- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Is Up 6.0% After OpenAI Partnership and $100B AI Infrastructure Commitment - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In late September 2025, NVIDIA confirmed a multi-billion-dollar partnership with OpenAI to deploy at least 10 gigawatts of NVIDIA systems and invest up to $100 billion in AI infrastructure, fueling major expansion of next-generation AI model training and deployment.

- This partnership further secures NVIDIA’s position at the core of global AI innovation, as analysts emphasize rising capital expenditures across the sector and point to broader ecosystem collaborations and product launches reinforcing NVIDIA’s technology leadership.

- We'll explore how the OpenAI partnership, centered on Nvidia's large-scale AI infrastructure investment, realigns its longer-term investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 33 companies in the world exploring or producing it. Find the list for free.

NVIDIA Investment Narrative Recap

To own NVIDIA shares, investors need to believe that the adoption of advanced AI will keep driving demand for the company’s full-stack infrastructure and maintaining its lead in AI hardware. The historic $100 billion OpenAI partnership secures NVIDIA’s central position in the AI ecosystem and supports a robust near-term order pipeline, but it does not materially alter the key catalyst of ongoing generative AI adoption or the primary risk of customer vertical integration eroding market share.

Among recent announcements, NVIDIA’s collaboration with SHI International stands out for expanding RTX PRO GPU use in government accessibility solutions. While interesting, this does not shift major short-term catalysts or mitigate core risks such as hyperscale customers moving to custom chips.

By contrast, investors should be mindful that growing customer investment in alternative silicon could mean NVIDIA’s data center dominance is less assured if...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's narrative projects $337.2 billion in revenue and $187.9 billion in earnings by 2028. This requires 26.8% yearly revenue growth and a $101.3 billion increase in earnings from the current $86.6 billion.

Uncover how NVIDIA's forecasts yield a $209.19 fair value, a 11% upside to its current price.

Exploring Other Perspectives

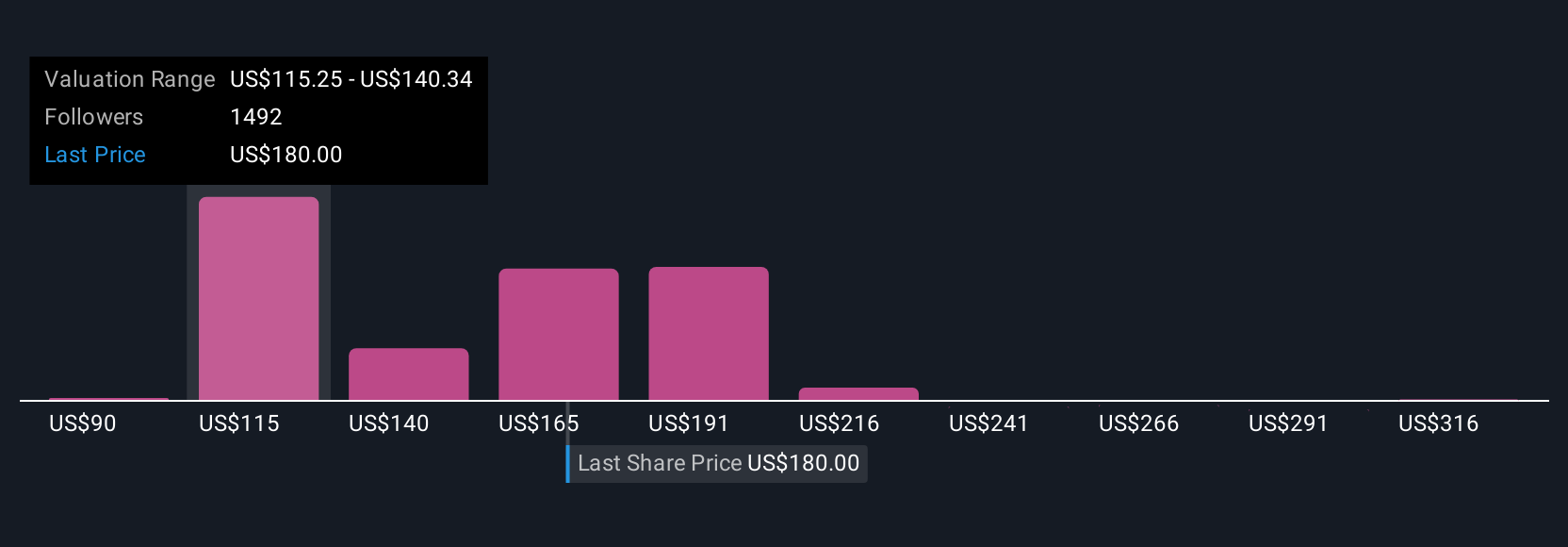

444 members of the Simply Wall St Community estimate NVIDIA’s fair value between US$90 and US$341 per share. With custom AI chip development by top customers increasing, the gap in outlooks speaks to highly polarized expectations for NVIDIA’s future performance.

Explore 444 other fair value estimates on NVIDIA - why the stock might be worth as much as 81% more than the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)