- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Powers Ouster BlueCity's AI-Driven Smart Traffic Management System

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) experienced a 21% increase in its stock price over the last month, a move that coincides with several significant developments. Of particular interest is Ouster Inc.'s announcement of advancements in its traffic management solution within the NVIDIA Metropolis ecosystem. This event, alongside several collaborative efforts with companies like Peachtree Corners and Vertiv, underscores NVIDIA's role in driving AI innovation across sectors. While the broader market showed modest growth, NVIDIA's advancements likely bolstered its position, contributing to its notable stock performance during this period.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments involving NVIDIA and its collaborations within the Metropolis ecosystem, as well as partnerships with companies like Toyota and Uber, could potentially enhance its strategic positioning in AI-driven sectors. NVIDIA's focus on AI innovation across industries is pivotal, as evidenced by its long-term share price appreciation. Over the past five years, the company's total shareholder return was very large (including share price and dividends), indicating robust historical performance. In contrast, when considering the short-term, NVIDIA's one-year return exceeded the US Semiconductor industry benchmark, reflecting stronger growth.

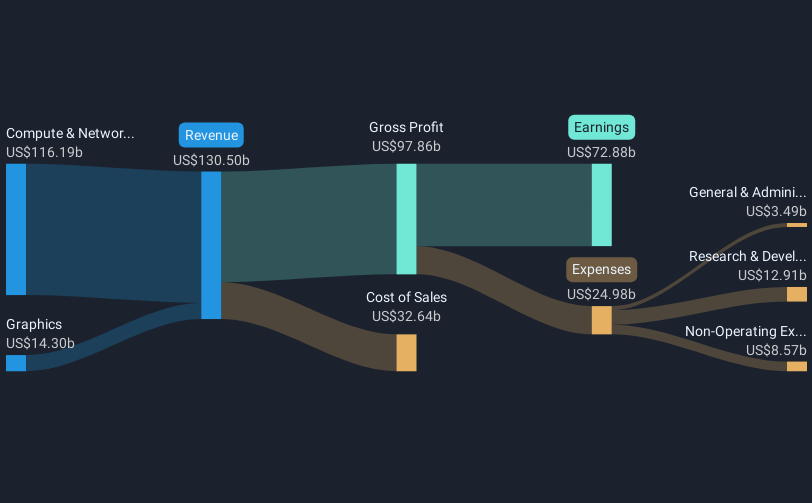

The advancements in NVIDIA's ecosystem and partnerships may bolster its revenue and earnings forecasts as the company continues to dominate AI workloads, particularly in data centers and the automotive sector. As such, the consensus revenue forecast assumes a growth rate of 20.3% annually, with earnings set to increase over the next three years. Current developments reinforce NVIDIA's potential for sustained growth and the realization of these forecasts, although regulatory challenges remain. In the context of its price target, NVIDIA's recent market movements offer a significant discount relative to the analyst consensus price target of US$163.12, suggesting room for potential appreciation should the company meet analysts' expectations.

Upon reviewing our latest valuation report, NVIDIA's share price might be too pessimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade NVIDIA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives