- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova (NVMI): Evaluating Valuation Following Breakthrough WMC Platform Launch in Advanced Semiconductor Manufacturing

Reviewed by Simply Wall St

If you have been eyeing Nova (NasdaqGS:NVMI), the recent excitement probably caught your attention. The company just launched its new Nova WMC optical metrology platform, and this is not your everyday product tweak. The WMC's ability to address a host of advanced semiconductor manufacturing challenges, including hybrid bonding and non-traditional wafer shapes, has already attracted paying customers and a pipeline of new orders. For investors who follow industry innovation, this type of progress is more than a technical update; it is a clear signal that Nova sees a path to bigger opportunities.

Looking at the bigger picture, Nova's shares have posted an impressive 40% gain over the past year. Growth momentum is solid, building on the back of both new product releases and substantial revenue recognition from recent system deliveries. The buzz following the WMC launch feels different compared to prior announcements, with markets reacting to the company’s strengthening position in a rapidly evolving corner of the semiconductor sector. Long-term returns appear robust as well, but the recent run-up suggests investors are factoring in a fresh wave of growth potential.

With expectations rising, the question now is whether Nova is offering a window to buy into future success at a reasonable price, or if the market has already priced in all the upside.

Most Popular Narrative: 8.2% Undervalued

According to the most widely followed narrative, Nova appears to be trading below its fair value based on long-term growth assumptions and discounted cash flow analysis. The narrative points to robust industry tailwinds and company-specific growth drivers as key catalysts for further upside.

"Ongoing global investments in semiconductor manufacturing capacity (including reshoring, new fabs in multiple regions, and government incentives) are broadening Nova's customer base and diversifying revenue streams. This supports sustained top-line growth and reduces reliance on any single geography or customer."

Want to see why analysts think Nova’s growth engine could outpace the competition? The heart of this narrative is a bold bet on revenue and earnings expansion, plus a future profit multiple that rivals industry leaders. What is behind this aggressive valuation? Explore the full story to uncover the projections that could rewrite Nova’s place in the semiconductor market.

Result: Fair Value of $298 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, any slowdown in key customer spending or challenges with new product adoption could quickly undermine Nova’s growth story and valuation momentum.

Find out about the key risks to this Nova narrative.Another View: What Do Market Comparisons Say?

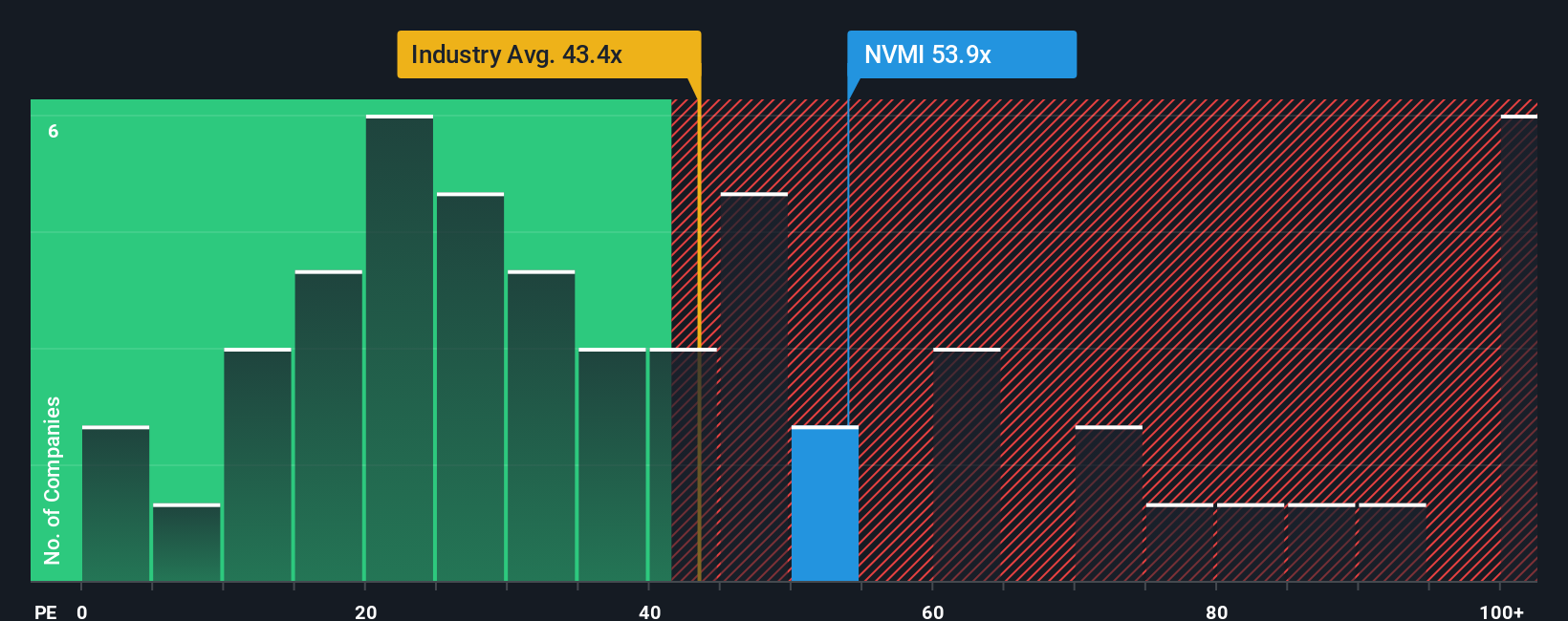

While the discounted cash flow model sees upside, market comparisons raise eyebrows. Nova’s price-to-earnings ratio is higher than the US semiconductor industry. This suggests some optimism may already be built in. Could this mean the market is running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nova Narrative

If you want to dig in yourself and see a different story in the numbers, you can shape your own view of Nova in just minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nova.

Looking for more investment ideas?

Great opportunities do not stick around for long. Smart investors are already targeting tomorrow’s winners, and you can too by putting the Simply Wall Street Screener to work. Make your next move count by spotting strategies others overlook.

- Unlock growth in healthcare innovation by tracking the latest progress with healthcare AI stocks before everyone else sees the trend.

- Tap into reliable income streams and stay resilient through market cycles by assessing top picks using dividend stocks with yields > 3%.

- Get ahead of the curve in the digital asset revolution with game-changing stocks found through cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sells of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives