- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Slammed 34% Impinj, Inc. (NASDAQ:PI) Screens Well Here But There Might Be A Catch

The Impinj, Inc. (NASDAQ:PI) share price has fared very poorly over the last month, falling by a substantial 34%. Still, a bad month hasn't completely ruined the past year with the stock gaining 75%, which is great even in a bull market.

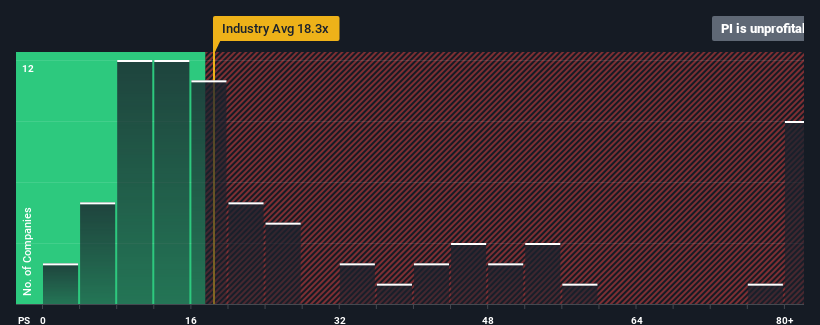

In spite of the heavy fall in price, Impinj may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -126.4x, since almost half of all companies in the United States have P/E ratios greater than 15x and even P/E's higher than 29x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's superior to most other companies of late, Impinj has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Impinj

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Impinj's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 67% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 80% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 5.0%, which is noticeably less attractive.

In light of this, it's peculiar that Impinj's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Impinj's P/E

Shares in Impinj have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Impinj's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Impinj that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026