- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

The Bull Case For NXP Semiconductors (NXPI) Could Change Following Automotive Inventory Normalization and Dividend Move

Reviewed by Sasha Jovanovic

- NXP Semiconductors delivered a presentation at the IMAPS Symposium 2025 in San Diego and recently authorized an interim dividend for Q3 2025, reflecting ongoing confidence in its cash flow and capital structure.

- The end of excess automotive Tier 1 inventory in Western markets is expected to boost the company's automotive revenue outlook, improving earnings visibility despite prior concerns about revenue softness and cash flow margins.

- We'll explore how the improved automotive inventory situation could reshape NXP Semiconductors' investment narrative in the coming quarters.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NXP Semiconductors Investment Narrative Recap

To be a shareholder in NXP Semiconductors today, you need to believe that the company can capitalize on the normalization of automotive Tier 1 inventory in Western markets, leading to improved revenue visibility and earnings recovery. While recent news around the IMAPS Symposium presentation and the interim dividend reflects ongoing management confidence and a stable capital structure, the automotive rebound remains the most important near-term catalyst, offset by lingering risks around margin pressure from China and order volatility, which the news does little to materially change.

Among recent developments, NXP’s announcement of a fresh interim dividend for Q3 2025 stands out. This move underscores management’s consistent commitment to returning capital to shareholders as the business navigates key catalysts like the recovery in automotive end-demand, suggesting continued operational discipline alongside sector challenges.

Yet, even as optimism builds around inventory normalization, renewed volatility in automotive demand, especially from unexpected shifts in customer restocking, remains a risk every investor should understand before...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' outlook forecasts $15.5 billion in revenue and $3.5 billion in earnings by 2028. This projection assumes an annual revenue growth rate of 8.7% and represents a $1.4 billion increase in earnings from the current $2.1 billion.

Uncover how NXP Semiconductors' forecasts yield a $258.19 fair value, a 13% upside to its current price.

Exploring Other Perspectives

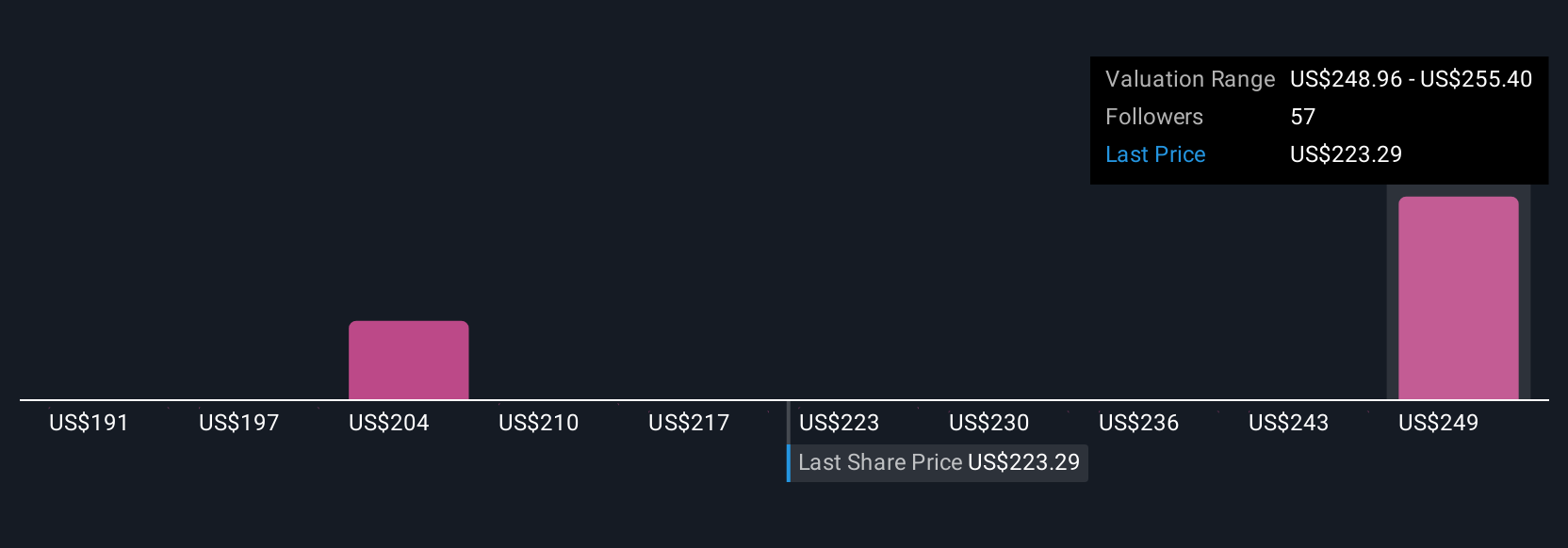

Simply Wall St Community members offered 11 fair value estimates for NXP Semiconductors, ranging from US$187.08 to US$294.09 per share. As you weigh these varied opinions, keep in mind that continued margin pressure from increased competition in China could impact the company's future results, explore the range of perspectives for a fuller picture.

Explore 11 other fair value estimates on NXP Semiconductors - why the stock might be worth as much as 28% more than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives