- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Expands AI Cloud With US$193 Million GPU Purchase At Prince George Campus

Reviewed by Simply Wall St

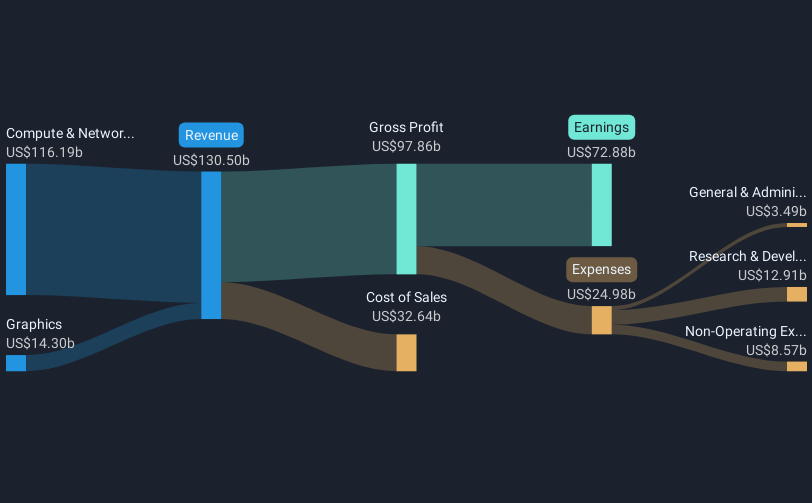

NVIDIA (NVDA) has experienced a significant 31% increase in its share price over the last quarter, reflecting a period marked by notable corporate developments and broader market trends. A key factor was IREN Limited's strategic acquisition of an extensive number of NVIDIA's Blackwell B200 GPUs, suggesting robust demand for the company’s products. Alongside this, NVIDIA's earnings report revealed a substantial rise in revenue and net income compared to the previous year. The announcement of new technologies and product partnerships further supported investor confidence. These developments were reinforced amid a mixed market backdrop, which saw tech stocks, including NVIDIA, perform positively.

Be aware that NVIDIA is showing 1 risk in our investment analysis.

The recent developments at NVIDIA, including the acquisition of Blackwell B200 GPUs by IREN Limited and new product partnerships, may significantly impact the company's narrative. These events underline robust demand for NVIDIA’s advanced computing technology, potentially bolstering future revenue and earnings projections. The strategic moves into data centers and AI, coupled with expansion into the automotive sector through partnerships with Toyota and Uber, are likely to enhance NVIDIA’s growth prospects across various sectors. However, challenges such as regulatory issues and the complexity of Blackwell system costs remain hurdles that could affect profitability.

Over the past five years, NVIDIA's total return, including its share price and dividends, soared to a very large percentage, evidencing the company's notable long-term growth trajectory. In the last year alone, NVIDIA’s performance surpassed that of the US Semiconductor industry, which returned 31.3%, and the overall US market, which returned 15.9%. This longer-term performance suggests a strong track record, though it contrasts with its recent price movement and analyst expectations.

Despite its recent share price increase of 31% this quarter, NVIDIA’s current share price of US$177.99 remains below the consensus analyst price target of US$192.59. This discount suggests that analysts see some upside potential based on projected earnings and revenue growth. However, realizing these targets may require the company to overcome existing challenges and maintain momentum in its innovative ventures across key industries. As analysts predict substantial growth in earnings and revenue, NVIDIA needs to continue leveraging its technology advancements and market strategies to meet these ambitious forecasts.

Click to explore a detailed breakdown of our findings in NVIDIA's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives