- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Penguin Solutions (PENG): One-Off $16.8M Loss Challenges Quality of Newly Profitable Results

Reviewed by Simply Wall St

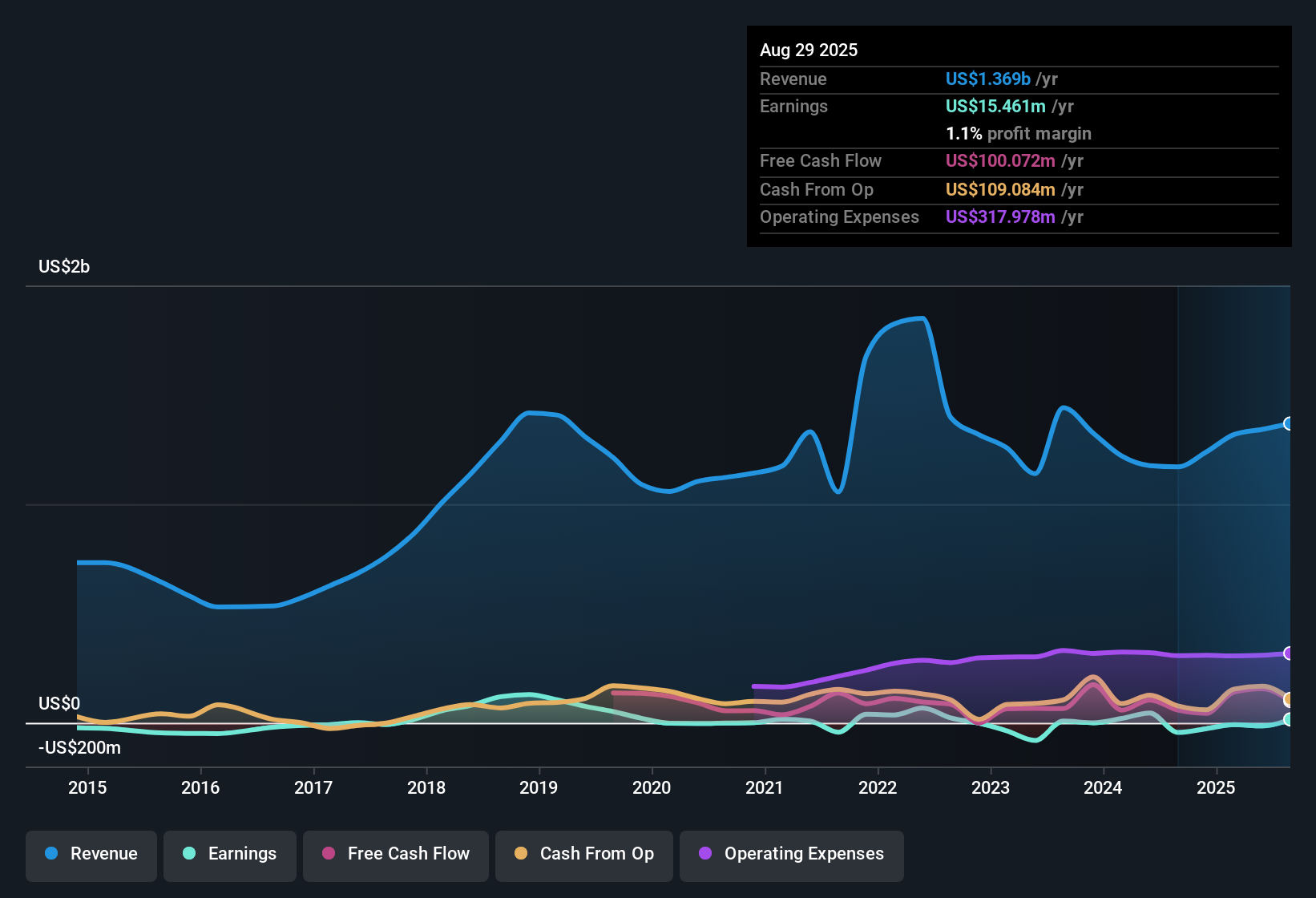

Penguin Solutions (PENG) posted a turnaround in its bottom line this year, with the company moving into profitability following years of losses. Still, the latest results were dented by a notable one-off loss of $16.8 million, and over the past five years, average annual earnings growth has trended at -15.6%. With revenue expected to climb by 9.9% per year, matching the broader US market, investors find themselves weighing the quality of these profits against the significance of non-recurring items and the lofty 76.9x P/E multiple.

See our full analysis for Penguin Solutions.Next, let’s see how these headline numbers stand up against the narratives and expectations in the wider market. Some stories will no doubt be confirmed, while others could face tough questions.

See what the community is saying about Penguin Solutions

Profit Margins Seen Rising to 17.5%

- Analysts expect profit margins to move from -1.1% today to 17.5% within three years, anchored by a forecasted increase in annual revenue growth to 10.4%.

- According to the analysts' consensus view, margin improvement is closely tied to the growth of higher-margin services and steady gains in recurring software revenue.

- Expanding channel partnerships and a broader pipeline are highlighted as key drivers supporting stability and topline acceleration.

- At the same time, the ongoing digital transformation in enterprise IT infrastructure is expected to provide fertile ground for additional market share gains and improved earnings durability.

- Consensus narrative points out these strong profit margin forecasts face risks from lingering revenue lumpiness, especially given heavy reliance on large deals and unpredictable deployment schedules.

- Unpredictable project timing, particularly in the Advanced Computing segment, is cited as a source of volatility that could weigh on both quarterly operating income and longer-term earnings growth.

- Tariff exposure in the company’s China manufacturing base further complicates margin consistency, introducing ongoing cost uncertainty and potential pressure on overall profitability.

- For a look at how bulls and bears are debating Penguin's profit turnaround, see the consensus narrative for detailed case analysis. 📊 Read the full Penguin Solutions Consensus Narrative.

Valuation Premium Despite Sub-Fair Value Price

- At $22.68, Penguin trades 16.3% below its DCF fair value of $27.10, yet still carries a 76.9x P/E that is almost double the industry average.

- The analysts' consensus narrative stresses that the company’s below-fair-value share price may lure bargain hunters, but the lofty earnings multiple sets a demanding bar for execution.

- For the consensus valuation to hold in 2028, revenue must reach $1.8 billion and earnings $316.1 million, with a price-to-earnings multiple dropping down to 6.0x, far below today's level.

- The wide gap between current valuation and future metrics leaves little room for missteps; any softness in growth or margins could pressure the stock regardless of the current discount to fair value.

Recurring Services Smoothing Earnings Volatility

- Expansion of recurring software and managed services is highlighted as a stabilizing force, with services revenue smoothing out profit swings tied to “lumpier” hardware deals.

- The analysts' consensus view spotlights that this shift toward solutions and software is expected to provide better earnings quality over time.

- Anchoring more of the business in steady, recurring streams may help mitigate timing risks and hardware margin pressures, lending credibility to bullish projections for higher aggregate profitability.

- Nevertheless, the consensus also warns that failure to fully deliver on the software and services transition could sustain margin headwinds and expose long-term growth to competitive threats.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Penguin Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret the numbers in your own way? Share your unique take and build a fresh narrative in just a few minutes. Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Penguin Solutions’ profits remain vulnerable to unpredictable project timing, revenue lumpiness, and heavy reliance on large, irregular contracts.

If you want a smoother ride, use our stable growth stocks screener to target companies showing consistently strong and stable growth no matter the market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion