- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

Where Does NXP Stand After Announcing New Automotive AI Chip Partnership in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your NXP Semiconductors shares? You are not alone, especially as the stock has shown some interesting moves lately. Over just the last week, prices nudged up 0.4% while the past month saw a minor slip of -2.1%. Step back, though, and you will notice that NXP has climbed an impressive 10.4% year-to-date. This is enough to grab anyone's attention. However, despite this upward momentum, the one-year return is basically flat at -0.5%, suggesting investors are still sorting out what to expect from the chipmaker.

Broader trends in the semiconductor industry have certainly influenced NXP's swings. Brisk demand for automotive chips and supply chain improvements have helped underpin longer-term confidence. That explains, in part, why the stock is still up 51.6% over three years and a remarkable 83.9% over five. If you are looking for a quick valuation takeaway, NXP's current value score lands at 3 out of 6. This means it appears undervalued in half the key ways analysts test for bargains.

So what does that really mean for your portfolio, and what can the different valuation methods reveal about where NXP goes from here? Let us dig into each approach and, later, take a look at an even more insightful way to think about stock value.

Why NXP Semiconductors is lagging behind its peers

Approach 1: NXP Semiconductors Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model looks at what a company might earn in the future, estimates future cash flows, and then discounts those amounts back to today's value. This helps investors decide what the business could actually be worth now, based on its ability to generate cash.

For NXP Semiconductors, the latest reported Free Cash Flow stands at $1.64 Billion. Analysts expect this figure to grow steadily, with projections suggesting Free Cash Flow will reach $4.71 Billion by 2029. Beyond that, Simply Wall St extrapolates further growth through 2035, though the highest confidence estimates cover the next five years.

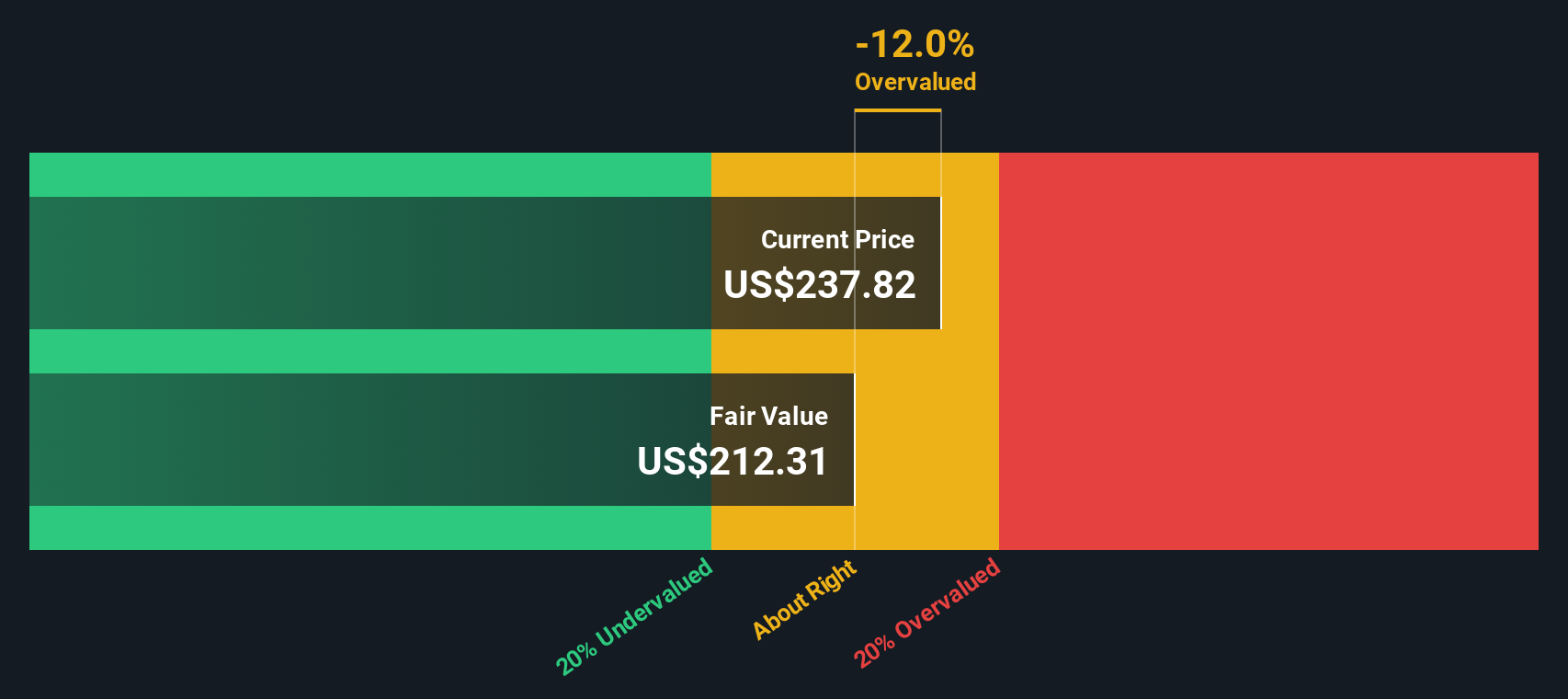

After crunching these projections with a two-stage Free Cash Flow to Equity model, the DCF valuation produces an intrinsic value of $211.56 per share. At the moment, this implies NXP's stock is about 7.6% above its fair value according to this model.

In short, based on cash flow projections, NXP Semiconductors currently appears a bit expensive, but not dramatically so.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out NXP Semiconductors's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: NXP Semiconductors Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like NXP Semiconductors. It helps investors gauge how much they are paying for each dollar of the company's earnings. A "normal" or "fair" PE ratio is influenced by growth prospects, profitability, and risk. Companies with higher expected growth and lower risks usually command higher PE multiples, while riskier businesses or slower growers trade at lower multiples.

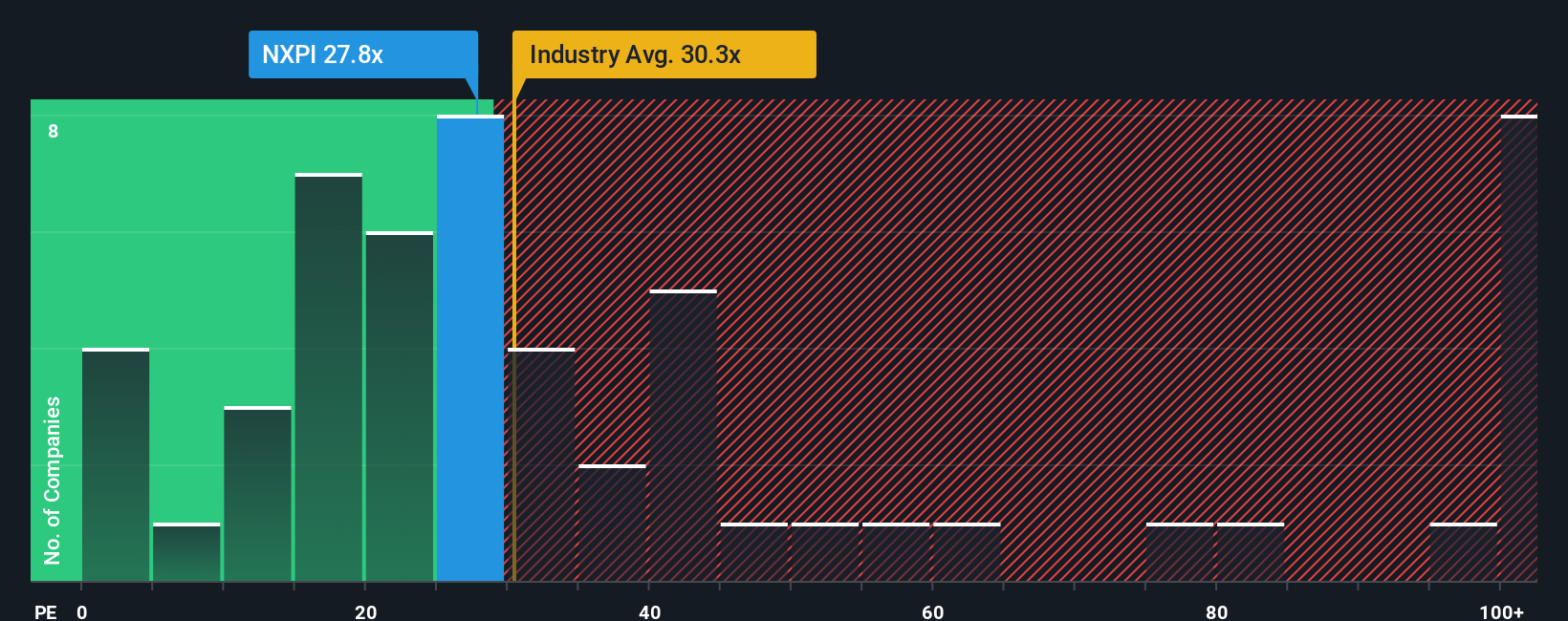

Currently, NXP trades at a PE ratio of 26.7x. For context, this sits below both the semiconductor industry average of 37.7x and the peer average of 35.8x. At first glance, this makes NXP seem attractively priced compared to its sector.

Simply Wall St adds another layer of analysis with the "Fair Ratio," which for NXP lands at 32.6x. Unlike the blunt comparison with industry or peer averages, the Fair Ratio estimates the right multiple for the company by factoring in its earnings growth, risk profile, profit margins, size, and industry dynamics. This offers a much more customized view of value.

With NXP's current PE of 26.7x compared to a Fair Ratio of 32.6x, the stock appears attractively valued on this basis. The difference is notable, suggesting investors are getting earnings at a relative discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NXP Semiconductors Narrative

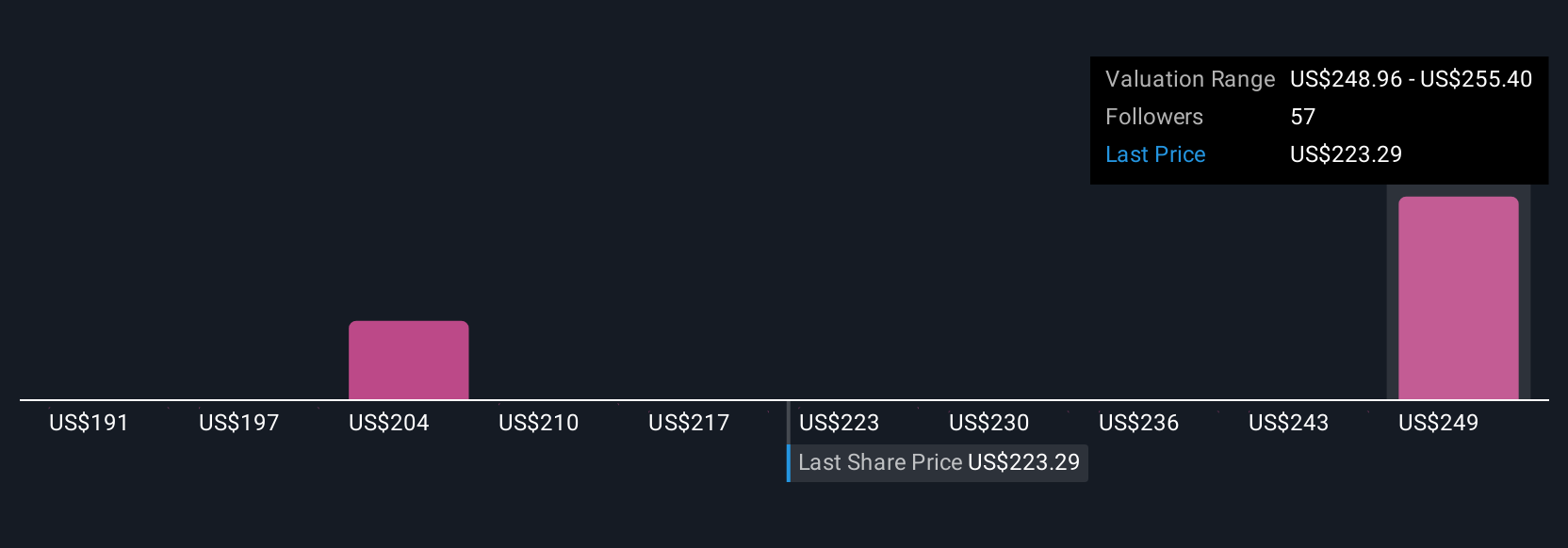

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is simply your story about a company; it captures your perspective and combines it with concrete assumptions about future revenue, earnings, and profit margins to arrive at a genuine fair value for the business.

Unlike traditional metrics, Narratives connect the company's real-world story to a complete financial forecast, letting you see how your expectations translate into an estimated valuation. They are easy to use and available to everyone on Simply Wall St's Community page, where investors all over the world share and refine their ideas in real time.

With Narratives, you can quickly compare different fair value estimates against the current market price, helping you decide whether it is the right time to buy or sell. Because Narratives are updated dynamically whenever new news or earnings data is released, your investment thesis stays relevant and actionable.

For example, some investors believe strong automotive demand and recovery in IoT could lift NXP’s fair value as high as $289 per share. Others, concerned about competitive pressures and rising costs, think it could be closer to $210. Narratives put all these viewpoints in your hands, so you can invest in line with your own convictions and stay ahead as new insights emerge.

Do you think there's more to the story for NXP Semiconductors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives