- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

What Can Investors Make of NXP After Shares Jump 22% on Automotive Chip Optimism?

Reviewed by Simply Wall St

Thinking about what to do with your NXP Semiconductors stock? You are not alone. With all the recent hype and shifting perceptions in the chip sector, holding or buying NXPI feels like both an opportunity and a puzzle right now. Over the last quarter, NXP’s share price has surged by 22%, and year-to-date gains are a solid 13.9%. Yet, if you zoom out to the last twelve months, there is actually a slight -5.3% dip, reminding us that semiconductor stocks do not always go straight up.

Much of this recent strength is tied to renewed optimism in automotive chips and industrial technology, areas where NXP is a global leader. Investors seem to be pricing in both growth potential and some lingering uncertainty, especially after last year’s broader market volatility. Is NXPI finally in value territory, or did recent optimism push things too far, too fast?

On our six-point value scoring system, the company scores a 3. That means NXP checks the box for being undervalued on half the major criteria analysts use. It is an encouraging start but not a slam-dunk buy signal just yet. Curious what those six checks are, and whether they really capture the whole valuation picture? Let’s break down how NXP stacks up on traditional valuation metrics first. Next, I will share my favorite way to get insight that numbers alone cannot offer.

NXP Semiconductors delivered -5.3% returns over the last year. See how this stacks up to the rest of the Semiconductor industry.Approach 1: NXP Semiconductors Cash Flows

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and then discounting those amounts back to their value today. This approach helps investors gauge whether a stock is attractively priced in relation to what the business is expected to generate in cash over time.

For NXP Semiconductors, last year’s Free Cash Flow stood at $1.64 Billion. Looking ahead, analysts project these cash flows will grow, reaching about $4.92 Billion by 2035. The company’s ten-year forecast shows steady progression, with milestones like $3.22 Billion by 2026 and $4.71 Billion by 2029, based on analyst and internally estimated growth rates.

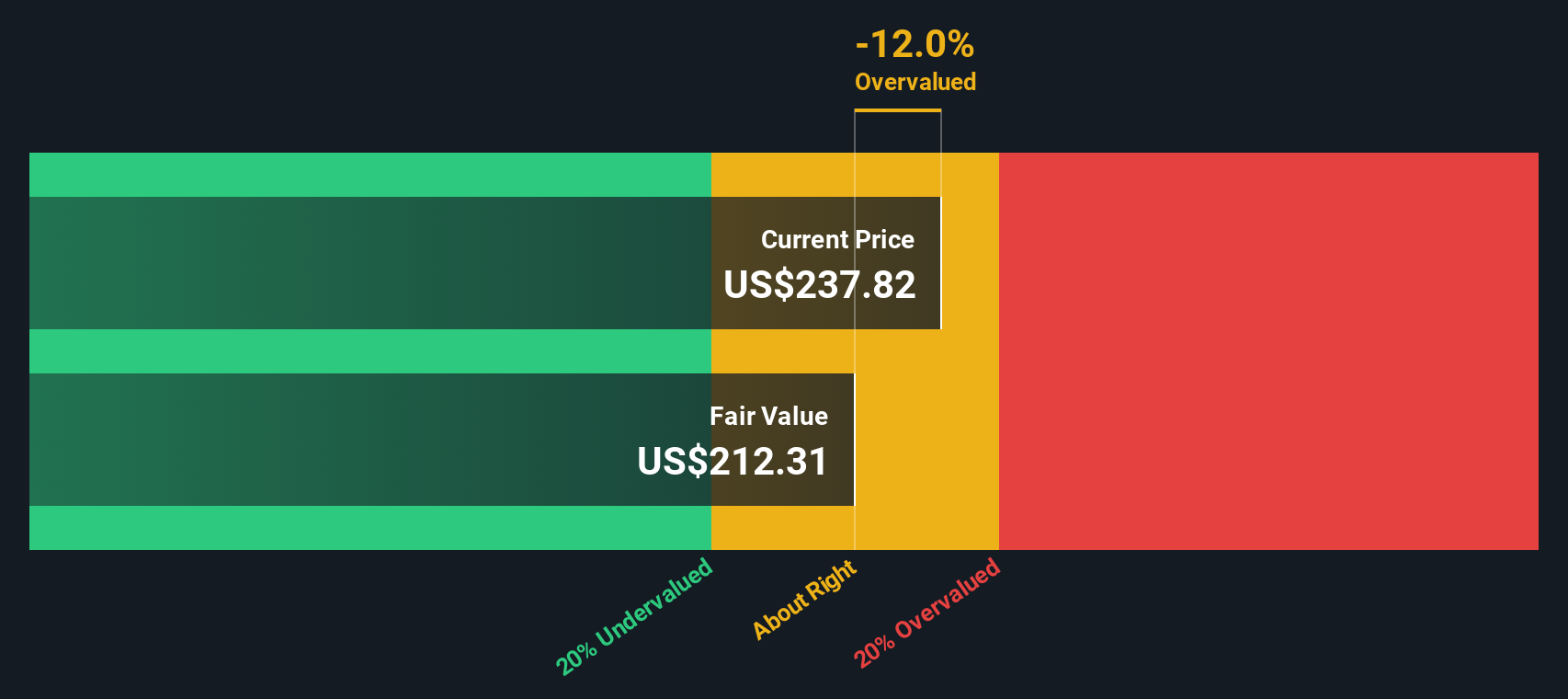

When all those future billions are discounted back to today, the DCF model arrives at an intrinsic fair value of $211.28 per share. Compared to recent share prices, this implies NXP is trading at an 11.1% premium. In other words, the stock appears 11.1% overvalued by this measure right now.

Result: OVERVALUED

Approach 2: NXP Semiconductors Price vs Earnings

When a company is consistently profitable, the Price-to-Earnings (PE) ratio is one of the most tried-and-true ways to assess value. The PE ratio tells investors how much they are paying for each dollar of the company’s earnings. A lower PE compared to peers can signal a potential bargain, while a much higher PE might reflect lofty growth expectations or lower perceived risks.

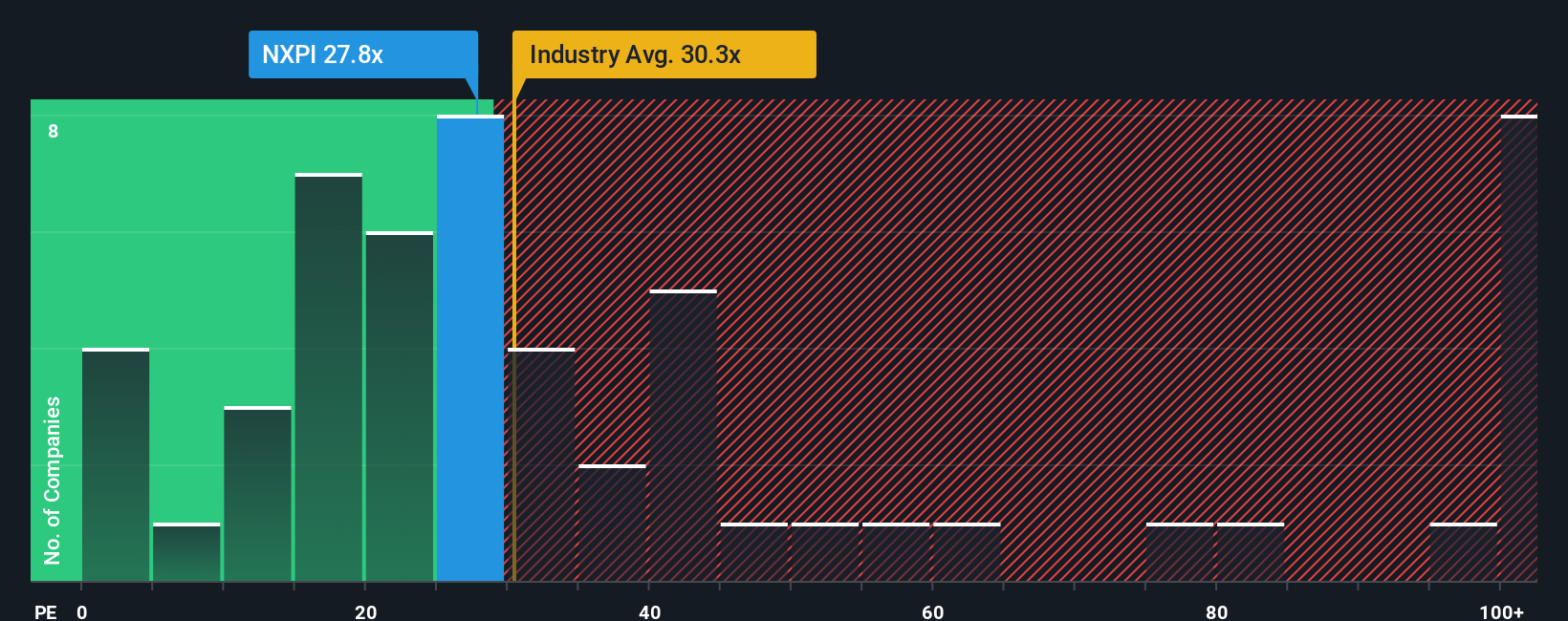

What is considered a normal PE ratio depends largely on expectations for future growth and the degree of business risk. Fast-growing companies or those with stable earnings often command higher PE multiples, while mature or riskier firms tend to have lower benchmarks. For NXP Semiconductors, the current PE ratio is 27.6x, which is slightly below both the semiconductor industry average of 30.1x and the peer group average of 30.2x. This suggests a modest discount compared to what other investors are paying for similar businesses at this time.

Now consider the Fair Ratio. This proprietary metric reflects a PE multiple that should be justified for NXP based on factors such as its growth prospects, profitability, industry standing, and risk profile. For NXP, the Fair Ratio is calculated at 31.3x. This is only a small premium to its current multiple and indicates that NXP’s shares are priced quite closely to what would be considered fair value for its profile.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your NXP Semiconductors Narrative

Beyond the numbers, every investor brings a unique story or perspective to their analysis. This is what we call a "Narrative." A Narrative connects what you believe about a company’s future, such as growth drivers or risks, with concrete forecasts for revenue, earnings, and profit margins. This makes the connection from story to numbers to fair value seamless and intuitive.

With Simply Wall St, Narratives are easy to use and let you shape your investment decision by linking your outlook for NXP Semiconductors to its financial forecasts. Comparing your Narrative’s Fair Value with the current share price can quickly tell you whether the stock is a buy or a sell. As news or earnings updates roll in, your Narrative can adapt in real time, keeping your thesis up to date without extra effort.

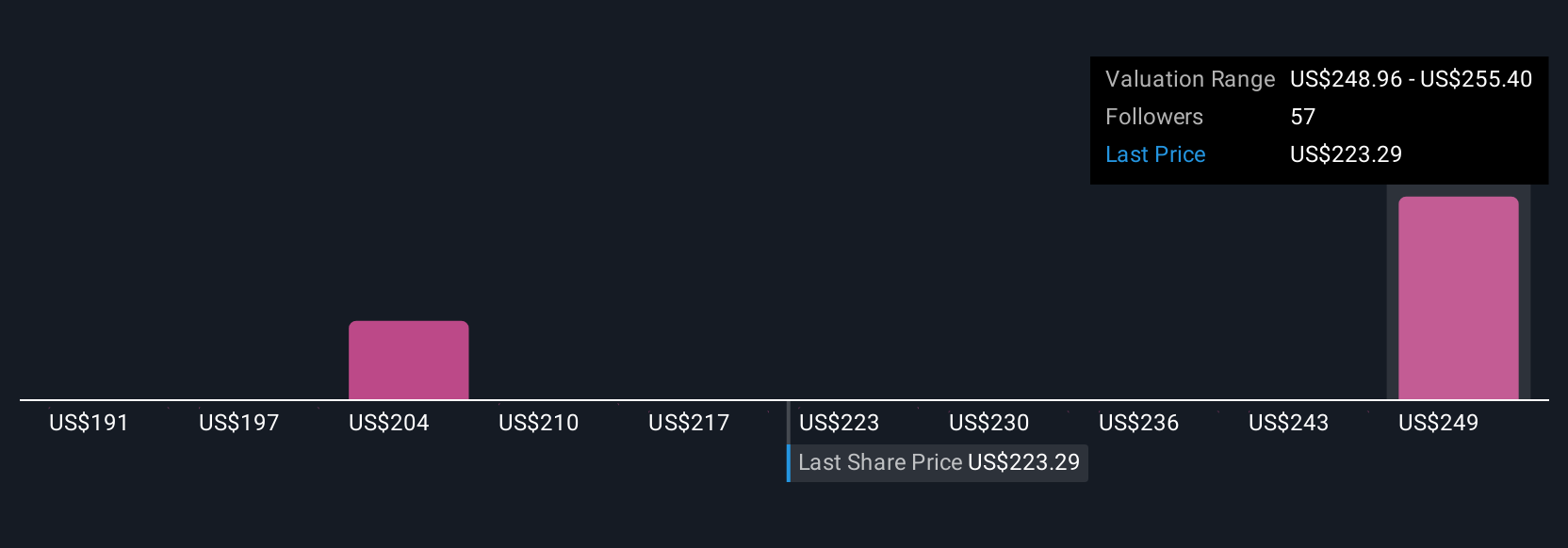

For example, some investors currently see NXP’s fair value as high as $289, based on strong automotive growth and margin expansion. Others, who are more cautious about risks and competition, see it as low as $210. Narratives make it easy for you to see, test, and update your own point of view in just minutes.

Do you think there's more to the story for NXP Semiconductors? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives