- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Unveils AI Innovations For Automotive And Massive-Context Processing

Reviewed by Simply Wall St

At the IAA Mobility 2025, NVIDIA (NVDA) unveiled its AIBOX, a significant AI innovation for automotive applications. Concurrently, the company announced the Rubin CPX GPU, enhancing capabilities in complex software development. These product launches, combined with the expansion of the Cadence Reality Digital Twin, highlight NVIDIA's advancements in AI technology. These efforts seemingly supported the company’s stock price increase of 18% over the last quarter, aligning with a strong performance in the AI sector as seen with market highs reached by indices like the Nasdaq amidst bullish sentiment on AI demand.

Find companies with promising cash flow potential yet trading below their fair value.

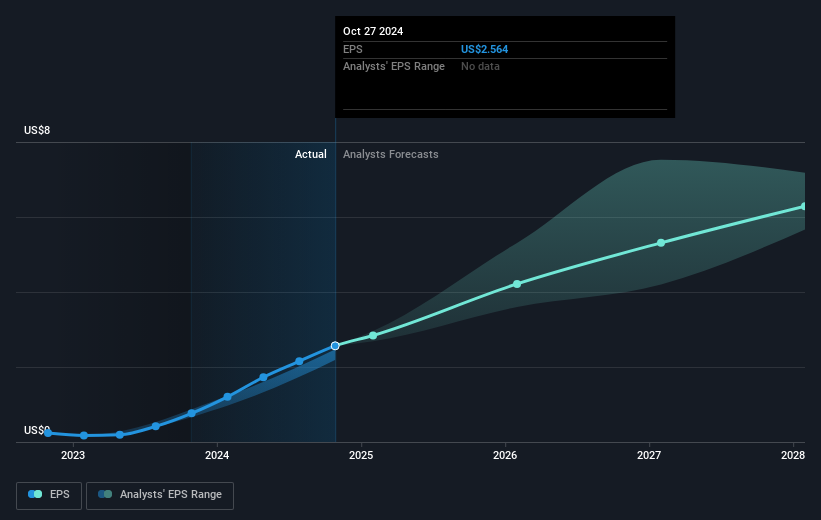

Recent announcements such as NVIDIA's unveiling of the AIBOX and Rubin CPX GPU demonstrate the company's drive to solidify its position in the AI sector. This commitment to innovation can potentially boost NVIDIA's revenue and earnings forecasts by attracting more interest in its AI solutions, as accelerating AI adoption continues to propel demand in related industries. With revenue currently at US$165.22 billion and earnings at US$86.60 billion, these advancements might support continued growth, although risks like geopolitical tensions remain a concern.

Over the past five years, NVIDIA's total shareholder returns, which includes both the share price appreciation and dividends, surged by a very large percentage, highlighting its strong long-term performance. This is indicative of investor confidence in the company's ability to capitalize on AI-driven opportunities. Recently, NVIDIA's shares have also outpaced the broader US Semiconductor industry within the past year, reflecting its robust market position.

The current share price of US$170.76 suggests there is potential upside when compared to the consensus analyst price target of US$207.01, which implies a 21.23% increase. This target price reflects positive sentiment regarding the company's growth potential in AI technologies. Investors will be keenly watching how NVIDIA's strategic initiatives, particularly in AI and data center advancements, play a role in achieving these forecasts and closing the gap toward the price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026