- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Shareholders Reject Amendment To Remove Supermajority Provisions

Reviewed by Simply Wall St

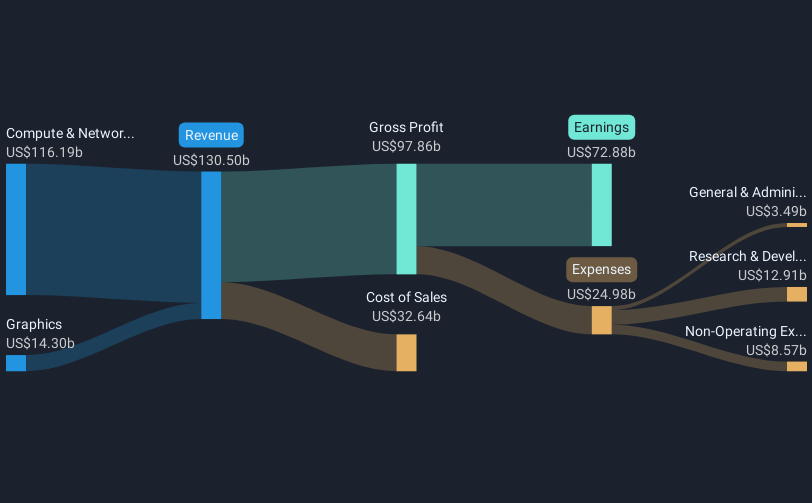

NVIDIA (NasdaqGS:NVDA) recently saw a significant share price increase of 39% over the last quarter. This move was accompanied by several key developments, including the company's AGM decision not to remove supermajority provisions. Despite this, NVIDIA's robust earnings report, with a notable rise in sales and net income, likely reinforced its upward trajectory. The launch of new AI-focused products and partnerships, especially in developing AI infrastructure, also supported the tech sector's strength, aligning with the broader increases in the S&P 500 and Nasdaq Composite, which recently saw a modest rise, highlighting the tech sector's ongoing momentum.

NVIDIA has 1 possible red flag we think you should know about.

The recent developments surrounding NVIDIA, such as the company's decision to maintain supermajority provisions and the launch of new AI-focused products, have broader implications for its market positioning and strategic growth path. While the earnings report highlighted an increase in sales and net income, sustaining this momentum may be challenging amidst regulatory hurdles. These factors could significantly influence NVIDIA's revenue and earnings forecasts, as ongoing investments in AI infrastructure and partnerships could enhance future revenue streams, potentially stabilizing profit margins despite existing headwinds.

Over a five-year period, NVIDIA's total shareholder returns were very large, underscoring the company's strong long-term performance. In contrast, the company's performance over the past year has outpaced both the broader US market and the Semiconductor industry, indicating robust investor confidence. This context highlights the significance of recent developments, which, if executed effectively, could enhance NVIDIA's market standing further.

The current share price of NVIDIA reflects a considerable discount to the consensus analyst price target, suggesting potential room for growth. However, the analyst consensus assumes aggressive growth in revenue and earnings, which are contingent upon NVIDIA overcoming regulatory challenges and successfully expanding its AI-focused offerings. As the company navigates these complexities, the extent to which these forecasts align with actual outcomes remains a focal point for decision-makers.

Evaluate NVIDIA's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives