- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova (NVMI): Reassessing Valuation After Fresh Analyst Calls Highlight AI-Driven Semiconductor Tailwinds

Reviewed by Simply Wall St

Nova (NVMI) caught investors attention after fresh analyst calls, including new coverage from Morgan Stanley and an updated view from Jefferies, spotlighted its role in AI driven semiconductor manufacturing demand.

See our latest analysis for Nova.

Those upbeat calls landed just as the stock hit a soft patch, with the latest 7 day share price return of minus 10.08 percent and a 1 day move of minus 5.38 percent. However, that pullback sits against a powerful backdrop of a 48.44 percent year to date share price return and a 53.16 percent total shareholder return over the past year, suggesting momentum is cooling in the short term rather than breaking the longer term uptrend.

If Nova's AI driven story has caught your eye, it is worth seeing what else is setting up for growth in semis and beyond by exploring high growth tech and AI stocks.

With the shares still trading at a discount to consensus targets but coming off a sharp short term pullback, the key question now is whether Nova is a bargain on potential future AI upside or if markets already anticipate what is coming.

Most Popular Narrative: 16.7% Undervalued

With Nova last closing at $301.09 against a narrative fair value of about $361, the current market price implies meaningful upside if those projections play out.

The accelerating complexity of semiconductor devices driven by AI, larger die sizes, advanced nodes, and heterogeneous packaging, continues to fuel demand for Nova's advanced metrology solutions across both logic or foundry and memory segments. This is poised to lift long term revenue growth as global digitization trends expand. Ongoing global investments in semiconductor manufacturing capacity (including reshoring, new fabs in multiple regions, and government incentives) are broadening Nova's customer base and diversifying revenue streams, which supports sustained top line growth and reduces reliance on any single geography or customer.

Curious how steady double digit growth, thick margins, and a punchy future earnings multiple can still point to upside from here? The full narrative unpacks the revenue runway, margin path, and valuation math driving that higher fair value without assuming boom or bust cycles.

Result: Fair Value of $361 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few advanced node customers and potential delays in adopting new metrology platforms could quickly undermine those upbeat assumptions.

Find out about the key risks to this Nova narrative.

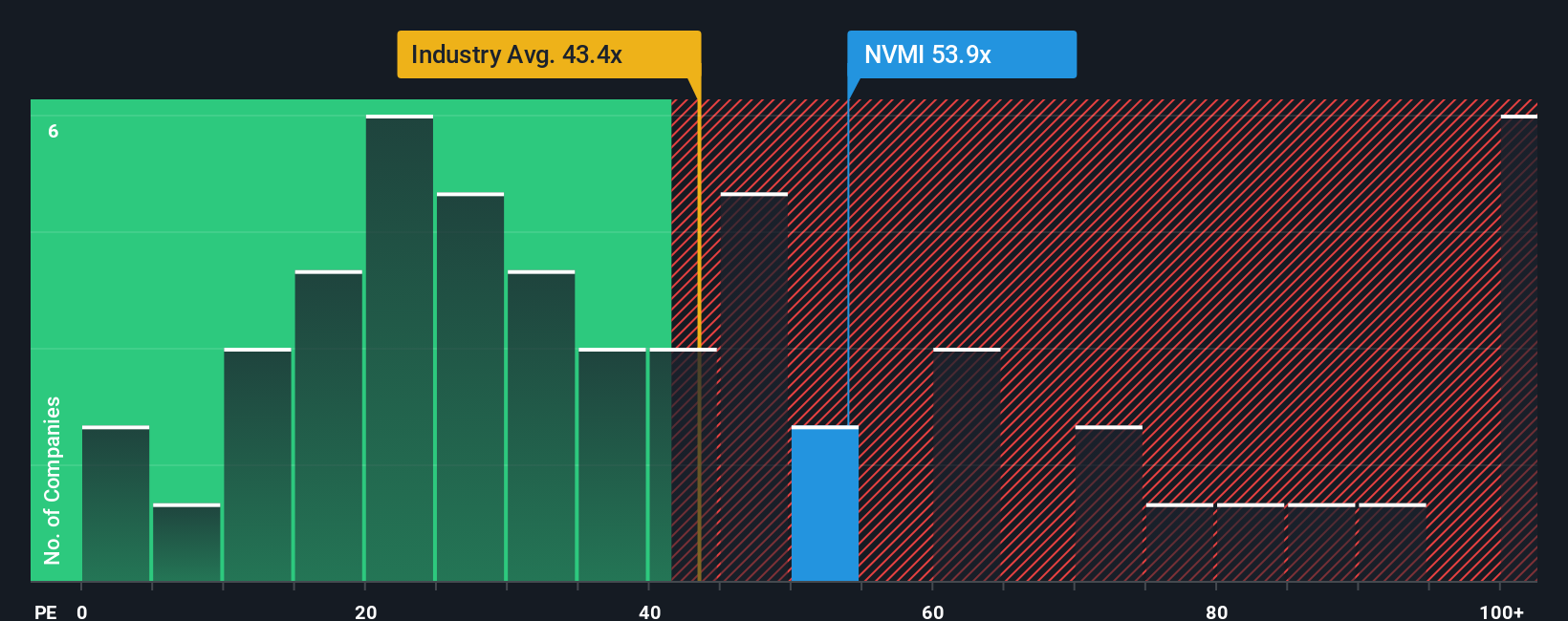

Another View: Market Ratio Sends a Different Signal

Looking at Nova through its price to earnings ratio tells a less generous story. The current 36.4 times earnings is above our fair ratio of 27.9, even if it still sits just below the US semiconductor peer average of 36.8. This hints at less margin of safety than the narrative fair value implies.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nova for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nova Narrative

If you see things differently or want to stress test the assumptions with your own research, you can build a full narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Nova.

Looking for more investment ideas?

Do not stop with one compelling story. Use the Simply Wall St Screener to uncover more opportunities tailored to your strategy before the market moves on without you.

- Capture mispriced potential by reviewing these 911 undervalued stocks based on cash flows that combine strong fundamentals with attractive valuations before sentiment fully catches up.

- Ride structural growth trends by scanning these 29 healthcare AI stocks applying artificial intelligence to transform diagnostics, treatment, and operational efficiency in medicine.

- Position ahead of the next wave of innovation by evaluating these 28 quantum computing stocks pushing the boundaries of computing power and real world problem solving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)