- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor Shares Rebound 7.6% After New EV Partnerships: What Does This Mean for Value?

Reviewed by Bailey Pemberton

- Curious if ON Semiconductor is a hidden value play or just another chip stock? Here is a breakdown of what really matters for investors considering price versus potential.

- The stock recently bounced back 7.6% over the last week, despite falling 5.8% this past month and shedding 19.6% year-to-date. This suggests shifting market sentiment and ongoing volatility.

- Recent headlines have focused on ON Semiconductor’s expanding partnerships in the electric vehicle and industrial markets. Many analysts see these as growth drivers behind the latest rebound. Regulatory updates and growing interest in U.S.-based chipmakers have also put a spotlight on the stock’s prospects and risk profile.

- When it comes to traditional fair value checks, ON Semiconductor scores only 1 out of 6 on our scale, suggesting plenty of room for debate about its current price. Up next, we will explore the major valuation models that investors rely on, and introduce an alternative way to assess what ON Semiconductor is really worth.

ON Semiconductor scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ON Semiconductor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. The DCF approach helps investors determine whether a stock is trading above or below its true worth based on its cash-producing ability.

For ON Semiconductor, the latest model uses a two-stage Free Cash Flow to Equity calculation. In the most recent twelve months, ON Semiconductor generated Free Cash Flow of $989.4 Million. Analyst forecasts suggest this number will grow steadily over the next decade, with FCF expected to reach $2.26 Billion in 2029. While direct analyst estimates only go out five years, projections for later years are extrapolated by factoring in a gradual slowing of growth as the company matures.

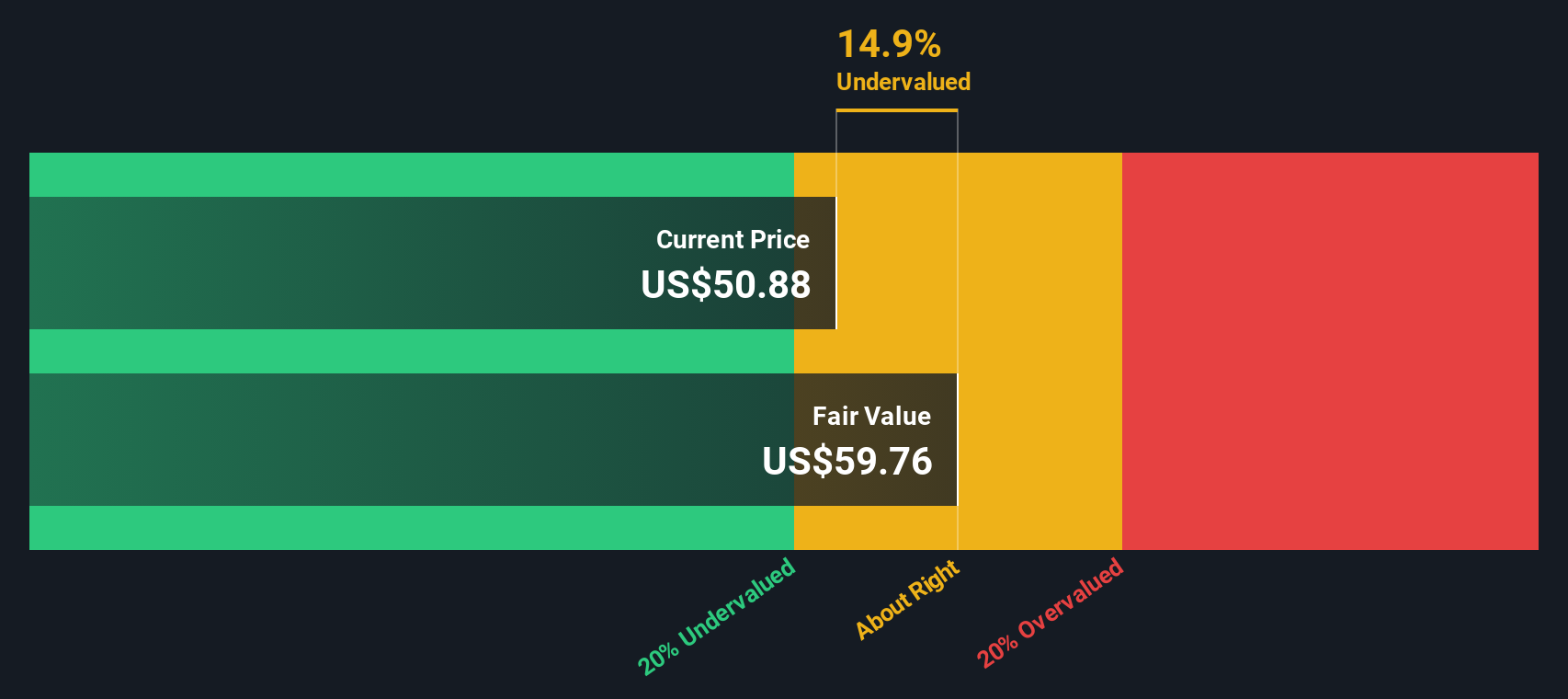

Based on these projections, the DCF model calculates an intrinsic value for ON Semiconductor shares at $54.37. Compared to the current market price, this implies an 8.7% discount, indicating the stock is just slightly undervalued according to this method.

Result: ABOUT RIGHT

ON Semiconductor is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: ON Semiconductor Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a strong valuation tool for profitable companies like ON Semiconductor because it directly connects the company’s market price with its actual bottom-line performance. For investors, the PE ratio answers a key question: how much are you paying per dollar of current earnings?

What makes a PE ratio “normal” or “fair” varies, often depending on growth outlook and perceived risk. A higher PE typically points to expectations of rapid earnings growth or lower risk, while a lower PE may reflect the opposite.

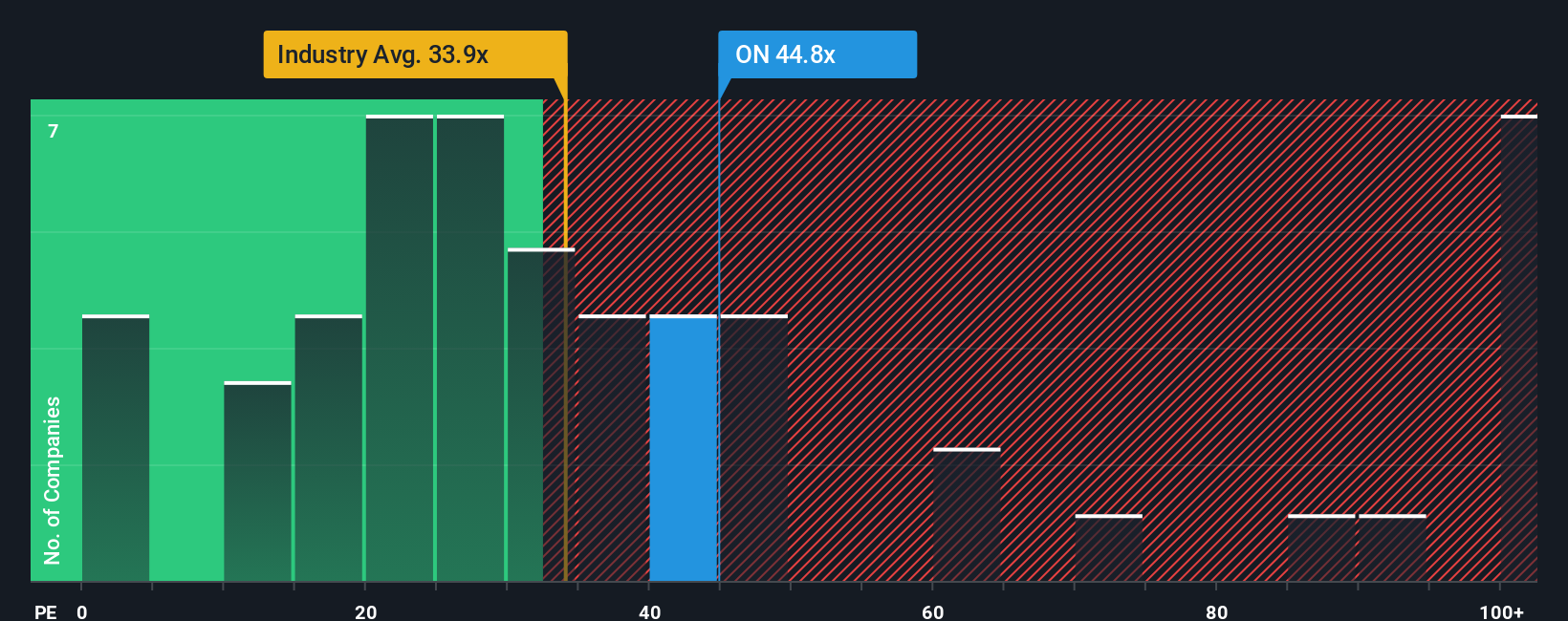

Currently, ON Semiconductor trades at 62.6x earnings, which stands well above the semiconductor industry average of 35.8x and the peer group average of 34.9x. This signals the market is pricing in significant growth, premium profitability, or perhaps reduced risk compared to rivals.

Simply Wall St introduces the "Fair Ratio," which estimates what a reasonable PE should be for ON Semiconductor by using factors beyond peer and industry averages, such as the company’s earnings trajectory, competitive positioning, margins, and market cap. This Fair Ratio is currently pegged at 54.2x. By tailoring the benchmark to ON Semiconductor’s specific outlook and risk profile, the Fair Ratio can offer a more accurate gauge of value than broad averages.

With the actual PE ratio just moderately above this Fair Ratio, the stock is priced almost exactly where you would expect given its fundamentals and future prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ON Semiconductor Narrative

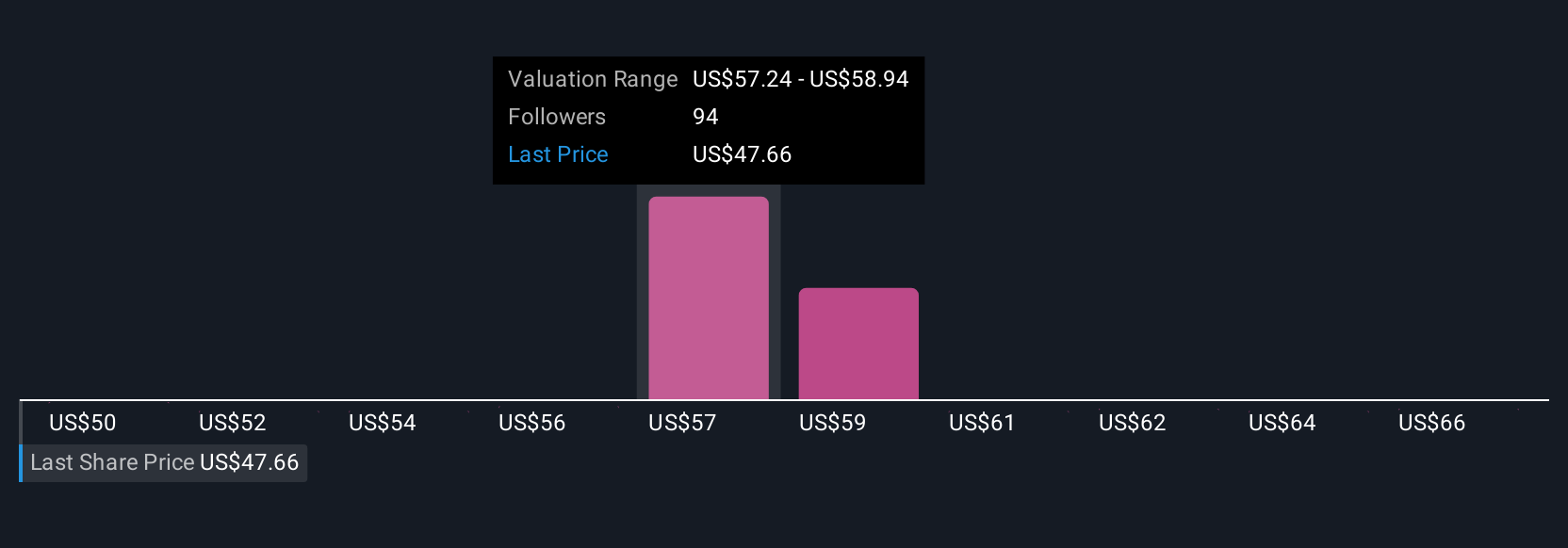

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives, an approach that helps you invest with confidence by weaving the company’s story into the numbers. A Narrative is your perspective on a stock. You decide what you expect for ON Semiconductor’s future growth, profit margins, and risks, and then see how these assumptions influence what you believe is a fair price.

With Narratives, you connect the dots between ON Semiconductor’s business developments, your own financial forecast, and the resulting fair value estimate in a simple, accessible format available on Simply Wall St’s Community page. Millions of investors use Narratives to decide when to buy or sell by directly comparing their fair value to the current share price. Since Narratives update automatically when news, earnings, or analyst projections change, you can react quickly as conditions evolve.

Differing views are easy to see at a glance. For example, some investors now expect ON Semiconductor is worth as much as $70 due to its EV and AI potential, while others see risks that put fair value closer to $40.

This makes Narratives a powerful tool for seeing all sides and taking control of your investment decisions with conviction.

Do you think there's more to the story for ON Semiconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success