- United States

- /

- Semiconductors

- /

- NasdaqCM:POET

Does POET Technologies’ (POET) New US$143 Million Shelf Registration Reframe Its Capital Allocation Playbook?

Reviewed by Sasha Jovanovic

- In late November 2025, POET Technologies Inc. filed a shelf registration for up to US$143.30 million, covering 29,608,160 common shares.

- This filing gives the company flexibility to raise capital quickly, which can influence expectations around funding plans, partnerships, or future projects.

- Next, we’ll examine how this sizeable shelf registration capacity shapes POET Technologies’ investment narrative and future capital-raising flexibility.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is POET Technologies' Investment Narrative?

To own POET Technologies, you really have to believe that its optical engine platform can turn early design wins and collaborations into meaningful, recurring revenue before cash needs become a constraint. The recent US$143.30 million shelf registration sits right at the center of that debate. On one hand, it increases near term flexibility to fund the Sivers and QCi development roadmaps, support production ramps from 2026, and bridge ongoing losses. On the other, it adds a fresh layer of dilution risk on top of an already active year for equity issuance, in a business that is still generating less than US$1 million in annual sales and remains deeply unprofitable. With the share price volatile and expectations already sensitive, how and when management uses this shelf could become an important short term catalyst.

However, one near term funding choice could significantly alter the risk profile that shareholders face. The valuation report we've compiled suggests that POET Technologies' current price could be inflated.Exploring Other Perspectives

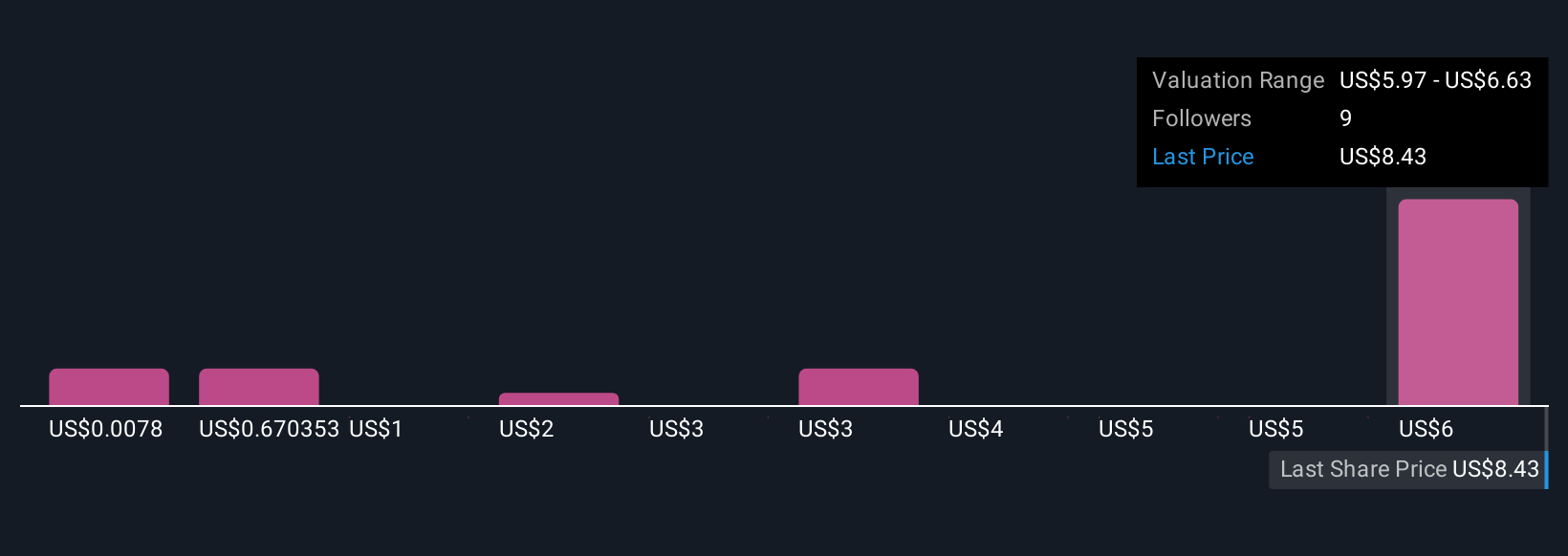

Eleven members of the Simply Wall St Community currently see POET’s fair value anywhere between US$0.01 and US$17.37 per share, a very wide spread that underlines how differently people view its prospects. When you set those numbers against the company’s ongoing losses, heavy recent dilution and new US$143.30 million shelf capacity, it becomes clear that understanding both the upside scenarios and the funding risks is essential before forming a view on POET’s long term potential.

Explore 11 other fair value estimates on POET Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own POET Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your POET Technologies research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free POET Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate POET Technologies' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:POET

POET Technologies

Designs, develops, manufactures, and sells semiconductor products and services for commercial applications in the United States, Canada, Singapore, and China.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026