- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Is QUALCOMM Attractively Priced After September Chip Tariff Announcement?

Reviewed by Simply Wall St

Thinking about what to do with QUALCOMM stock right now? You are not alone. With chipmakers constantly in the headlines and global politics shaking up the sector, deciding whether to buy, hold, or steer clear can feel overwhelming. If you have been following the recent moves, QUALCOMM has put in some impressive gains over the past month, up 8.6%, despite a mild dip of 0.3% in the past week. Over one year, returns have been 1.9%, and over five years QUALCOMM has posted a 57.2% climb. What is driving these changes? News of looming tariffs on semiconductor imports and global demand shifts has put chip stocks in the spotlight, making the sector even more interesting for long-term investors.

Here is something valuation fans will love: QUALCOMM currently scores a 4 on our value index, meaning it is undervalued in 4 out of 6 key checks. That is a solid showing for a major tech player, especially as investors weigh growth versus risk in light of fresh policy changes. Whether you are eyeing the company’s long-term resilience or responding to the latest headlines, understanding how QUALCOMM stacks up on valuation is crucial.

Next, let us break down some of the most common ways analysts assess QUALCOMM’s value. By the end, we will share an even more insightful approach to putting these numbers in context.

Why QUALCOMM is lagging behind its peersApproach 1: QUALCOMM Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s fair value by projecting its future cash flows and discounting them back to today at an appropriate rate. For QUALCOMM, this approach starts with last year’s free cash flow of $11.25 billion and factors in analyst growth forecasts and longer-term trend estimates.

Analysts forecast QUALCOMM’s free cash flow to grow steadily, reaching about $16.32 billion by 2029. For the next decade, Simply Wall St extrapolates these estimates, accounting for a reasonable slowing of growth over time.

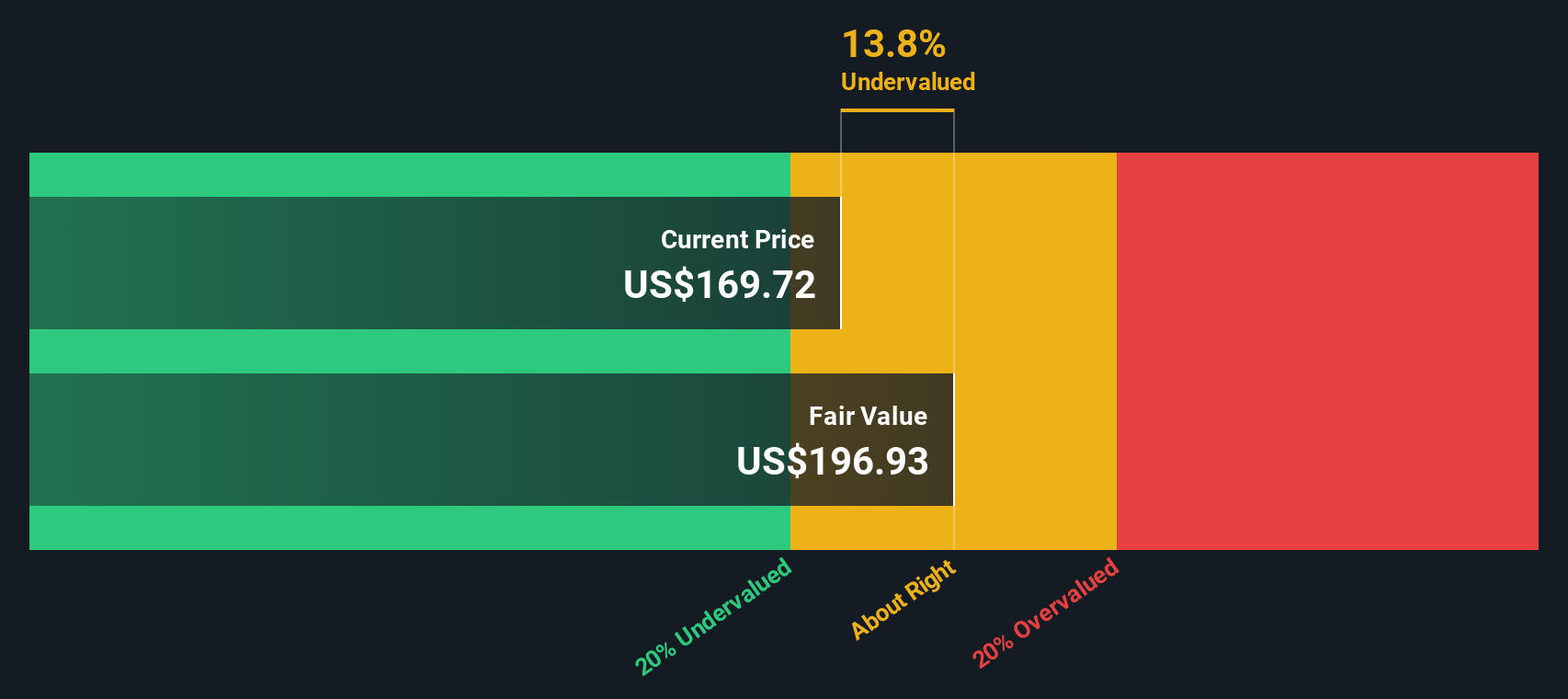

Using this method, QUALCOMM’s intrinsic fair value is calculated at $197.62 per share. Compared to its current market price, this figure suggests the stock is 18.9% undervalued.

The DCF analysis indicates QUALCOMM is trading below its estimated worth, even after factoring in cautious long-term growth assumptions.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for QUALCOMM.

Approach 2: QUALCOMM Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is often the first stop for investors evaluating profitable companies like QUALCOMM, as it relates a company’s share price to its per-share earnings. The PE ratio gives a quick snapshot of how the market values a company’s current profits compared to its stock price.

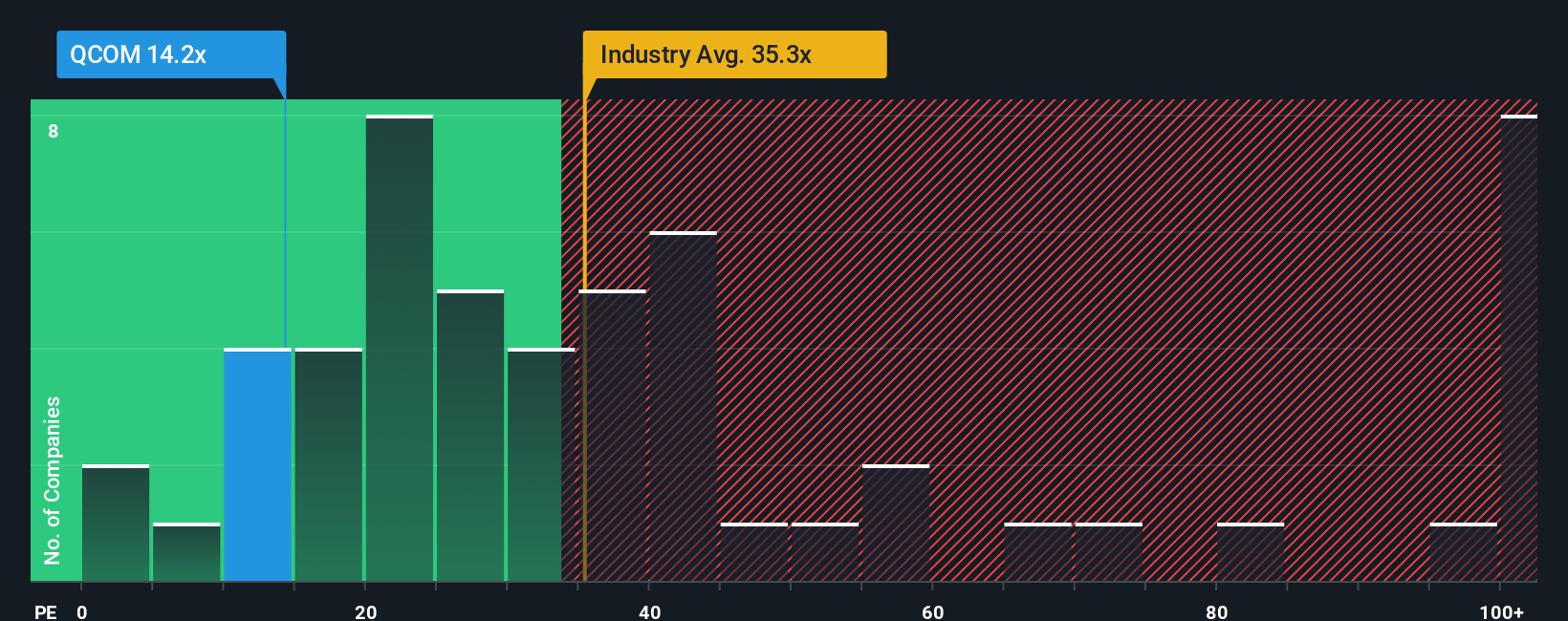

Generally, higher growth expectations or lower business risk will justify a higher PE ratio, while slower growth or greater uncertainty puts a lid on what investors are willing to pay. QUALCOMM’s current PE ratio stands at 14.9x. For context, this is well below the semiconductor industry average of 33.7x, and also lower than the average among its closest peers, which sits at 52.5x.

While comparisons to peers and industry averages offer some perspective, they do not capture all the moving parts that should drive the “right” PE ratio for a company. Simply Wall St’s proprietary Fair Ratio steps in here, blending in QUALCOMM’s earnings growth prospects, profitability, risk factors, market size, and its position within the broader industry. QUALCOMM’s Fair Ratio is calculated at 25.5x, meaning that given its fundamentals and risk profile, investors could reasonably expect to pay about 25.5 times earnings for the stock.

Comparing QUALCOMM’s actual PE ratio of 14.9x to its Fair Ratio of 25.5x, the shares look attractively valued based on this method, pointing to meaningful upside if the market recalibrates its expectations.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your QUALCOMM Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple and powerful tool for investors to tell their story about a company, connecting their views on its future with the numbers they expect, such as fair value, revenue growth, and earnings margins, instead of just relying on generic analyst assumptions.

Think of a Narrative as a way to link QUALCOMM’s story (the business drivers and industry context you believe in) to your own financial forecast. This approach then results in a fair value tailored to your expectations. Narratives are widely used on Simply Wall St's Community page, making it easy for millions of investors to share ideas and update their outlooks as news or earnings reports become available.

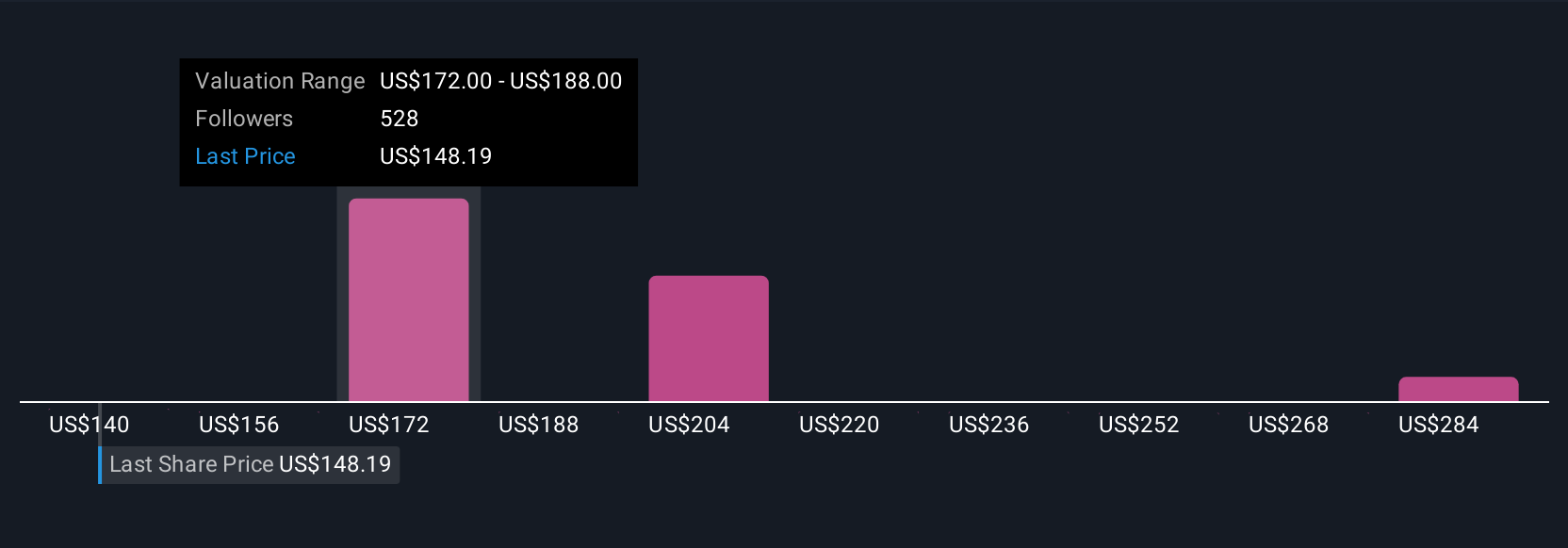

By using Narratives, you can quickly see if you think QUALCOMM’s share price is attractive by comparing your fair value to the market price and update your view instantly if something important changes. For example, one user’s bullish Narrative expects AI and automotive growth to drive a fair value of $300 per share, while a more cautious perspective sees $140 as fair value based on slower growth and higher risks. Narratives let you invest with confidence, grounded in your own understanding.

Do you think there's more to the story for QUALCOMM? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026