- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NasdaqGS:NVDA) Powers IREN's AI Cloud Growth with Blackwell GPU Expansion

Reviewed by Simply Wall St

NVIDIA (NasdaqGS:NVDA) has recently been in the spotlight due to a significant purchase by IREN Limited, showcasing widespread market application and pushing its stock price up by 54% over the last quarter. This rise is reflective of the overall tech sector momentum, supported by a buoyant Nasdaq. The company’s robust first-quarter earnings, major share buybacks, and strategic alliances further fueled investor optimism. While broader market trends like the Nasdaq's rally and recent economic data supported this growth, NVIDIA’s involvement in high-performance AI and strategic expansions significantly contributed to its impressive performance.

You should learn about the 1 warning sign we've spotted with NVIDIA.

The significant investment by IREN Limited in NVIDIA, combined with the acquisition of partnerships in the automotive sector, may enhance NVIDIA's growth narrative by potentially expanding its AI market presence. These developments could bolster revenue from both AI and automotive sectors, aligning with NVIDIA's strategic focus on high-performance AI and autonomous vehicle platforms. Such partnerships are crucial as they can drive up impending revenue streams and refine earnings forecasts, positioning NVIDIA well in an evolving tech landscape.

Over a five-year period, NVIDIA achieved a very large total return of 1,444%, reflecting its impressive growth trajectory. This performance starkly contrasts with its one-year return, surpassing the US Market's 13.2% and the US Semiconductor industry's 14.4% return over the same period. NVIDIA's ability to outperform its peers and broader market emphasizes its dominant position and innovative prowess.

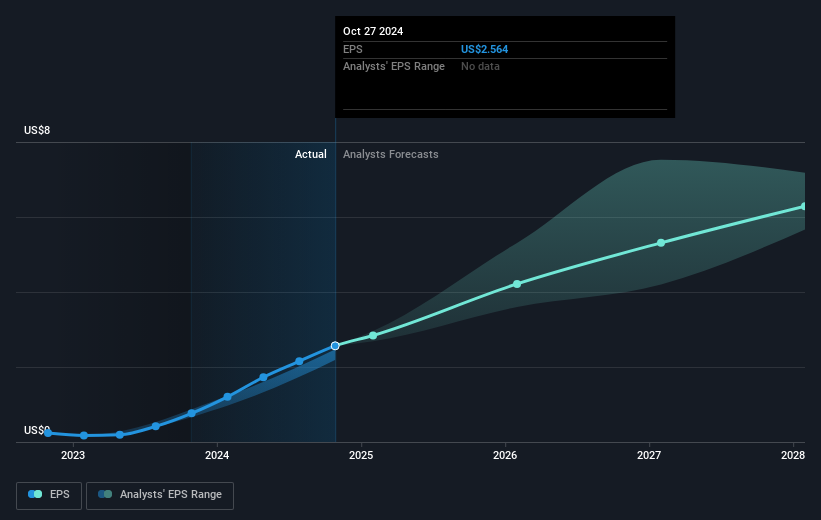

With the current share price at US$113.54 and an analyst price target of US$174.18, there remains a potential upside of over 50% based on the consensus. This disparity signifies room for share appreciation if NVIDIA successfully capitalizes on its strategic initiatives. Continued execution on growth drivers like the Blackwell architecture, alongside recent earnings momentum, could see analysts' revenue and earnings forecasts materialize, impacting future valuations and market expectations positively.

Our expertly prepared valuation report NVIDIA implies its share price may be too high.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives