qualcomm's activities, including expanded roles for financial institutions in recent public offerings, may have added weight to its share price performance, reflecting investor confidence in the company’s ongoing initiatives.

Buy, Hold or Sell QUALCOMM? View our complete analysis and fair value estimate and you decide.

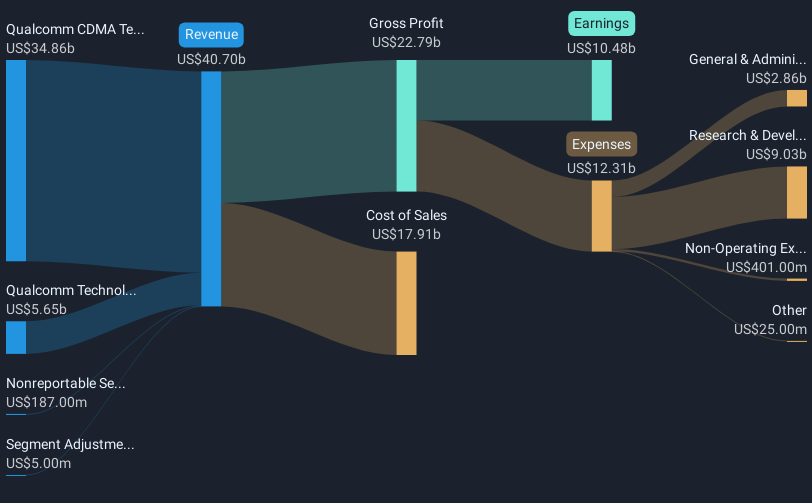

The potential acquisition of Alphawave IP Group may enhance QUALCOMM's strategic positioning in the semiconductor industry by accelerating its growth in automotive and IoT sectors. These avenues are crucial as they align with QUALCOMM's expansion goals, potentially reaching significant revenue figures by fiscal 2029. Over the past five years, QUALCOMM's total return, including share price and dividends, was 77.46%, highlighting a robust long-term performance despite short-term market fluctuations.

In comparison, QUALCOMM underperformed over the past year against the broader US market, which returned 11.9%, and the US Semiconductor industry, which saw a return of 11.6%. These figures may indicate the market's cautious stance toward QUALCOMM amid global trade uncertainties and competitive pressures. However, reports of a 5% increase in QUALCOMM's share price over the past month suggest investor optimism regarding the acquisition news and its potential impact on revenue and earnings forecasts.

The announcement places QUALCOMM’s current share price movement in the wider context of analyst price targets, seeing a significant discount to the estimated consensus target of US$176.86. This price target suggests an increase of roughly 20.9% from the recent share price of US$139.9. Therefore, should the acquisition materialize, it could bolster investor confidence, impacting revenue forecasts positively as analysts have considered in their current assessments.

Examine QUALCOMM's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives