- United States

- /

- Semiconductors

- /

- NasdaqGS:ON

ON Semiconductor (ON) Valuation After New GaN Power Partnership With GlobalFoundries

Reviewed by Simply Wall St

ON Semiconductor (ON) just gave investors another reason to revisit the stock by announcing a new collaboration with GlobalFoundries to co-develop next-generation gallium nitride power devices for high-growth, energy-hungry markets.

See our latest analysis for ON Semiconductor.

That backdrop helps explain why, despite a weak year to date with a negative share price return and a one year total shareholder return of about negative 16 percent, the recent 1 month share price return near 20 percent suggests momentum may be rebuilding as investors reassess ON’s growth story.

If this GaN deal has you thinking about where the next winners might come from, it is a good time to explore high growth tech and AI names through high growth tech and AI stocks.

Yet with earnings under pressure, mixed long term returns, and the stock now sitting only modestly below analyst targets, is ON still flying under the radar, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 5.9% Undervalued

With ON Semiconductor last closing at $55.21 versus a narrative fair value near $58.70, the story frames current pricing as leaving some upside on the table.

Structural improvements in manufacturing efficiency, including the Fab Right initiative and selective capacity reduction, are lowering operational costs and setting up significant margin expansion as utilization rates recover with end market demand. This operational leverage is likely to drive higher net margins and cash flow conversion as the cycle turns.

Curious how modest top line growth assumptions still translate into powerful earnings expansion and a richer future multiple than today without stretching belief? Dive into the full narrative to see which levers matter most and how they add up to that fair value.

Result: Fair Value of $58.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent fab underutilization and slower than expected EV demand, especially outside China, could delay margin recovery and undermine the current undervaluation thesis.

Find out about the key risks to this ON Semiconductor narrative.

Another Angle on Valuation

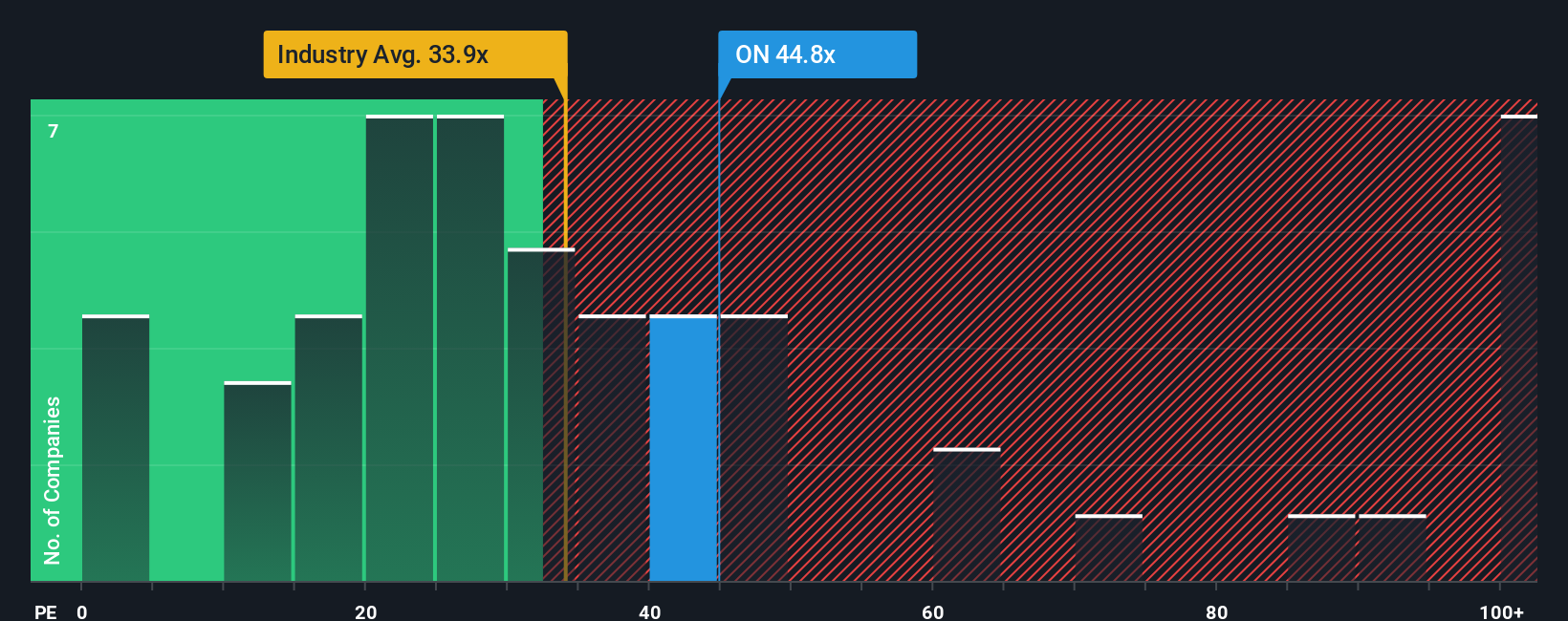

Our ratio view paints a tougher picture. ON trades on a 69.6x price to earnings ratio, versus a fair ratio of 57.8x, the US semiconductor average of 36.1x and peer average of 34.2x. This suggests investors are already paying up for the turnaround. Are you comfortable with that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ON Semiconductor Narrative

If you see the story differently or want to stress test the numbers yourself, you can spin up a personalized narrative in just minutes using Do it your way.

A great starting point for your ON Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunity by using the Simply Wall Street Screener to find high conviction stocks that match your strategy.

- Capture early stage upside by targeting under the radar names through these 3624 penny stocks with strong financials that have improving fundamentals and increasing market attention.

- Gain exposure to the next wave of intelligent automation by focusing on these 25 AI penny stocks that combine powerful algorithms with scalable business models and growing demand.

- Identify potential value opportunities by filtering for these 914 undervalued stocks based on cash flows where market prices may lag behind cash flow strength and long term prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ON

ON Semiconductor

Provides intelligent sensing and power solutions in Hong Kong, Singapore, the United Kingdom, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion