- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

Did the eInfochips Partnership Just Shift NXP Semiconductors' (NXPI) Software Support Narrative?

Reviewed by Sasha Jovanovic

- eInfochips and NXP Semiconductors recently announced a multi-year collaboration aimed at improving software distribution and customer support for NXP's S32 microcontrollers and microprocessors.

- This agreement highlights NXP's focus on streamlining application development and providing enhanced support services to its customers, even as the broader chip sector faces uncertainty.

- We’ll examine how this new partnership around the S32 platform could influence NXP’s long-term growth narrative and customer engagement strategies.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NXP Semiconductors Investment Narrative Recap

To be a shareholder in NXP Semiconductors, you need to believe that the company’s exposure to automotive and industrial markets, especially as auto demand normalizes and content per vehicle rises, can offset cyclical and competitive pressures. The new eInfochips partnership may strengthen customer engagement for NXP’s S32 platform, but in the near term, it does not materially shift the most important catalyst: direct shipments to recovering automotive customers, or the primary risk: margin pressure from China and persistent inventory volatility.

Among recent announcements, NXP’s ongoing collaborations in the automotive sector stand out, such as its August alliance with Rimac Technology for software-defined vehicles, supporting the same S32 family targeted in the eInfochips deal. These partnerships, while positive, still hinge on the pace at which automotive demand truly rebounds and on whether NXP can defend margins in highly contested international markets.

But just as partnerships promise innovation, investors should not overlook how increased competition and pricing pressure in China could…

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' outlook anticipates $15.5 billion in revenue and $3.5 billion in earnings by 2028. This is based on an expected 8.7% annual revenue growth rate and represents a $1.4 billion increase in earnings from the current $2.1 billion.

Uncover how NXP Semiconductors' forecasts yield a $258.19 fair value, a 17% upside to its current price.

Exploring Other Perspectives

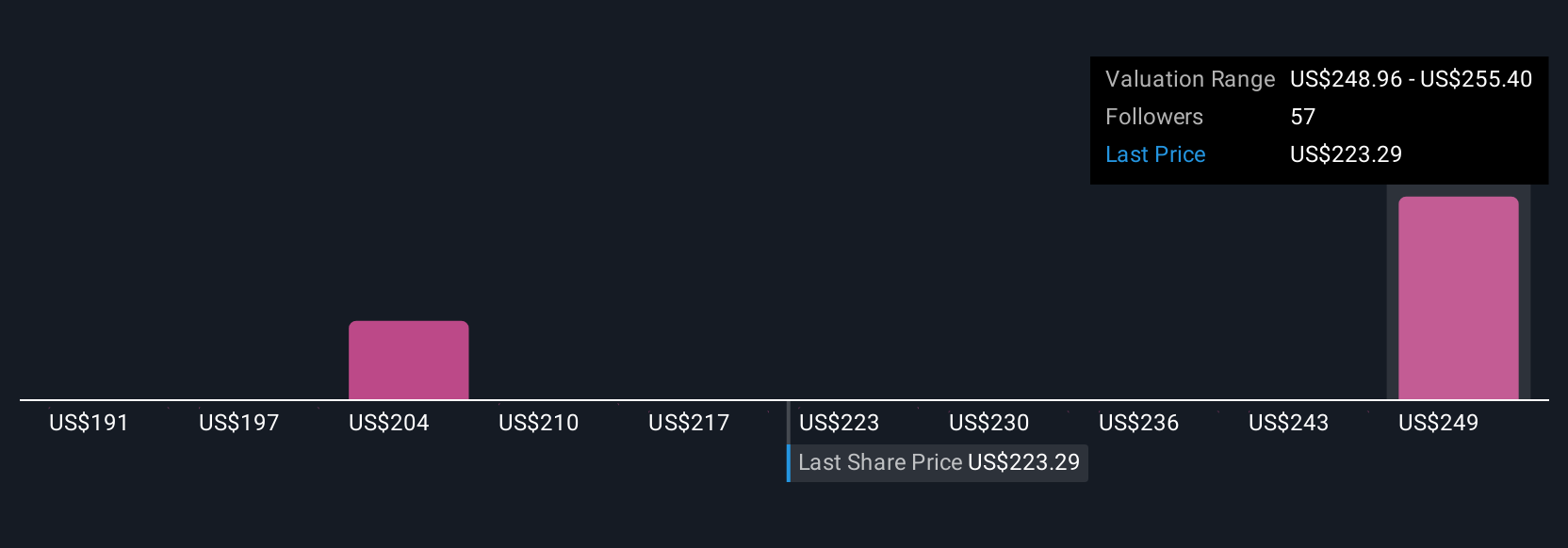

Fair value views from 10 members of the Simply Wall St Community span from US$187.08 to US$294.09 per share, reflecting wide-ranging expectations. While some anticipate robust auto-driven recovery, ongoing competition and uncertain inventory trends remain critical factors for NXP’s near-term prospects, review the range of opinions to broaden your outlook.

Explore 10 other fair value estimates on NXP Semiconductors - why the stock might be worth as much as 33% more than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives