- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Impinj (PI) Valuation Check After Q3 2025 Earnings Beat and Gen2X RFID Technology Launch

Reviewed by Simply Wall St

Impinj (PI) caught investors attention after third quarter 2025 results topped expectations and management showcased new Gen2X technology designed to cut counterfeiting and improve RFID tag performance, reinforcing confidence in its growth story.

See our latest analysis for Impinj.

Even after the initial excitement around Gen2X and the earnings beat, Impinj’s 30 day share price return of negative 13 percent and 90 day share price return of negative 17.9 percent suggest momentum has cooled. However, its 3 year total shareholder return of 38.3 percent still points to a strong longer term story.

If this kind of RFID driven growth has your attention, it could be worth seeing what else is out there in high growth tech by exploring high growth tech and AI stocks.

With shares still below analyst targets despite rapid revenue and earnings growth, the key question now is whether Impinj is trading at a meaningful discount or if the market has already priced in its next leg of expansion.

Most Popular Narrative Narrative: 35% Undervalued

With Impinj closing at $156.79 against a narrative fair value of $241.11, the spread reflects aggressive expectations for growth, profitability, and sustained adoption.

M800 and Gen2X platform enhancements, including improved readability, faster inventory counting, and unique enterprise use cases (like loss analytics), are driving higher gross margin product mix and expanding the company's addressable market by enabling new categories such as food, high-value apparel, and hard-to-read items. Sustained adoption of these products bolsters future gross margins and earnings.

Want to see the math behind that confidence gap? The narrative leans on turbocharged revenue expansion, a sharp margin reset, and a future earnings multiple usually reserved for market leaders. Curious which assumptions really power that fair value number and how far profitability is expected to scale from here? Dive into the full narrative to unpack the projections driving this valuation call.

Result: Fair Value of $241.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained tariff uncertainty and slower than expected food and logistics deployments could quickly challenge the lofty growth and margin assumptions underpinning this valuation.

Find out about the key risks to this Impinj narrative.

Another Angle on Valuation

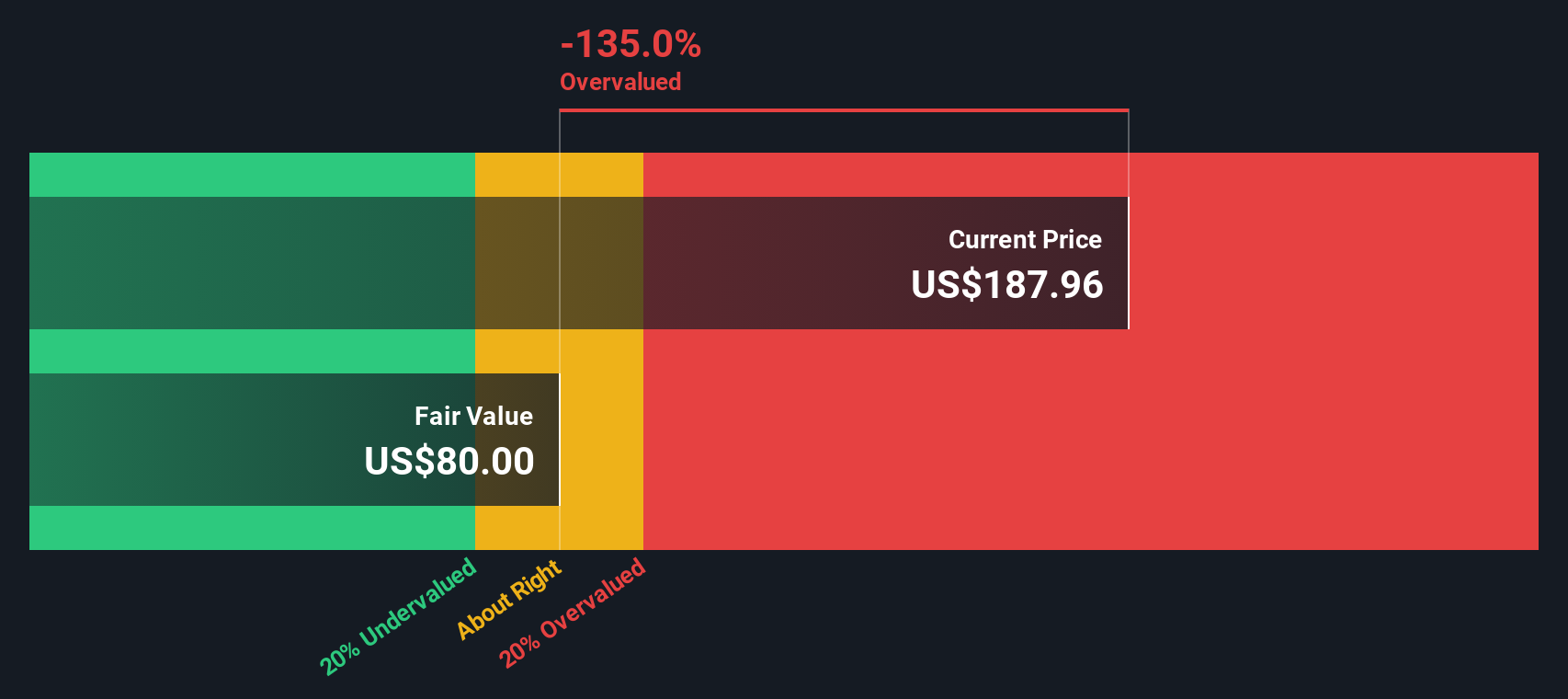

While the narrative suggests Impinj is around 35 percent undervalued, our DCF model is more cautious. It points to a fair value of about $173.51, only 9.6 percent above the current $156.79 price. Is the truth closer to modest upside than a deep discount?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Impinj Narrative

If you are not aligned with this outlook or would rather dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Impinj.

Ready for more investment ideas?

Before you move on, use the Simply Wall Street Screener to identify your next potential investment idea, targeting focused themes and building a sharper watchlist today.

- Capture momentum in digital disruption by scanning these 26 AI penny stocks that are reshaping software, automation, and data driven decision making.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that could help you build a more reliable cash flowing portfolio.

- Position ahead of financial innovation by tracking these 81 cryptocurrency and blockchain stocks fueling the shift toward blockchain enabled payment and infrastructure networks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026