- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Is NVIDIA's (NVDA) Desktop AI Superchip Partnership With MediaTek Changing the Company's Demand Outlook?

Reviewed by Sasha Jovanovic

- Earlier this week, MediaTek and NVIDIA unveiled the GB10 Grace Blackwell Superchip powering the NVIDIA DGX Spark, a personal AI supercomputer offering up to 1 PFLOP of desktop AI performance for developers working with models as large as 200 billion parameters.

- This collaboration signals a shift toward highly accessible, power-efficient AI development hardware, equipping broader segments of the industry to independently fine-tune and deploy advanced models without cloud reliance.

- We'll examine how broadening access to energy-efficient desktop supercomputing could reshape NVIDIA's investment narrative and future demand profile.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

NVIDIA Investment Narrative Recap

To be a shareholder in NVIDIA, you need to believe in the multi-year rise of AI-driven compute demand, with NVIDIA’s leadership in full-stack, energy-efficient AI hardware and platforms as a key driver of expanding revenue and margins. The MediaTek partnership on the GB10 Grace Blackwell Superchip and DGX Spark desktop AI systems marks a step toward broader AI accessibility and desktop adoption, but does not materially affect the major short-term catalyst, strong hyperscale and enterprise AI infrastructure spending, nor address the biggest risk from ongoing US-China trade restrictions.

Of the recent announcements, Oracle's rollout of OCI Zettascale10, built on NVIDIA GPUs, stands out. This milestone reinforces NVIDIA’s position at the heart of hyperscale AI deployments and ties directly to the main near-term driver for the company: persistent hyperscaler and sovereign demand for large-scale training and inference infrastructure.

By contrast, regulatory shifts or export limitations affecting NVIDIA’s China business could become an issue many investors have yet to consider fully...

Read the full narrative on NVIDIA (it's free!)

NVIDIA's narrative projects $337.2 billion revenue and $187.9 billion earnings by 2028. This requires 26.8% yearly revenue growth and a $101.3 billion earnings increase from $86.6 billion today.

Uncover how NVIDIA's forecasts yield a $218.51 fair value, a 19% upside to its current price.

Exploring Other Perspectives

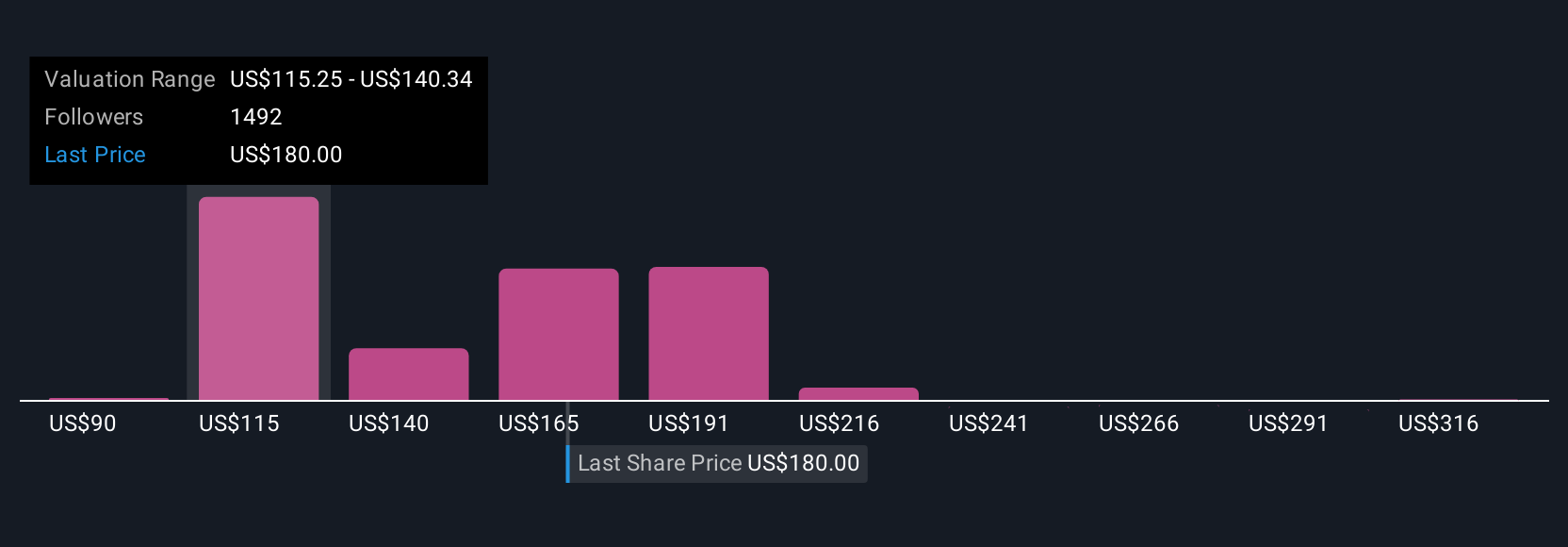

With 454 fair value estimates from the Simply Wall St Community ranging from US$90.15 to US$341.12, retail perspectives on NVIDIA’s worth vary widely. Many participants are focused on the company’s ability to maintain technology leadership and capture ongoing AI infrastructure investment, which remains central to the current outlook.

Explore 454 other fair value estimates on NVIDIA - why the stock might be worth as much as 86% more than the current price!

Build Your Own NVIDIA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NVIDIA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NVIDIA's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives