- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Is Nova’s Soaring 63% Rally in 2025 Justified After Recent Sector Optimism?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Nova stock? You’re not alone. Whether you’re a long-term investor who’s watched Nova leap an eye-popping 478.4% over five years, or you’re wondering if last week’s 2.2% uptick is the start of something bigger, the company has certainly grabbed attention. Even the 63.4% jump year-to-date makes people sit up and ask: is there more room to run, or has the train already left the station?

Much of Nova’s momentum can be pinned on renewed market optimism around its sector, which has only intensified as investors look for resilient growth stories. The 9.6% pop in the last month hints that traders might be sensing improving fundamentals or less risk than before, fueling a bit of a buying spree. Still, these robust gains add another layer of challenge for anyone asking how much Nova is actually worth right now.

Here’s the twist: when measured across six different valuation checks, Nova’s value score is just 0. In other words, the company doesn’t flash as undervalued according to these traditional signals. That doesn’t mean it isn’t a worthy investment, but it does mean we’ll need to look more closely at what these valuation methods do and don’t tell us. Later, I’ll share a smarter way to think about valuation entirely.

Nova scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nova Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting Nova's future cash flows and then discounting those values back to today. This provides an estimate of what the business is intrinsically worth. This method relies on current free cash flow and assumed growth rates to paint a picture of the company’s long-term value.

For Nova, the current Free Cash Flow stands at $204.7 Million. Analysts provide forecasts up to 2026, after which future numbers are based on a reasonable extrapolation. By 2026, free cash flow is projected to rise to $240.7 Million. Ten years out, the model estimates this metric could reach $370.4 Million. However, figures further into the future are increasingly speculative.

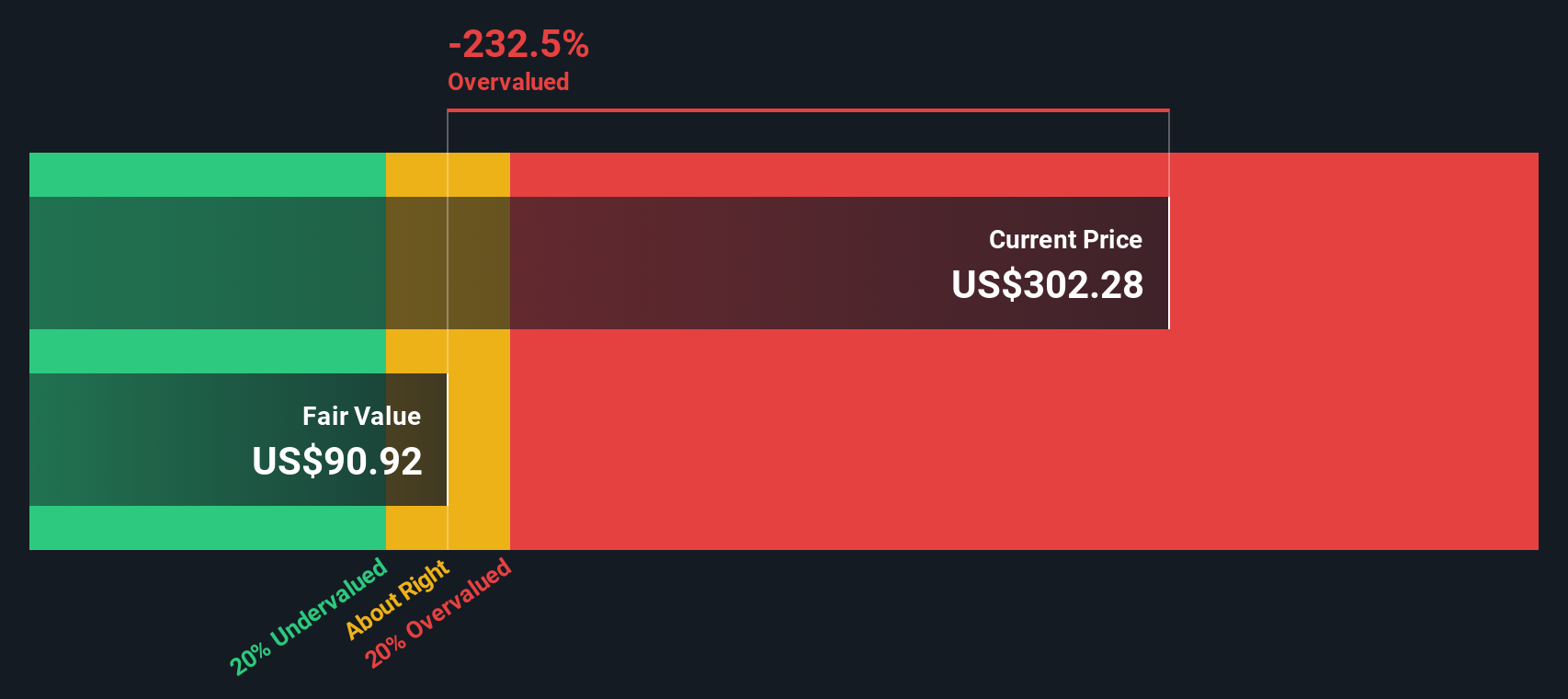

After calculating the numbers for all projected years and discounting them back to the present, the DCF model sets Nova's intrinsic value at $91.56 per share. This figure implies a steep disconnect from the current stock price, suggesting that the stock is 261.9% overvalued using this method.

While DCF offers an insightful snapshot grounded in future cash generation, its verdict is clear in this case. Nova’s shares are priced far above what their future cash flows alone might justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nova may be overvalued by 261.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nova Price vs Earnings (PE Ratio)

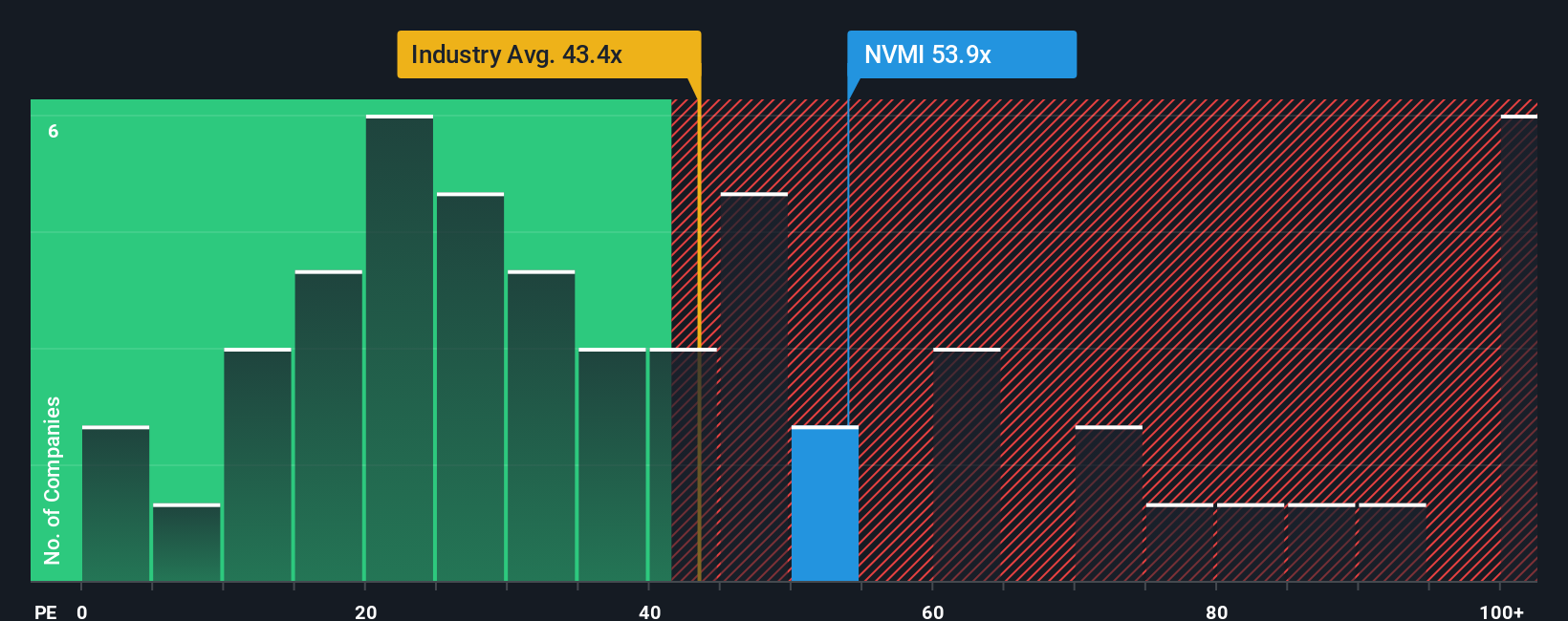

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Nova because it directly measures how much investors are willing to pay for each dollar of earnings. This makes it especially useful for comparing companies in the same sector, as it captures both their profitability and how the market views their future prospects.

What counts as a "fair" PE ratio often depends on expectations for future growth and the level of risk investors believe is present. Higher growth and lower risks usually justify a higher multiple, as investors are banking on more robust future earnings. Conversely, a low PE might signal caution or expectations of limited expansion.

Nova currently trades at a PE ratio of 41.8x, putting it notably above the semiconductor industry average of 35.6x and its peer average of 37.1x. However, strictly comparing these numbers can be misleading since companies can differ widely in growth rates, profitability, or scale. That is where the Simply Wall St Fair Ratio comes in. Nova’s Fair Ratio stands at 24.7x, which is calculated based on factors like its projected earnings growth, profit margins, market cap, sector, and risk profile. This delivers a more tailored benchmark for the stock’s fair value.

By comparing Nova’s current 41.8x PE to its Fair Ratio of 24.7x, the stock appears to be trading well above what would be justified by its fundamentals. This suggests that, at the moment, Nova is overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nova Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives let you define your own story about Nova by combining your expectations of its future, such as growth rates, margins, and fair value, directly with the numbers, making your investment view as dynamic as the company’s outlook itself.

In simple terms, a Narrative is like a personalized scenario: you lay out the catalysts and risks you believe shape Nova’s journey, translate that story into a financial forecast, and from there, see your tailored fair value compared with the current price. This helps you move beyond static ratios or outdated models, giving context to when Nova looks like a buy or a sell based on what you actually believe is possible for the business.

Best of all, Narratives are easy to create and update on Simply Wall St’s Community page, where millions of investors share and refine their perspectives in real time. When new information arrives, such as fresh earnings or major news, Narratives dynamically recalculate fair value so your decisions are always informed by the latest numbers.

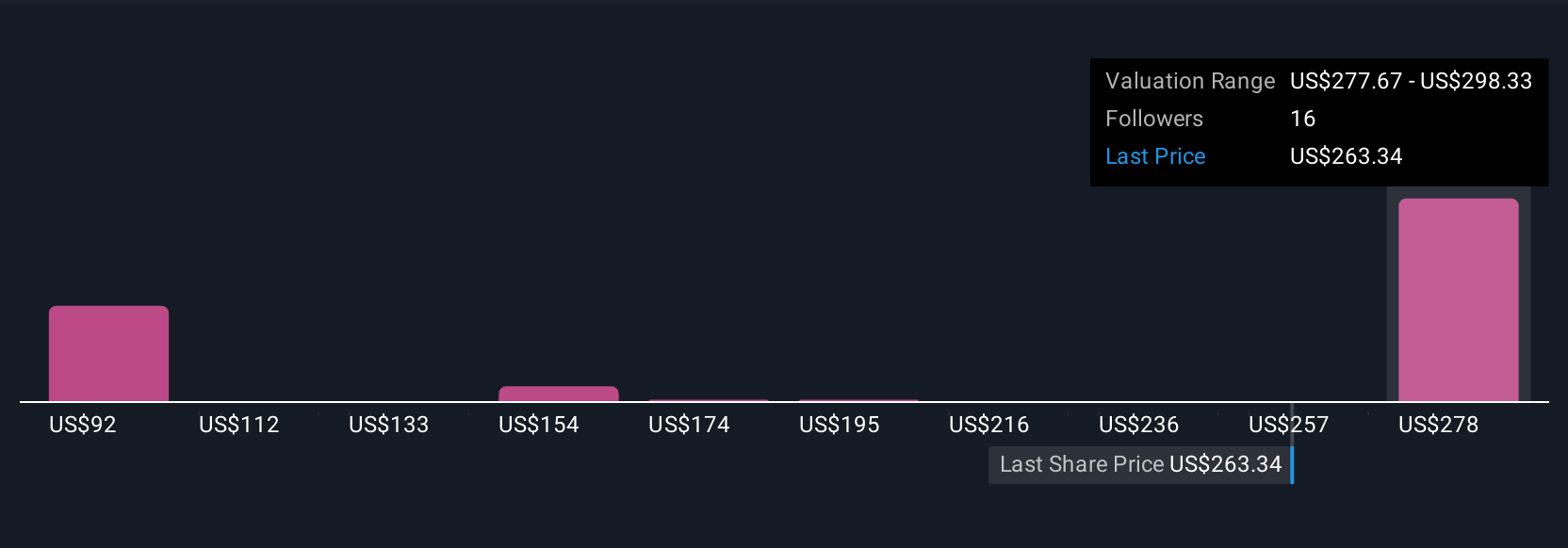

For Nova, some investors may tell a growth-focused narrative that expects $1.1 billion in revenue and a price target of $306.67 per share, while more cautious views might project lower sales and a fair value closer to $91.56. You can instantly compare these and judge how your own view stacks up, all in one place.

Do you think there's more to the story for Nova? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.