- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Nova (NasdaqGS:NVMI): Assessing Valuation After Recent Pullback and Long-Term Growth

Reviewed by Simply Wall St

Nova (NasdaqGS:NVMI) has been on investors’ watchlists lately, especially as its shares have delivered a mix of returns over the past year. Recent moves in the stock price have some shareholders assessing future growth prospects and market positioning.

See our latest analysis for Nova.

Nova’s share price has pulled back from last month’s highs, recently slipping by 12.5% over the past 30 days. Even so, momentum remains impressive, as the stock is still up 43.3% year-to-date. Long-term holders have been well rewarded, with a 1-year total shareholder return of 62.6%, and a remarkable 372.9% over five years. This suggests the pace of gains has only picked up.

If Nova’s strong run has you curious about what else is gaining attention, this could be a smart time to discover fast growing stocks with high insider ownership

With Nova’s share price pulling back from its highs yet still boasting robust long-term gains, investors face a key question: is the recent dip a chance to buy into further upside, or has the market already factored in the company's future growth?

Most Popular Narrative: 9.7% Undervalued

According to the narrative, Nova's fair value is calculated at $321.67 per share, which is notably above the latest closing price of $290.57. This sets the stage for a debate about whether the current market is truly factoring in the company's growth story.

Ongoing global investments in semiconductor manufacturing capacity (including reshoring, new fabs in multiple regions, and government incentives) are broadening Nova's customer base and diversifying revenue streams, supporting sustained top-line growth and reducing reliance on any single geography or customer.

Want to know what’s powering this valuation premium? The narrative hinges on bold projections for sales growth, future earnings expansion, and profit margins that rival industry leaders. Curious which aggressive assumptions are behind these numbers? Click through to see the surprising financial expectations driving Nova’s fair value call.

Result: Fair Value of $321.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competitive pressures and overestimated semiconductor demand could challenge Nova’s growth outlook and put its current valuation at risk.

Find out about the key risks to this Nova narrative.

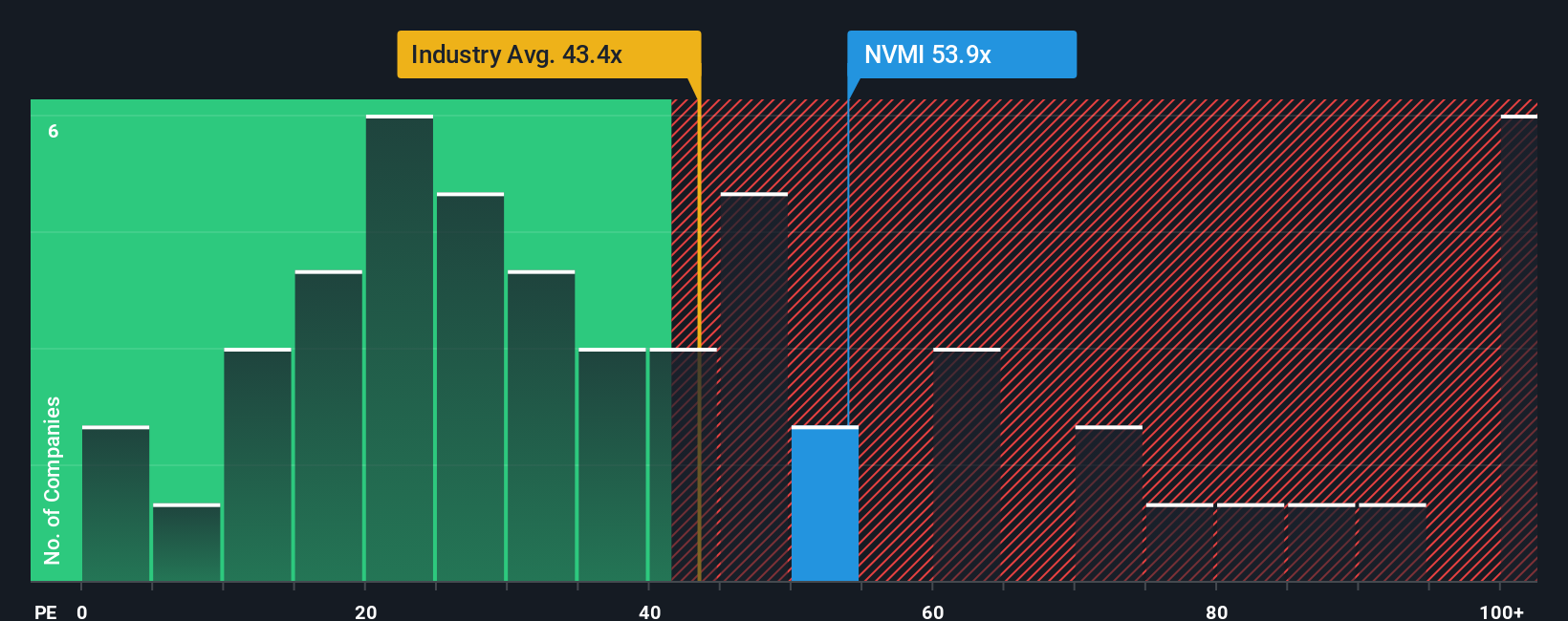

Another View: Multiples Paint a Cautious Picture

While analyst fair value estimates suggest Nova is undervalued, the current price-to-earnings ratio of 35.2 is higher than the industry average of 34.2 and exceeds the fair ratio of 26.4. This premium suggests that the market might have already priced in future growth, leaving less room for upside than it seems.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nova for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nova Narrative

If you see things differently or want to dig into the data yourself, you can build your own Nova story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nova.

Looking for more investment ideas?

Don’t let opportunity slip by. Use the Simply Wall Street Screener to move confidently beyond Nova and identify your next smart investment from other standout stocks.

- Boost your portfolio with reliable income streams by tapping into these 16 dividend stocks with yields > 3% offering yields over 3% and time-tested payouts.

- Step into the future by researching these 25 AI penny stocks capitalizing on breakthroughs in artificial intelligence technology and game-changing business models.

- Gain an edge with undervalued options through these 877 undervalued stocks based on cash flows, pinpointing stocks the market hasn’t fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives