- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

How Investors Are Reacting To QUALCOMM (QCOM) Clearing Legal Hurdles in Arm License Dispute

Reviewed by Sasha Jovanovic

- In early October 2025, a U.S. District Court ruled entirely in Qualcomm's favor in a high-profile legal dispute brought by Arm Holdings over alleged breaches of license agreements involving Qualcomm and its subsidiary Nuvia, dismissing all of Arm's claims and upholding previous jury verdicts.

- This outcome removes a significant legal overhang for Qualcomm, enabling the company to move forward confidently with its AI-enabled chip development and partnerships in the semiconductor industry.

- We’ll examine how the resolution of this long-running legal battle could strengthen Qualcomm’s investment case in advanced chip solutions and AI.

Find companies with promising cash flow potential yet trading below their fair value.

QUALCOMM Investment Narrative Recap

To own Qualcomm, an investor must believe in the company’s sustained innovation in mobile and AI chipsets and its successful diversification into high-growth markets beyond smartphones. The recent complete legal win over Arm Holdings removes a major overhang, directly supporting Qualcomm’s efforts to accelerate AI-enabled chip development, a leading short-term catalyst, while reducing the immediate risk of disruptive licensing rulings, though competitive and regulatory pressures remain relevant.

In connection with this win, Qualcomm’s recent announcement to adopt Arm’s latest v9 architecture in future PC and smartphone chips is especially timely. By continuing to integrate advanced Arm technologies, even during legal disputes, Qualcomm signals its commitment to pushing ahead in next-generation, AI-capable device markets, which are central to its current growth strategy.

However, investors should be alert to another factor: while the legal risk with Arm is lower, questions remain about Qualcomm’s vulnerability to...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's outlook anticipates $46.9 billion in revenue and $12.2 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 2.7% and an earnings increase of $0.6 billion from current earnings of $11.6 billion.

Uncover how QUALCOMM's forecasts yield a $177.71 fair value, a 5% upside to its current price.

Exploring Other Perspectives

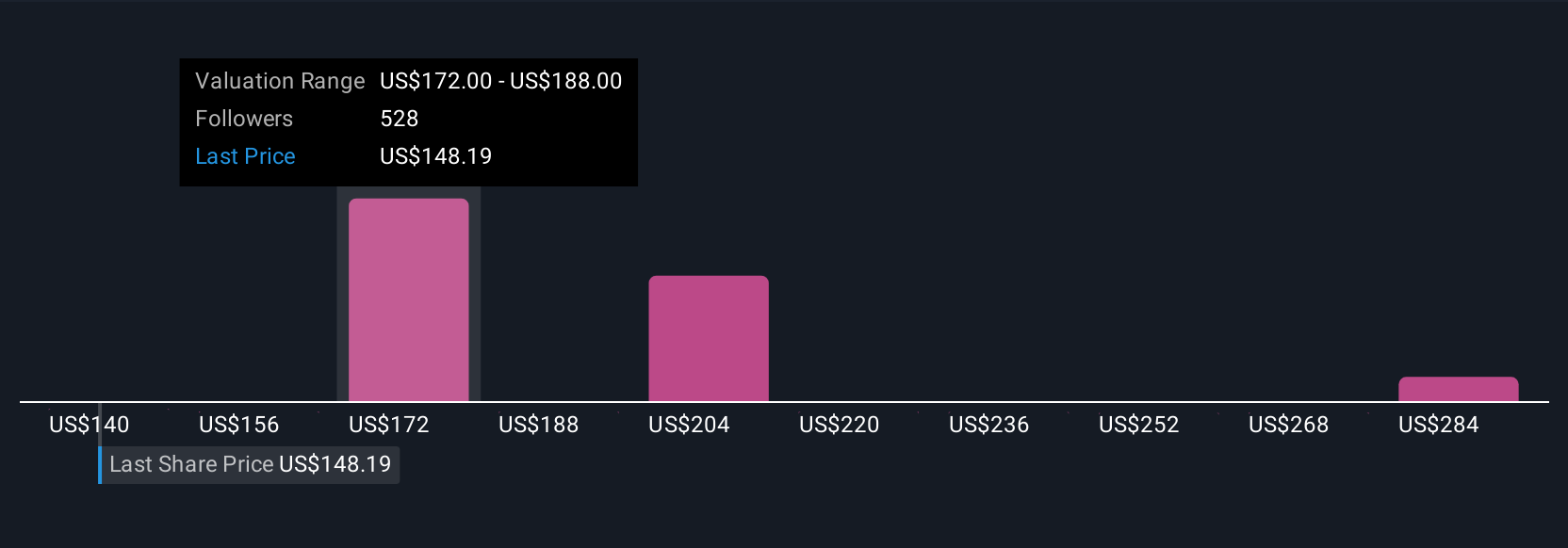

Simply Wall St Community users submitted 38 fair value estimates for Qualcomm ranging from US$140 to US$300 per share. Awareness of shifting license and regulatory risks is critical, as these can significantly influence expectations and price targets.

Explore 38 other fair value estimates on QUALCOMM - why the stock might be worth as much as 77% more than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026