- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Does Q3 Miss Amid AI Pivot Momentum Change The Bull Case For Penguin Solutions (PENG)?

Reviewed by Sasha Jovanovic

- In the past quarter, Penguin Solutions reported Q3 revenue of US$337.9 million, up 8.6% year on year but slightly below analyst expectations, while CEO Mark Adams emphasized 2025 as a year of strong execution in repositioning the company as an enterprise AI infrastructure solutions provider.

- Meridian Funds’ recent commentary highlighted Penguin Solutions’ diversified exposure to computing, memory, and LEDs, underscoring how the company’s AI-focused transformation is starting to resonate with institutional investors despite earlier earnings pressure and order delays.

- We’ll now examine how Penguin Solutions’ renewed execution on its AI infrastructure transition could reshape elements of its investment narrative and outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Penguin Solutions Investment Narrative Recap

To own Penguin Solutions, you need to believe its shift into enterprise AI infrastructure can translate solid AI demand into steadier, more profitable growth. The latest Q3 result, with revenue slightly below expectations and a sharp share price pullback, does not fundamentally change the near term catalyst around executing this AI transition, but it does highlight how timing volatility and investor sentiment remain key risks to the story right now.

The most relevant recent update is Penguin’s support for the latest NVIDIA GPUs across its OriginAI portfolio, including DGX B300 systems from early 2026. This aligns directly with the company’s push to be a full stack AI infrastructure provider, tying hardware, ICE ClusterWare software and services together in a way that could gradually reduce reliance on large, lumpy project wins and improve the quality of recurring revenue.

Yet while AI infrastructure demand is encouraging, investors should still be aware of how concentrated, project based Advanced Computing deals can...

Read the full narrative on Penguin Solutions (it's free!)

Penguin Solutions’ narrative projects $1.8 billion revenue and $316.1 million earnings by 2028. This implies 10.4% yearly revenue growth and about a $331 million earnings increase from -$14.9 million today.

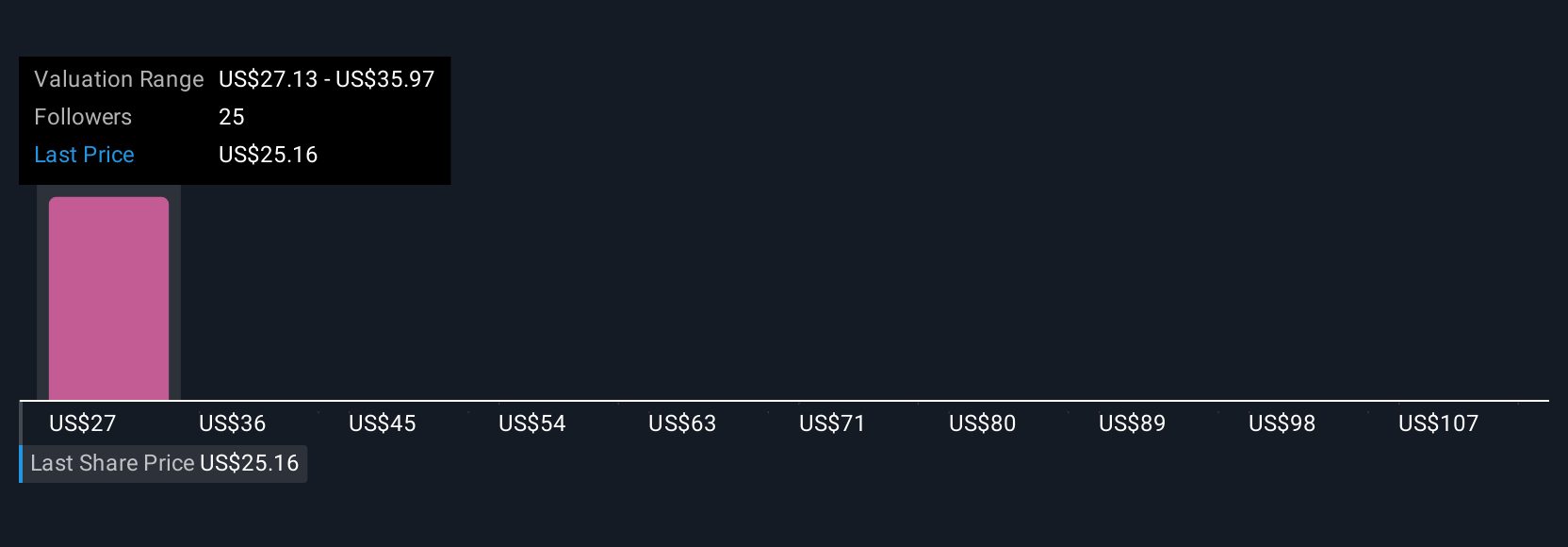

Uncover how Penguin Solutions' forecasts yield a $28.25 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently see fair value for Penguin Solutions anywhere between about US$25.80 and US$156.06 per share, showing how far opinions can stretch. Before the latest earnings, many were focused on the same AI infrastructure execution risk that now looks even more important for understanding how the business might perform from here.

Explore 6 other fair value estimates on Penguin Solutions - why the stock might be worth just $25.80!

Build Your Own Penguin Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penguin Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Penguin Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penguin Solutions' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026