- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Is Now the Right Moment for Nvidia After 31% Gain in 2025?

Reviewed by Bailey Pemberton

Thinking about whether to stick with NVIDIA, add more, or finally cash out? You are not alone. The stock is once again front and center in market conversations, as both retail and institutional investors revisit what it is really worth. Over the past five years, NVIDIA shares have soared more than 1,300%, turning what used to be a niche chipmaker into a key player at the heart of artificial intelligence, cloud computing, and gaming. Year-to-date, the stock has delivered a remarkable 31% gain, although recent weeks have brought more muted movement, with a 0.7% uptick in the last 7 days and a modest -1.3% dip over the past month.

So what is fueling this eye-popping growth, and are the risks changing? NVIDIA has been making headlines with its breakthrough AI hardware, high-profile partnerships, and the race among tech giants to secure its chips for next-generation data centers. The story here is not just about rapid growth in revenue, but how the company has positioned itself as essential infrastructure for the evolving tech landscape. However, with so much optimism baked into the price, now is the perfect time to take a closer look at whether the stock’s current valuation truly lines up with its potential. To help make sense of it all, NVIDIA earns a value score of 3 out of 6 based on our latest valuation checks, suggesting that it is undervalued on half the key criteria we track.

Let’s dig into exactly how we arrive at that score, and later, reveal a smarter way to look at valuation that every investor should consider.

Why NVIDIA is lagging behind its peers

Approach 1: NVIDIA Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows and then discounting those back to today’s value, reflecting both expected growth and the risk of uncertainty. For NVIDIA, this approach uses a two-stage Free Cash Flow to Equity model in USD, incorporating both analyst forecasts and extended projections by Simply Wall St.

NVIDIA’s current Free Cash Flow sits at $72.28 billion. Analysts expect robust growth in the years ahead. By 2030, free cash flow is forecast to reach $249.21 billion. It is important to note that expert coverage typically extends only five years, and projections beyond that point rely on extrapolation. Over the coming decade, annual free cash flow is predicted to rise rapidly, signaling confidence in both NVIDIA’s market strengths and the broader trends powering its business.

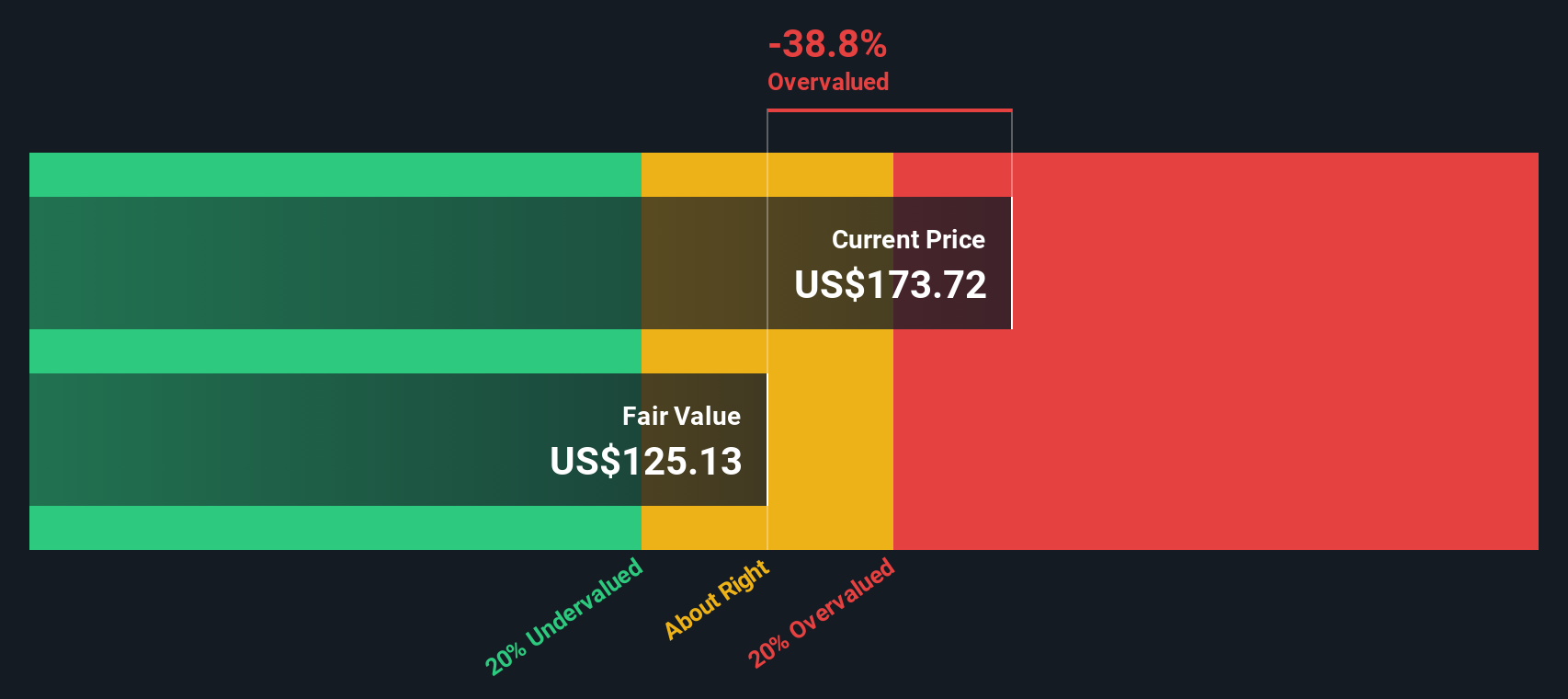

Despite these impressive growth outlooks, the DCF model sets the company’s intrinsic value at $141.66 per share. Because NVIDIA’s market price currently exceeds this estimate, the DCF analysis implies the stock is 27.9% overvalued at present.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVIDIA may be overvalued by 27.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NVIDIA Price vs Earnings

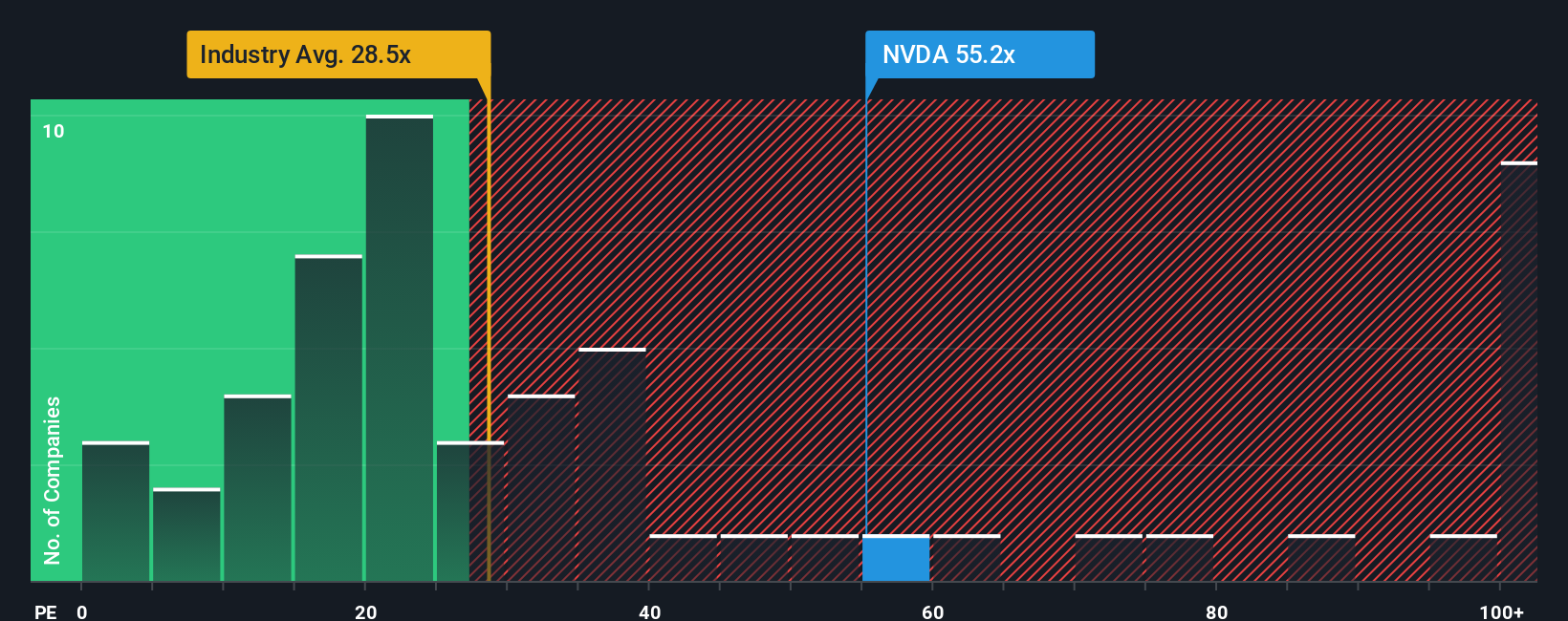

For profitable companies like NVIDIA, the Price-to-Earnings (PE) ratio is the preferred way many investors judge valuation. The PE ratio tells you how much investors are willing to pay for each dollar of earnings, making it especially useful when strong profits are the main story. What is considered a fair or normal PE depends heavily on growth expectations and risk. Fast-growing or lower-risk companies tend to justify higher PE ratios, while slower or more uncertain firms usually trade at lower ones.

Currently, NVIDIA trades at a PE ratio of 50.8x. That stands well above the average for semiconductor peers (37.2x) and above the peer group average (67.4x). To try to make sense of these wide-ranging numbers, Simply Wall St uses a proprietary "Fair Ratio," which estimates where NVIDIA’s valuation should land based on its unique earnings growth, margins, size, industry, and risk profile. In this case, NVIDIA's Fair PE Ratio is 57.9x, higher than current levels and comfortably above the industry average. This approach goes beyond simple industry or peer comparisons by fully accounting for what sets NVIDIA apart.

Because NVIDIA's actual PE ratio is slightly below its Fair Ratio, this method suggests the stock is valued about right at current prices, once its specific strengths and risks are included in the mix.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVIDIA Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful tool that lets you tell your story about a company by combining your personal perspective with your assumptions for future revenue, profits, and what you think is a fair price.

Rather than just looking at static numbers, Narratives help you see how a company’s story connects directly to a financial forecast and ultimately to a fair value estimate. Narratives are available to everyone in the Simply Wall St Community page, making it easy for investors of all experience levels to analyze and share their perspectives alongside millions of others.

With Narratives, you can quickly decide if it’s time to buy, hold, or consider selling by comparing your Fair Value to the current market price. Because they are updated dynamically whenever new news or earnings are released, your view always stays relevant.

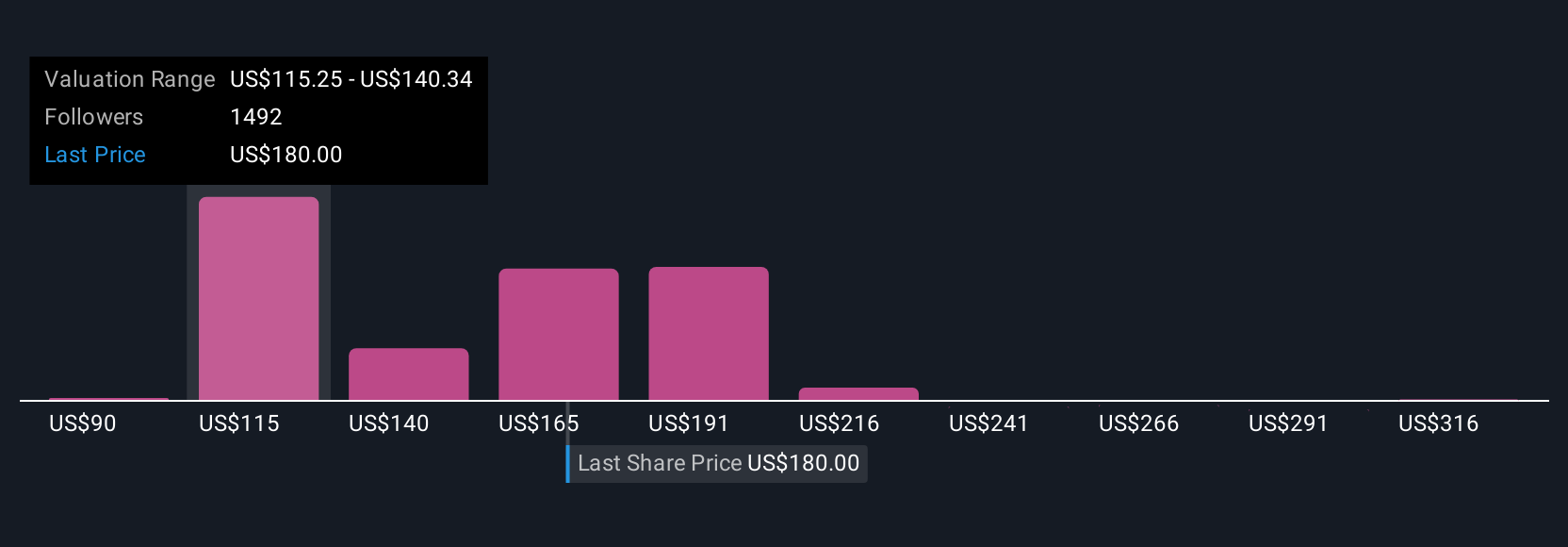

For example, when it comes to NVIDIA, some investors are forecasting fair values as low as $68 per share and others as high as $341, reflecting different beliefs about market risks, growth, and technological leadership. Narratives let you track, compare, and refine your investment view in real time so you always invest in the market’s most important story: your own.

For NVIDIA, we'll make it really easy for you with previews of two leading NVIDIA Narratives:

Fair Value: $218.51

Currently undervalued by approximately 17% versus the last close

Forecast revenue growth: 27.1%

- Rapid AI adoption and infrastructure digitization are projected to drive sustained, multi-year growth in NVIDIA's top line and demand for its platforms.

- Continuous innovation and full-stack offerings deepen customer lock-in and support margin improvements, positioning NVIDIA with pricing power as AI evolves.

- Key risks include geopolitical tensions, supply chain fragility, and rising competition, but the consensus is that technology leadership and diversified demand offer strong support for future fair value above current prices.

Fair Value: $67.95

Currently overvalued by approximately 167% versus the last close

Forecast revenue growth: 14.4%

- Risks of oversupply in GPU compute power and intensifying competition from AMD, Samsung, Intel, and in-house chips from major cloud customers could erode NVIDIA's market share and margins.

- Customer vertical integration and the rise of alternative architectures such as chiplets may further challenge NVIDIA’s pricing power and long-term profitability.

- While NVIDIA maintains AI leadership, the future could bring lower profit margins and a significant rerating of its earnings multiple versus current high levels due to cyclical and industry headwinds.

Do you think there's more to the story for NVIDIA? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives