- United States

- /

- Semiconductors

- /

- NasdaqCM:NVEC

We Discuss Why NVE Corporation's (NASDAQ:NVEC) CEO Will Find It Hard To Get A Pay Rise From Shareholders This Year

The disappointing performance at NVE Corporation (NASDAQ:NVEC) will make some shareholders rather disheartened. At the upcoming AGM on 05 August 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for NVE

Comparing NVE Corporation's CEO Compensation With the industry

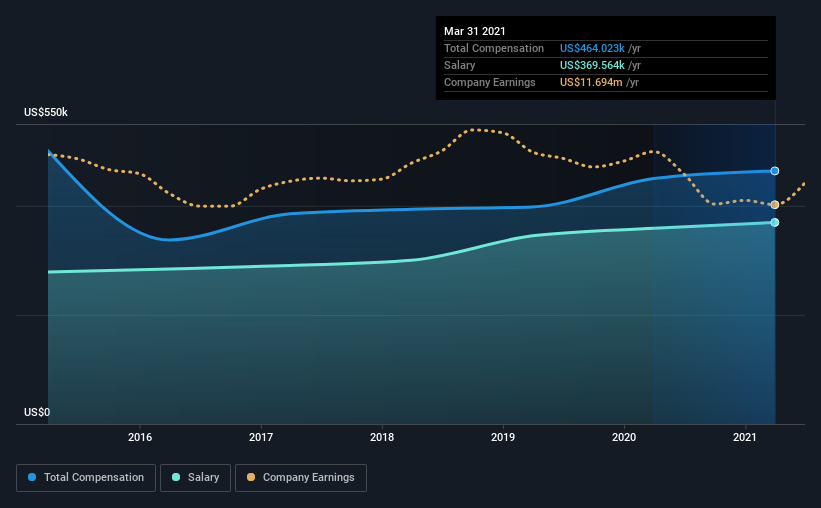

According to our data, NVE Corporation has a market capitalization of US$379m, and paid its CEO total annual compensation worth US$464k over the year to March 2021. That's just a smallish increase of 3.1% on last year. We note that the salary portion, which stands at US$369.6k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.4m. This suggests that Daniel Baker is paid below the industry median. Moreover, Daniel Baker also holds US$6.4m worth of NVE stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$370k | US$359k | 80% |

| Other | US$94k | US$91k | 20% |

| Total Compensation | US$464k | US$450k | 100% |

On an industry level, roughly 12% of total compensation represents salary and 88% is other remuneration. It's interesting to note that NVE pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

NVE Corporation's Growth

Over the last three years, NVE Corporation has shrunk its earnings per share by 4.0% per year. In the last year, its revenue changed by just 0.9%.

Few shareholders would be pleased to read that EPS have declined. And the flat revenue is seriously uninspiring. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has NVE Corporation Been A Good Investment?

With a three year total loss of 13% for the shareholders, NVE Corporation would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for NVE that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading NVE or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NVE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:NVEC

NVE

Develops and sells devices that use spintronics, a nanotechnology relying on electron spin to acquire, store, and transmit information, both in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives