- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Assessing Impinj (PI) Valuation After Q3 Beat and New Gen2X Anti‑Counterfeiting Launch

Reviewed by Simply Wall St

Impinj (PI) just cleared a key hurdle in its third quarter, beating earnings and revenue expectations while rolling out new Gen2X features designed to tackle counterfeiting and messy tag data across large enterprise deployments.

See our latest analysis for Impinj.

The upbeat quarter appears to be breathing life back into the story, with a 1 month share price return of nearly 15% helping offset a weaker 3 month patch and backing up a 5 year total shareholder return near 291%. This suggests momentum is starting to rebuild rather than roll over.

If this kind of rebound has your attention, it may be a moment to explore other high growth tech and connectivity names using our high growth tech and AI stocks as a starting point.

But with the share price already rebounding, analyst targets implying further upside, and growth still outpacing reported profits, is Impinj an underappreciated compounder, or is the market already baking in its next leg of expansion?

Most Popular Narrative Narrative: 30.9% Undervalued

With Impinj last closing at 166.49 dollars versus a narrative fair value of about 241.11 dollars, the story assumes a lot more upside still to come.

Expanding deployment of RFID solutions for food traceability and freshness, especially at the item level driven by pilots with major retailers, presents a multi-year growth opportunity. This trend is underpinned by regulatory and consumer demand for improved traceability and waste reduction, which is already leading to additional pilot programs and is expected to ramp into meaningful unit volumes in 2026 and beyond, supporting outsized future revenue growth.

Curious how that kind of long runway, rising margins, and a punchy future earnings multiple can still point to upside from here? See how the narrative connects the dots.

Result: Fair Value of $241.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on food and logistics pilots scaling smoothly and on key retail customers avoiding inventory pauses that could pressure growth and margins.

Find out about the key risks to this Impinj narrative.

Another Angle on Valuation

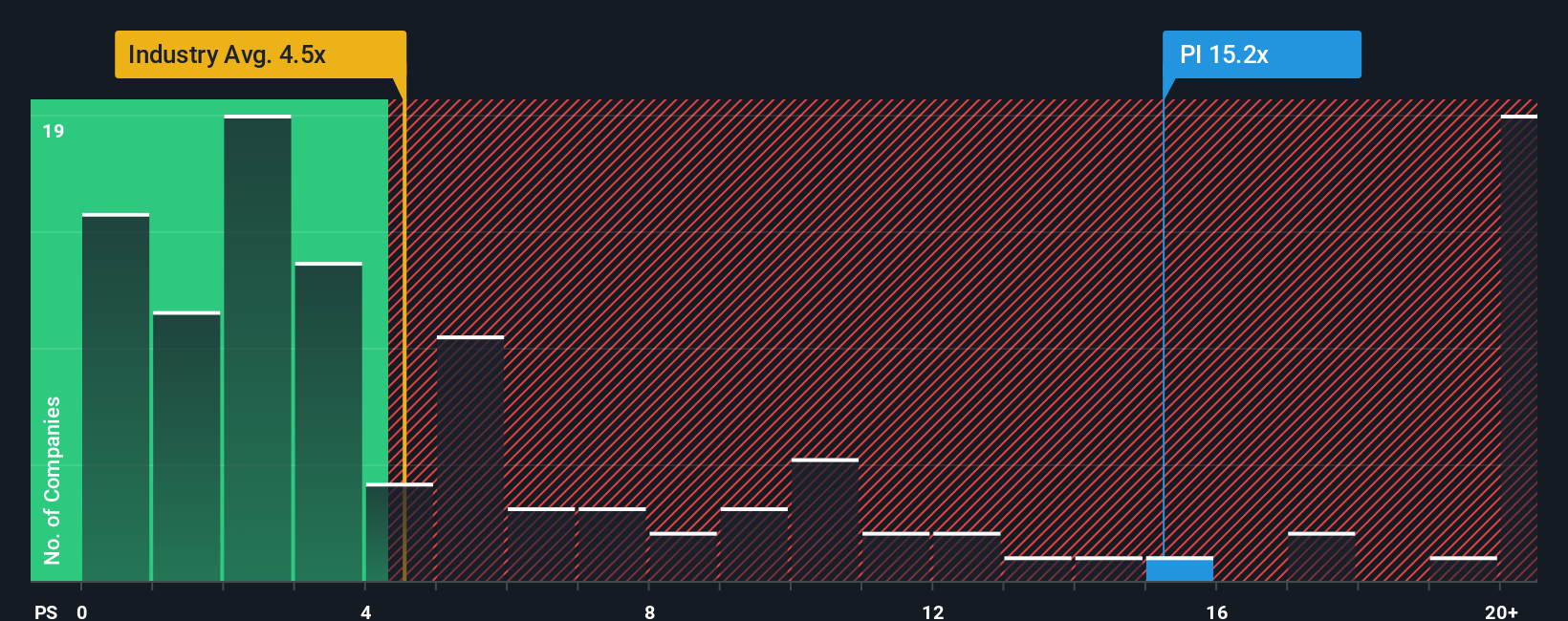

Setting aside the narrative fair value, Impinj appears expensive on a revenue basis. At roughly 13.9 times sales, it trades at more than double the US semiconductor average of 5.3 times and well above a fair ratio of 7.1 times. This raises the question of how much execution risk is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Impinj Narrative

If this perspective does not quite match your own view, dig into the numbers yourself and craft a personalized thesis in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Impinj.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning tailored stock ideas on Simply Wall Street, where data driven screens keep you a step ahead.

- Target potential multi baggers early by reviewing these 3642 penny stocks with strong financials that pair smaller market caps with solid underlying fundamentals.

- Capitalize on the AI transformation by checking out these 26 AI penny stocks positioned at the heart of automation, data intelligence, and smart infrastructure.

- Secure value focused opportunities by evaluating these 912 undervalued stocks based on cash flows that appear mispriced relative to their future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)