- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI): Assessing Valuation as Automotive Inventory Headwinds Ease in Key Western Markets

Reviewed by Kshitija Bhandaru

NXP Semiconductors (NXPI) shares are in focus as automotive Tier 1 inventory levels in Western markets begin to stabilize. This development ends a period that previously weighed on the company’s revenue outlook.

See our latest analysis for NXP Semiconductors.

After a stretch of choppy trading, NXP Semiconductors’ share price has been gaining ground this year, supported by signs that the worst of the automotive supply chain overhang is easing. Investors have responded with a more optimistic outlook, as reflected in the stock’s double-digit share price return year-to-date. However, the 1-year total shareholder return remains essentially flat. The recent appearance at the IMAPS Symposium highlights management’s efforts to showcase future growth catalysts as the sector’s momentum gradually rebuilds.

If you’re keeping an eye on how tech-driven companies are adapting to shifting supply trends, now’s a good moment to explore See the full list for free.

With the sector’s outlook improving and NXP Semiconductors’ fundamentals in flux, investors are left to consider whether the current share price reflects real opportunity or if optimism has already been fully priced in.

Most Popular Narrative: 11.3% Undervalued

Compared to NXP Semiconductors’ most widely tracked fair value estimate of $258, the last close price of $228.89 looks relatively attractive. This narrative’s outlook hinges on industry tailwinds and the company’s ability to translate these shifts into stronger profits.

A major catalyst is the normalization of automotive Tier 1 inventory levels in Western markets, which is ending after several quarters of being a growth headwind. As NXP can now ship directly to natural end demand, instead of customers burning through old inventory, this transition is expected to drive higher automotive revenues and better earnings visibility through the next several quarters.

Curious about the specific projections propelling that fair value estimate? The narrative’s math is built on ambitious revenue expansion, rising profit margins, and a future earnings multiple that is hard to ignore. Want to find out which assumption tips the scale most? Read on and see how bold analyst forecasting can completely reshape what investors consider a bargain.

Result: Fair Value of $258 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering competition from China and only modest demand recovery could quickly dampen the bullish outlook for NXP Semiconductors.

Find out about the key risks to this NXP Semiconductors narrative.

Another View: Discounted Cash Flow Perspective

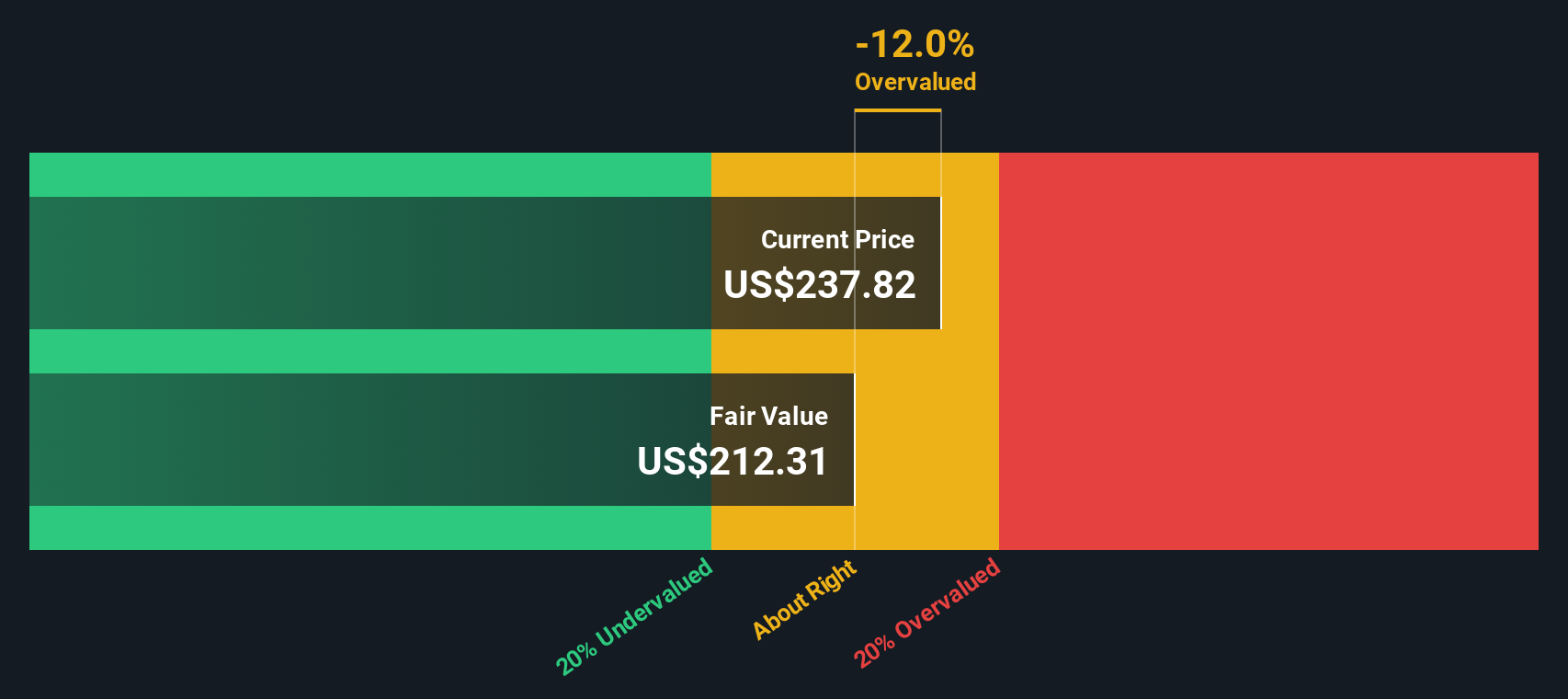

Looking through the lens of the SWS DCF model, NXP Semiconductors’ current price of $228.89 actually stands above its estimated fair value of $212.13. This suggests the shares could be modestly overvalued if cash flow projections drive your view. The question is whether the optimistic narrative is overreaching, or if there is potential upside that the DCF does not capture yet.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NXP Semiconductors for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NXP Semiconductors Narrative

If you think the story is more nuanced or want to investigate the numbers on your own, you can craft your own outlook in just a few minutes. Do it your way.

A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your strategy to a single stock. Give yourself an advantage by checking out specialized opportunities and untapped growth themes other investors might be missing.

- Start earning while you sleep by targeting income with these 19 dividend stocks with yields > 3% featuring companies offering impressive yields above 3%.

- Capture explosive potential in the tech landscape by examining these 25 AI penny stocks that are redefining how industries operate with innovative AI solutions.

- Spot tomorrow’s undervalued champions before the crowd by reviewing these 886 undervalued stocks based on cash flows. These stocks could be priced well below their true worth based on cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives