- United States

- /

- Semiconductors

- /

- NasdaqGS:NVMI

Can Nova’s AI Metrology Role Justify Investor Attention After Morgan Stanley’s NVMI Coverage?

Reviewed by Sasha Jovanovic

- Morgan Stanley recently initiated coverage on semiconductor process control specialist Nova with an "Equal-weight" rating, highlighting its role in supporting chip manufacturers as artificial intelligence and advanced nodes increase manufacturing complexity.

- The coverage has refocused attention on Nova’s position within metrology and analytics, underscoring how investor interest can shift as AI-related semiconductor spending gathers momentum.

- We’ll now explore how Morgan Stanley’s initiation of coverage shapes Nova’s existing investment narrative, particularly around AI-driven semiconductor demand.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Nova Investment Narrative Recap

To own Nova, you need to believe that metrology and process control will stay essential as chipmaking gets more complex with AI and advanced nodes. Morgan Stanley’s new Equal-weight coverage and price target appear to validate Nova’s relevance, but do not materially change the near term focus on customer CapEx timing as a key catalyst, or on concentration risk around a small group of advanced node customers as a central concern.

The recent opening of Nova’s new manufacturing facility in Bad Urach, Germany, which doubles capacity for its Chemical Metrology Division, ties directly into the same theme that underpins Morgan Stanley’s initiation: demand for more precise process control as fabs push into advanced structures and materials. For investors, that expansion sits alongside AI driven metrology needs as a potential growth driver, but both remain sensitive to broader wafer fab equipment spending cycles.

But while enthusiasm around AI linked demand is high, investors should be aware that...

Read the full narrative on Nova (it's free!)

Nova's narrative projects $1.1 billion revenue and $293.1 million earnings by 2028. This requires 9.8% yearly revenue growth and about a $58 million earnings increase from $234.9 million today.

Uncover how Nova's forecasts yield a $365.83 fair value, a 13% upside to its current price.

Exploring Other Perspectives

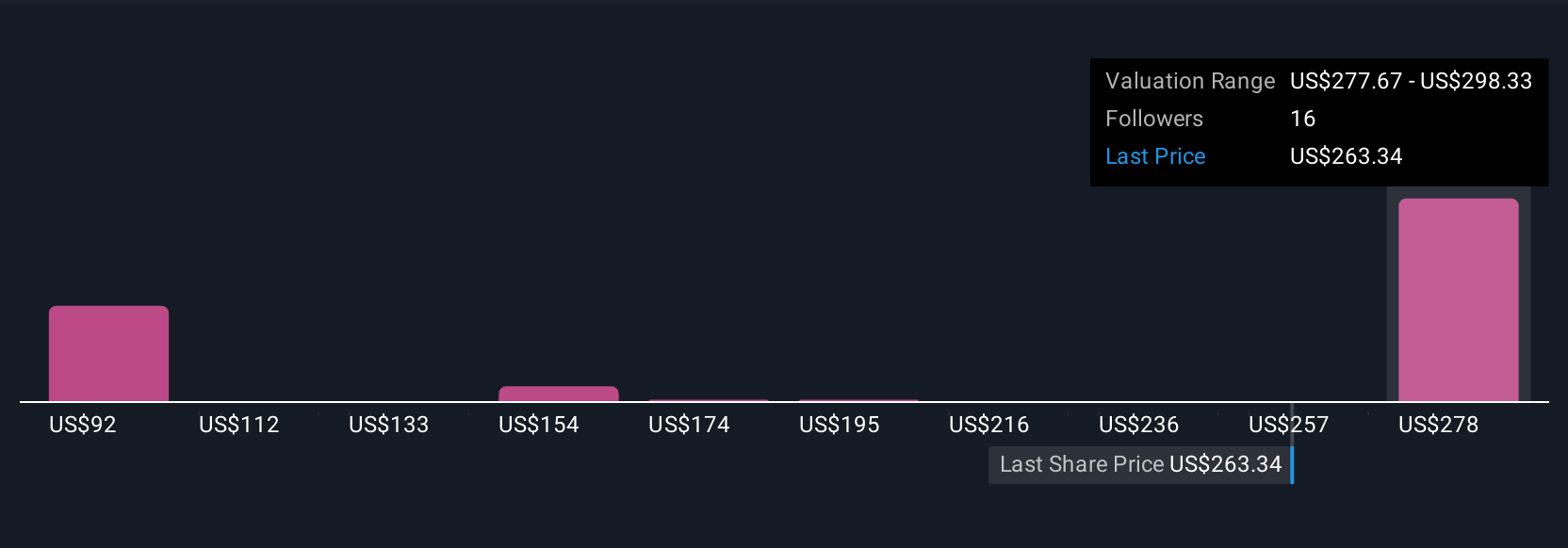

Five fair value estimates from the Simply Wall St Community span roughly US$82.9 to US$365.8 per share, showing just how far apart individual views can be. As you weigh those perspectives against Nova’s reliance on a concentrated group of advanced node customers, it is worth considering how different assumptions about future wafer fab spending could affect the company’s results.

Explore 5 other fair value estimates on Nova - why the stock might be worth as much as 13% more than the current price!

Build Your Own Nova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nova research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nova's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVMI

Nova

Engages in the design, development, production, and sale of process control systems used in the manufacture of semiconductors in Taiwan, the United States, China, Korea, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026