- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI) Announces US$1 Interim Dividend For Q3 2025

Reviewed by Simply Wall St

NXP Semiconductors (NXPI) recently affirmed an interim dividend of $1.014 per ordinary share, which reflects its commitment to returning value to shareholders. Over the last quarter, NXP's share price moved up by 25%, a significant increase amid a mixed market environment where major indices, including the S&P 500 and Dow, hit record highs. The company’s Q2 earnings report highlighted a decline in revenue and net income year-on-year, yet forward guidance was optimistic, likely due in part to strategic partnerships, such as its collaboration with Rimac Technology. These factors collectively added heft to market gains amidst tech sector volatility.

We've spotted 2 possible red flags for NXP Semiconductors you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent affirmation of a US$1.014 interim dividend by NXP Semiconductors underscores its focus on rewarding shareholders, potentially bolstering investor sentiment. This announcement comes amid a period of tech sector volatility but has helped drive a 25% increase in NXP's share price over the last quarter. Over the past five years, the company's total shareholder return, including dividends, stands at 106.12%, reflecting strong long-term performance despite recent year-on-year revenue and net income declines.

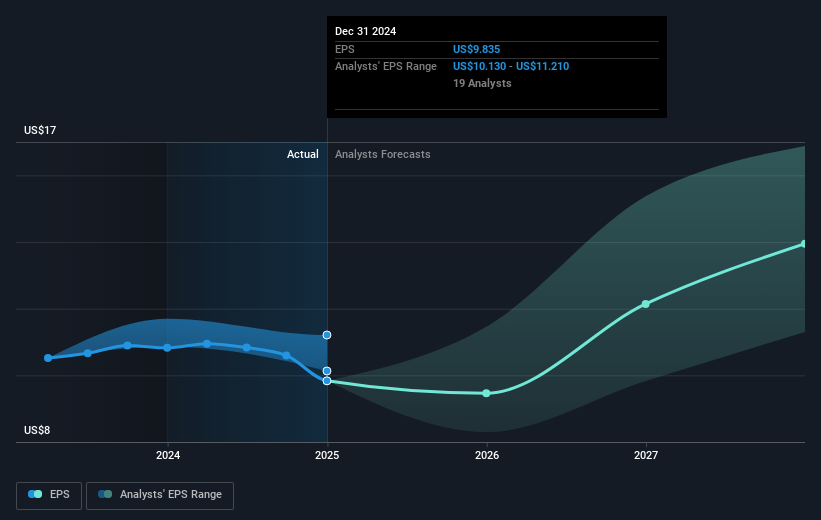

Comparing this long-term success, NXP's performance over the last year fell short of the US Market return of 17.2% and the US Semiconductor industry return of 40.8%. The company's recent revenue and earnings updates suggest optimistic forward guidance, potentially supported by automotive inventory normalization and IoT recovery. The impact of these factors, alongside strategic partnerships like the one with Rimac Technology, may improve earnings forecasts and top-line growth. Analysts have set a price target of US$257.48 for NXP, slightly above the current share price of US$239.07, indicating a modest share price discount of about 7.7%. This guidance suggests an alignment with expected revenue growth and continued commitment to enhancing shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion