- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Surges 13% With Microsoft Partnership For Neural Shading

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) recently unveiled significant enhancements to its RTX neural rendering technologies, just ahead of the Game Developers Conference, alongside a noteworthy partnership with Microsoft for neural shading support. These developments appear to have influenced the company's share price, which saw an increase of 13% over the last week, standing out amid a generally mixed market environment. NVIDIA's collaboration with Block Inc. to deploy its DGX SuperPOD for AI model research further underscores its commitment to advancing in the AI and tech sector. Meanwhile, the broader market experienced volatility, with the S&P 500 and Nasdaq Composite facing declines amidst concerns over economic uncertainty. Despite the recent slide in tech stocks, including NVIDIA's temporary dip at the start of the week, positive sentiment around its product announcements and partnerships likely supported its solid performance. With these strategic moves, NVIDIA has managed to differentiate itself within a challenging market landscape.

Click to explore a detailed breakdown of our findings in NVIDIA's financial health report.

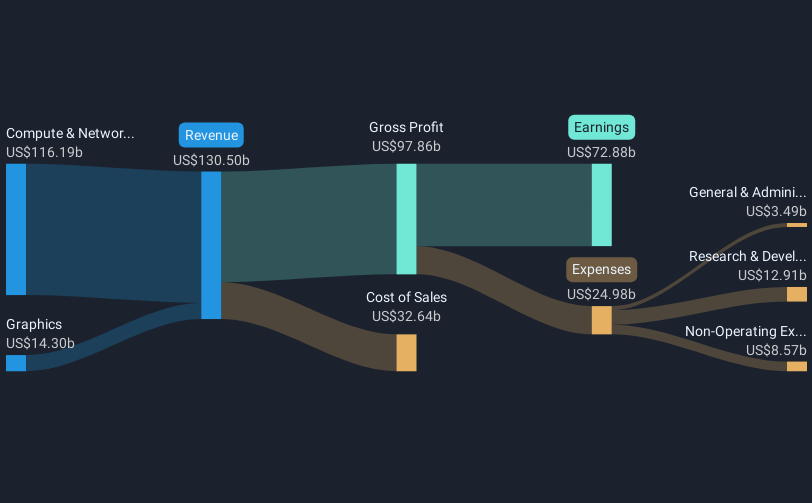

NVIDIA's shares have experienced a very large total return of 2196.64% over the last five years. This remarkable performance stands out, especially given that NVIDIA outperformed both the US Semiconductor industry, which saw a 16.3% return, and the broader US market, which returned 9% over the past year. Several factors have played a role. An important element has been NVIDIA's consistent earnings growth, with an accelerated earnings growth of 146.9% in the past year, significantly surpassing its five-year average. Moreover, NVIDIA's substantial earnings for fiscal year 2025, with sales reaching US$130.50 billion and net income at US$72.88 billion, highlights the company's robust financial health.

Complementing its financial performance are strategic alliances, such as the recent collaboration with Cisco to enhance AI technology solutions. Furthermore, NVIDIA's advancements in AI and graphic technologies have been complemented by its active share repurchase program, with 55.3 million shares bought back for approximately US$7.76 billion. These elements, alongside continued technological innovation and partnerships, have significantly contributed to the company’s outstanding returns over this period.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives